By Christina Siegel Malbon

2Q25 Portfolio Activity and Attribution

Fund Highlights

During the second quarter of 2025, the Patient Opportunity Equity Strategy generated a total return of 15.3% net of fees. In comparison, the strategy’s unmanaged benchmark, the S&P 500 Index, returned 10.9%.

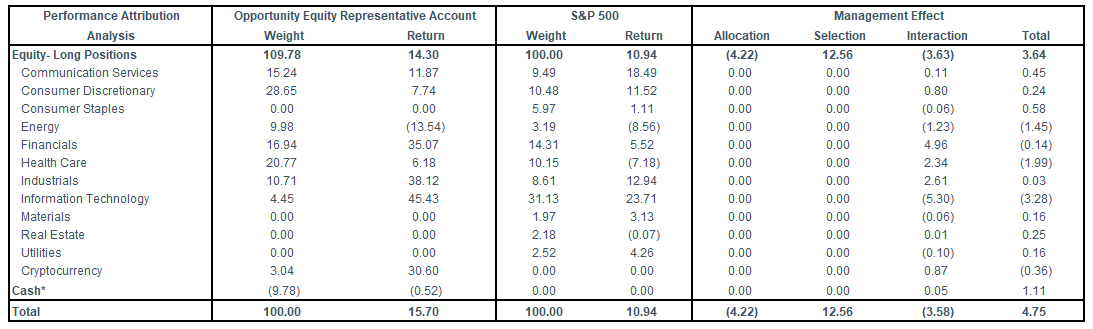

Using a three-factor performance attribution model, selection effect contributed to the portfolio’s outperformance which was partially offset by both allocation and interaction effects. QXO Inc. (QXO), Coinbase Global Inc. (COIN), Nvidia Corp. (NVDA), Dave & Buster’s Entertainment Inc. (PLAY), and Meta Platforms Inc. (META) were the largest contributors to performance, while New Fortress Energy Inc. (NFE), Kosmos Energy Ltd (KOS), Alibaba Group Holdings (BABA)(OTCPK:BABAF), JD.com (JD), and Biogen Inc. (BIIB) were the largest detractors.

Relative to the index, the strategy was overweight the Consumer Discretionary, Communication Services, Financials, Energy, Industrials, and Health Care sectors on average during the quarter. With zero allocation to Real Estate, Utilities, Materials, and Consumer Staples, the portfolio was underweight these sectors along with Information Technology.

The portfolio added five positions, Noble Corporation (NE), Tempus AI Inc. (TEM), UnitedHealth Group Inc. (UNH), Clear Secure (YOU), and Costco Wholesale Corporation Put Options (COST 1/16/26 P960) in the quarter. We eliminated three positions, Carvana Co. (CVNA), New Fortress Energy Inc. (NFE) and closed the long leg of our call spread in Nvidia Inc. (NVDA 9/19/2025 C118) during the quarter.

The portfolio ended the quarter with 41 holdings where the top 10 stocks represented 51.0% of total assets compared to 36.6% for the index, highlighting the portfolio’s meaningful active share of around 93.6%.

Portfolio Review

Following the sharp sell-off at the start of the second quarter, the stock market staged a V-shaped recovery, rallying 30% intraday trough-to-peak and ultimately surpassing the all-time high set in February. Early fears over aggressive tariff policy gradually faded as the market believed the final measures would be far less severe than initially anticipated.

As some positions approached our estimate of intrinsic value earlier in the year, we took down our exposure. However, the subsequent market decline created compelling opportunities, and we used the dislocation to add to severely depressed names.

By the end of the quarter, many of our holdings had rebounded sharply, particularly within our cyclical exposure, which was among the hardest hit earlier in the year.

Bitcoin ETFs (FBTC) and crypto-exposed names like Coinbase Global Inc. (COIN) rebounded sharply during the quarter following the Trump administration’s passing of the GENIUS Act in June along with Trump’s April executive order launching a Strategic Bitcoin Reserve, marking a pivotal shift toward a crypto-friendlier regulatory framework.

Turnaround names such as Dave & Buster’s Entertainment (PLAY) and Canada Goose Holdings Inc. (GOOS) had impressive rebounds, driven by better-than-expected earnings results and resilient consumer spending data. Both companies benefit from idiosyncratic catalysts that we believe can continue to drive improved performance outside of macro trends.

Finally, we continued to add to positions in Healthcare and Energy, two sectors that have broadly disappointed but where we see long-term opportunity.

In Energy, we seek out idiosyncratic opportunities with strong return potential. We added exposure to offshore drillers through Seadrill Limited (SDRL) and Noble Corp. (NE), which we believe are well positioned as onshore production contracts and offshore becomes the marginal source of supply over time. At the same time, the rig supply has tightened, creating a favorable long-term supply/demand dynamic. Kosmos Energy (KOS), on the other hand, is nearing a key inflection point. As its Tortue LNG project ramps to full capacity, production and free cash flow are expected to increase significantly. From 2025 to 2029, we believe Kosmos will generate more than twice its current market cap in free cash flow.

