Thesis

Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (NASDAQ:PDBC) seems to be the top choice for investors and traders. While I think that the latter can utilize it under certain circumstances, I don’t see why investors shouldn’t select alternatives.

The fund’s returns have been impressive, both on an absolute and relative basis. However, after a comparison with other options, there is at least one actively managed and index-tracking commodity ETF that has done better than PDBC. Below, I will show you which ones and in what manner.

What does PDBC do?

PDBC is an ETF issued by Invesco Capital Management LLC on 11/07/2014 that provides exposure to commodity markets through the use of futures contracts. It currently has $5.18 billion under management and is, therefore, the largest commodity ETF right now.

The fund is actively managed and aims to outperform the BIQ Optimum Yield Diversified Commodity Index Excess Return. However, the issuer states that the fund will seek to buy futures that represent the ones the index consists of, which are linked to the 14 most heavily traded commodities across the precious metals, energy, agriculture, and industrial metals sectors. The ETF’s biggest current positions involve gasoline, WTI crude oil, Brent crude, and NY Harbor ULSD.

PDBC makes its commodity-related investments through a Cayman Islands subsidiary and is, therefore, subject to the limitation of a maximum 25% asset allocation to commodities. At the same time, as the name of the fund suggests, it uses Form 1099 to report income and not a K-1.

Performance

With the first mention of a benchmark and the aspiration to beat it, the first thing I want to see is how the ETF performed against that benchmark. In the last 5 years, annualized returns for the index were 7.12% while PDBC returned 7.45% based on its market price. While the outperformance doesn’t seem significant, the longer time frame of its cumulative returns in the last 10 years hints at the persistence of this modest outperformance (1.28% and 1.35% for the index and fund, respectively).

So far, the fund seems able to deliver what’s promised. But with so many commodity ETF options out there and the space for only one in a simple diversified retirement portfolio, a comparison with actively managed commodity funds carries great utility.

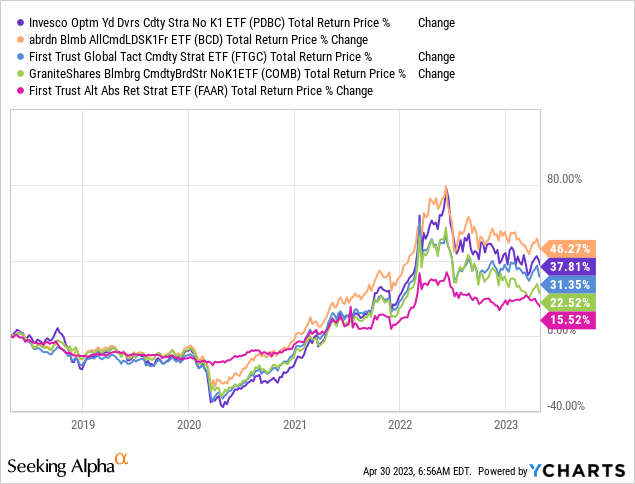

PDBC has been outperforming most other active commodity ETFs for the last 5 years by a good margin. The only ETF of the above comparison that produced greater returns during this time frame was abrdn Bloomberg All Commodity Longer Dated Strategy K-1 Free ETF (BCD). BCD also had a weaker correlation to the market and achieved its returns with less volatility in the last 5 years.

| Source: | portfoliovisualizer.com (4/30/2018 – 4/30/2023) | |||

| Ticker | Max. Drawdown (%) | Annualized Standard Deviation (%) | Correlation(SPY) | Beta (SPY) |

| PDBC | 37.58% | 19.02% | 0.52 | 0.52 |

| BCD | 26.11% | 14.77% | 0.51 | 0.41 |

| FTGC | 33.07% | 15.12% | 0.56 | 0.45 |

| COMB | 30.79% | 15.86% | 0.52 | 0.44 |

| FAAR | 13.83% | 8.77% | 0.22 | 0.1 |

As a result, I think that BCD seems like a superior choice for the investor looking for any kind of exposure to commodities that has the greatest chance to provide the best risk-adjusted returns, not accounting for the different sector weights. Among the above active ETFs, PDBC had the greatest maximum drawdown in the last 5 years along with the highest annualized standard deviation. Investors who place greater importance on low volatility and market correlation may find First Trust Alternative Absolute Return Strategy ETF (FAAR) more attractive as it had an exceptionally low correlation to the market and only a 13.83% maximum drawdown in these 5 years.