In Healthcare, we see a sector trading at attractive historical valuations with significant long-term potential. UnitedHealth Group (UNH), a long-time market favorite, saw its stock fall over 50% from peak to trough following disappointing results in its Medicare Advantage business. Despite near-term challenges, we believe United remains a category leader with a durable platform and strong competitive positioning. We have confidence in their ability to improve earnings power and profit margins. Companies like Tempus AI (TEM) are embedding AI across their vast molecular datasets, enabling more personalized and precise diagnostics, ushering in a new era of intelligent, data-driven healthcare.

New and Eliminated

This quarter we entered five new positions, while exiting three. We initiated a position in UnitedHealth Group Incorporated (UNH), one of the largest healthcare companies in the United States, after the stock declined more than 50% from its 2025 highs, reaching multi-year lows. The drop followed a rare misstep in its Medicare Advantage business, where higher-than-expected costs drove margin compression, a cut to EPS and ultimately, the withdrawal of forward guidance. In response, the company announced a leadership change, bringing back former CEO and current Chairman Stephen Hemsley. UNH has long been a market favorite for its consistency in growth, earnings and return on capital. The disappointment led investors to flee. While the short-term outlook remains murky, over the long-term we have confidence the company can improve underwriting margins. With all competitors focused on underwriting to margins, future pricing should be more rational and in line with current usage trends. Rebuilding investor confidence may take time, but we believe UNH’s integrated platform and unique asset mix position it to remain a category leader and return to strong returns over time. Following the sell-off, several insiders stepped in to buy stock, most notably Stephen Hemsley with a $25M purchase and the CFO, John Rex, with $5M. The company also has an $8.4B buyback authorization (roughly 3% of shares) and a robust 10% free cash flow yield. Management remains confident in its ability to compound EPS at a 13–16% rate over the long term. We view the recent dislocation as an opportunity to own a high-quality compounder at a compelling valuation.

We initiated a position in Noble Corporation PLC (NE) in the quarter. Noble is a leading offshore drilling contractor. We think the offshore drilling market is attractive long-term, particularly as growth in land-based oil production slows. Industry dynamics have steadily improved since 2019, with significant consolidation reducing the number of major players to just four. At the same time, nearly half of all deepwater rigs were scrapped over the past decade, and with minimal current capital investment, supply growth is expected to remain constrained for years to come. Despite recent rate pressures, Noble’s fundamentals remain sound. Their 2025 guidance is fully backed by its contracted backlog, and the company’s continued focus on cost discipline should support margin expansion and strong free cash generation. Management has committed to returning 100% of free cash flow to shareholders, through both a dividend (7% yield) and share repurchases (representing 8% of shares outstanding). We believe Noble is well positioned to further consolidate the sector and benefit from improving offshore market conditions over the long-term.

Tempus AI Inc. (TEM), is a leading precision medicine platform focused on transforming cancer care through data and artificial intelligence (AI). The business operates across three synergistic segments – genomics, data and services, and AI applications – that together reinforce its competitive moat. These segments feed into one another, enabling Tempus to build one of the world’s largest molecular databases of cancer patients. Leveraging this library, the company is embedding AI into diagnostic workflows to drive more personalized, data-driven treatment decisions. Though still early in its lifecycle, Tempus is on track to surpass $1B in revenue within its first decade and expects to achieve EBITDA profitability this year, an important milestone. While oncology remains its core market today, the company is expanding into other areas like cardiology, neuropsychology, and radiology. We believe healthcare is primed for disruption through AI and Tempus is well positioned to take advantage. We have high conviction in its ability to continue winning new business, expanding its database, and achieving profitability.

We initiated an options position in Costco Wholesale Corporation (COST 1/16/26 P960) during the quarter, purchasing at-the-money puts with a 2026 expiration. We’ve consistently highlighted the risk lurking in the “overpriced compounder” segment of the market, and we view Costco as a prime example. The stock is currently trading at 54x earnings despite growing only at a mid-single-digit rate. While Costco is undoubtedly a well-run business, we believe paying more than twice the market multiple for a low-growth, low-margin retailer is difficult to justify. At some point, we expect the market to reassess the premium valuation being placed on Costco’s fundamentals. When it does, we believe the stock could face meaningful downside from its current all-time high multiple.

We entered Clear Secure Inc. (YOU), a leading secure identity verification provider. The company is best known for helping customers bypass TSA lines at airports but they also provide similar security services at professional sports events and concerts. Their line-skipping business delivers impressive profitability with double-digit free cash flow yields and high margins. Longer-term the opportunity lies in expanding their identity verification technology into Healthcare and Financial Services. We haven’t found another company that has a 10% free cash flow yield, no debt on the balance sheet, record earnings, improving margins, excellent management, buying back stocks and is outperforming the market YTD and over 1-year.

We exited several smaller positions during the quarter to reallocate capital toward new opportunities and concentrate further in our highest-conviction names. We sold Carvana Co. (CVNA) and closed the long leg of our call spread in Nvidia Inc. (NVDA 9/19/2025 C118). We exited New Fortress Energy Inc. (NFE) following deteriorating fundamentals and an increasingly strained balance sheet.

Top Contributors and Top Detractors

| Top Contributors | Ticker | Net Contribution (BPs) |

| QXO Inc. | QXO | 287 |

| Coinbase Global Inc. | COIN | 235 |

| Nvidia Corp. | NVDA | 184 |

| Dave & Buster’s Entertainment Inc. | PLAY | 150 |

| Meta Platforms Inc. | META | 137 |

| Top Detractors | Ticker | Net Contribution (BPs) |

| New Fortress Energy Inc. | NFE | -107 |

| Kosmos Energy Ltd. | KOS | -63 |

| Alibaba Group Holdings Ltd. | BABA | -49 |

| JD.com Inc. | JD | -40 |

| Biogen Inc. | BIIB | -38 |

*Contribution illustrated above are provided net of fees and includes cash.

Top Contributors

QXO Inc. (QXO) was the top contributor to performance during the quarter following the completion of its $11B acquisition of Beacon Roofing in April. This marks the first of what is expected to be a series of acquisitions, as the company pursues a roll-up strategy in the highly fragmented building products distribution industry. QXO is leveraging a proven playbook that its management team has successfully executed across other sectors. With a strong track record and investor confidence, the company benefits from the ability to raise capital on attractive terms, giving it a competitive edge vs peers. Furthermore, management has proven their price discipline walking away from a bidding war for GMS Inc., which was ultimately acquired by Home Depot. We view this disciplined approach as a testament to management’s long-term focus. Over the next decade, QXO is targeting more than $50B in annual revenue. We have high conviction in Brad Jacobs’ leadership and believe the company is well positioned to become a long-term compounder.

Coinbase Global Inc. (COIN) rebounded in the second quarter, tracking strength in both Bitcoin and the broader cryptocurrency market. We believe it remains early innings for institutional adoption and exposure to digital assets, and Coinbase is steadily solidifying its position as the platform of choice within the crypto ecosystem. Recent enhancements to its wallet, Base platform, and USD Coin could help trigger broader uptake. Additionally, the Trump administration’s passage of the GENIUS Act in June along with Trump’s April executive order launching a Strategic Bitcoin Reserve, marks a pivotal shift toward a crypto-friendlier regulatory framework. We’re encouraged by Coinbase’s continued investment in innovation, which we believe will further widen its competitive moat over time.

Nvidia Corp. (NVDA) recovered strongly in the second quarter, climbing back from earlier declines to end the quarter at an all-time high. As the undisputed leader in Graphics Processing Units (GPUs), Nvidia continues to benefit from surging demand for AI training and inference. Despite concerns over competition from TPUs and rivals like AMD, Nvidia remains in the lead. The company is rapidly releasing next-gen products, with the Blackwell line-up, its fastest architecture yet, hitting the market just 2 years after its predecessor. Moreover, Nvidia is aggressively expanding into adjacent areas including robotics, edge AI, AI cloud leasing, and AI software putting them in direct competition with some of their biggest customers. CEO Jensen Huang describes Nvidia as a “full-stack, accelerated computing platform”, reflecting its blend of cutting-edge hardware, software (CUDA), and AI infrastructure. With leading-edge tech, a shortening innovation cycle, and robust cash flow, we believe Nvidia is well positioned to ride the accelerating wave of AI adoption.

Top Detractors

New Fortress Energy (NFE) declined during the quarter following a disappointing first quarter earnings report and growing concerns over its liquidity position. The company, a vertically integrated LNG infrastructure provider with strategic import terminals in developing markets, was initially expected to benefit from increased LNG adoption as a transitional fuel. However, reported volumes in its core terminal business fell well short of management’s expectations, and shifting supply dynamics left the company exposed to commodity price risk. With deteriorating fundamentals, a high debt load and near-term maturities, we chose to exit the position given the risking risk of potential default. Our concerns were further reinforced by the company’s delayed 10-K filing, which included new language expressing “substantial doubt” about its ability to continue as a going concern.