Naturally, if you’re looking for the best bet when it comes to long-term performance or low volatility/correlation returns, you’d also want to see how PDBC performed against index-tracking competitors:

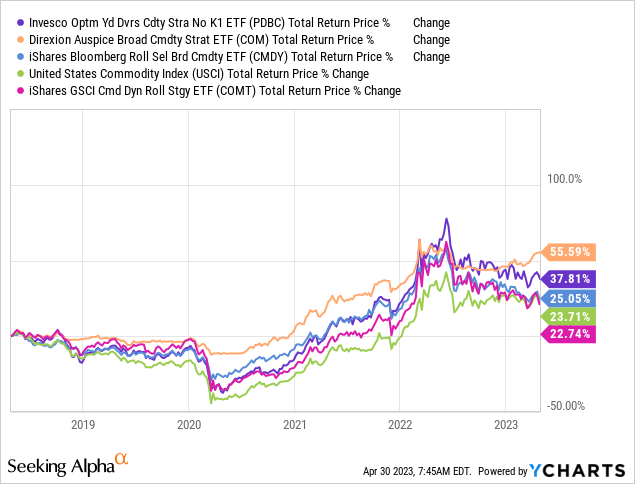

In this case, it outperformed all passively managed commodity ETFs above by a great margin but one; the Direxion Auspice Broad Commodity Strategy ETF (COM). I recently covered COM and found it to be a superior hedge to other options because of its risk-adjusted returns and low correlation to the market. Therefore, from any aspect that I look at PDBC, its past performance doesn’t make it more attractive than COM.

| Ticker | Max. Drawdown (%) | Annualized Standard Deviation (%) | Correlation (SPY) | Beta (SPY) |

| PDBC | 37.58% | 19.02% | 0.52 | 0.52 |

| COM | 15.06% | 9.85% | 0.38 | 0.2 |

| CMDY | 28.05% | 14.41% | 0.5 | 0.38 |

| USCI | 42.71% | 18.02% | 0.45 | 0.43 |

| COMT | 36.02% | 18.80% | 0.54 | 0.54 |

| Source: | portfoliovisualizer.com (4/30/2018 – 4/30/2023) |

So, both the active and passive management fields present better alternatives to PDBC. And though I understand that some traders may be attracted to the fund’s current allocations as opposed to those of other funds, there is an argument to be made about the flexibility in building a commodity portfolio using commodity sector-specific ETFs. In other words, PDBC’s relative underperformance and unattractive risk profile may be justified by its different allocations, but I think speculators may be better served by using sector-specific funds to express their outlooks.

However, let me note that in the absence of such funds with adequate trading volume, PDBC will surely be a decent vehicle for a trader. After all, it’s the largest commodity ETF and has the highest trading volume.

Fees

| Ticker | Expense Ratio | AUM | Inception Date |

| PDBC | 0.59% | $5.18B | 11/07/2014 |

| BCD | 0.29% | $272.41M | 03/30/2017 |

| FTGC | 0.95% | $2.97B | 10/21/2013 |

| COMB | 0.25% | $149.73M | 05/19/2017 |

| FAAR | 0.95% | $190.38M | 05/18/2016 |

PDBC has an expense ratio of 0.59%. Based on being an actively managed commodity ETF and without taking into account its relative performance, the fees are fair. However, the rest of the actively managed commodity ETFs from above also have attractive expense ratios, considering the sizes of their AUM and track records.

Risks

- Sector Concentration Risk: There’s a chance for funds like PDBC to concentrate in a particular commodity sector and, therefore, be subject to concentration risk.

- Counterparty Risk: Through its subsidiary, PDBC buys futures contracts on commodities and such an approach creates the risk that the other party in a futures transaction may become unable to fulfill its obligation.

- Commodity Risk: Since the ETF is exposed to the performance of commodity prices, it’s also sensitive to factors that may negatively affect those prices, such as market events, war, and political or regulatory changes.

Verdict

PDBC is a very common choice among investors and there’s a case to be made about being the right vehicle for traders. However, if you’re like me who is seeking long-term outperformance with low volatility from his commodity allocation, there are simply better options available.

For this reason, I would not use PDBC as the vehicle to get exposure to commodities. But based on your needs and insights, you may have a different opinion, which I would be glad to know about. Or you may want to criticize a point I made. Feedback helps me push forward to higher-quality insights, so please, leave a comment below and let me know. Thank you for reading.

Read the full article here