Kosmos Energy (KOS) traded lower during the quarter, in line with broader energy price declines. The company is approaching a key inflection point, with production and free cash flow expected to increase meaningfully as its Tortue LNG project ramps to full capacity. While 2025 has been disappointing, marked by delays in production timelines and cost overruns, we’re now seeing positive momentum, with Tortue coming online and volumes steadily increasing. Kosmos remains focused on maximizing cash generation and deleveraging its balance sheet. At current commodity prices, the company is positioned to generate free cash flow equal to nearly 2x its market cap between 2025 and 2029. With gas-heavy reserves, a ramping cash flow profile, and a strategic asset base, we believe Kosmos is significantly undervalued—and could be a compelling acquisition target in a consolidating energy environment.

Alibaba Group Holdings (BABA) sold off early in the quarter following President Trump’s “Liberation Day” tariff announcement, which imposed ~50% tariffs on Chinese goods. As the US and China moved toward tentative agreements, the stock began to recover. Fundamentally, we continue to see an attractive setup. Alibaba is benefiting from accelerating AI initiatives, renewed momentum in its Tmall platform, and rapid growth in instant shopping and local services. These trends support a broader turnaround in core commerce and digital services. Despite these tailwinds, the company trades at just 11.2x earnings, well below historical averages, and continues to return capital to shareholders through a 1% dividend yield and a robust buyback program. We believe Alibaba remains significantly undervalued relative to its sum-of-the-parts, and see meaningful upside as fundamentals stabilize and sentiment improves.

|

Market Proxy is S&P 500. Returns greater than 1 year are annualized. Source: Bloomberg and Patient Capital Management The data provided is from APX and Patient Capital Management, LLC and is believed to be reliable, but is not guaranteed as to its timeliness or accuracy. Percentages and returns may not sum to 100% due to rounding effects. A three-factor attribution consists of the allocation effect, selection effect, and the interaction effect, which sum to the portfolio’s performance relative to the benchmark. • Allocation. The allocation effect represents the portion of the portfolio’s excess return attributable to differences in sector weights between the portfolio and the benchmark index. • Selection. The selection effect represents the portion of the portfolio’s excess return attributable to differences in the weights of individual securities within each sector between the portfolio and the benchmark index. • Interaction. Most complex and sometimes counterintuitive, the interaction effect represents the portion of the portfolio’s excess return attributable to combining sector allocation decisions with security selection decisions, and is often thought of as measuring the accuracy of manager’s convictions. Please note that the methodology used by our independent third-party attribution software vendor will at times present sector allocation effects that are counterintuitive. For example, the software may calculate a negative sector effect even when the portfolio, on a weighted average basis for the period, was overweight an outperforming sector. Under the vendor’s methodology, allocation effects in recent months may overwhelm the allocation effects from earlier in the period, particularly over longer time frames. Returns illustrated above are provided net of fees and include cash. Total portfolio return figures provided above reflect the sum of the returns of the holdings in the representative account portfolio due to price movements and dividend payments or other sources of income. |

|

For Institutional Investors Only. This information does not constitute, and should not be construed as, investment advice or recommendations with respect to the securities and sectors listed. All investments are subject to risk, including the possible loss of principal. There is no guarantee investment objectives will be met. Neither Patient Capital Management, LLC, nor its information providers are responsible for any damages or losses arising from any use of this information. The Opportunity Equity composite performance figures reflected above include the deduction of a model investment management fee of 1% (the highest fee for separate accounts under our fee schedule), paid quarterly and certain other expenses. For important information about Opportunity Equity Strategy performance, please click on the Opportunity Equity Strategy Composite Performance Disclosure. Past performance is no guarantee of future results. All holdings and portfolio data are reflective of a representative Opportunity Equity account. Performance in attribution table is not official strategy returns. The return is sourced from APX and is net of fees based on the strategy’s representative account. Contributors detailed above represent the top five securities that contributed positively to performance during the quarter. Detractors detailed above represent the top five securities that detracted from performance during the quarter. Information detailed above is provided net of fees, includes cash, and is based on a representative Opportunity Equity account. Contribution listed above represents the period when the security was held during the quarter. For additional information on how Top Contributors and Top Detractors were determined and/or to obtain a list showing every holding’s contribution to the representative Opportunity Equity account performance contact us. The information presented should not be considered a recommendation to purchase or sell any security and should not be relied upon as investment advice. It should not be assumed that any purchase or sale decisions will be profitable or will equal the performance of any security mentioned. References to specific securities are for illustrative purposes only. Portfolio composition is shown as of a point in time and is subject to change without notice. The views expressed in this commentary reflect those of Patient Capital Management portfolio managers and analysts as of the date of the commentary. Any views are subject to change at any time based on market or other conditions, and Patient Capital Management disclaims any responsibility to update such views. The information presented should not be considered a recommendation to purchase or sell any security and should not be relied upon as investment advice. It should not be assumed that any purchase or sale decisions will be profitable or will equal the performance of any security mentioned. Past performance is no guarantee of future results. Click for the Opportunity Equity Strategy Composite Performance Disclosure. ©2025 Patient Capital Management, LLC |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here