The debt ceiling?

Who cares about the debt ceiling?

The United States dollar is under attack.

That is something we should care about!

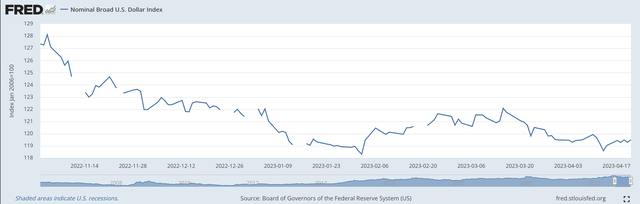

U.S. Dollar Index (Federal Reserve)

The U.S. dollar is down about 10 percent against a collection of currencies since the start of November 2022.

That is not a terrible drop, but it is a decline, and given all the other things going on it is certainly something to worry about.

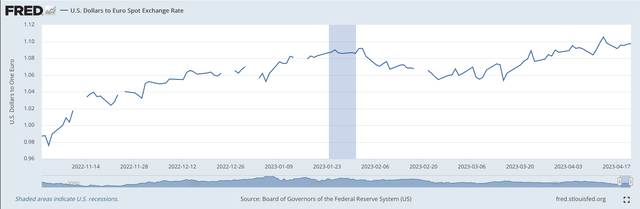

It is also down about 10 percent against the Euro.

U.S. Dollar to Spot Euro Exchange Rate (Federal Reserve)

The List of Things

There are several factors that are resulting in a weaker U.S. dollar. There is inflation that is going on in the economy.

There is a battle going on in the Ukraine. Not only the war itself is impacting the currency value, but there are all the sanctions that have been applied to Russia and its supporters.

A consequence of these actions has been a move to lessen the role of the dollar in the world. There is an effort at de-dollarization.

And, there are some other things.

But, there is also the battle going on in the United States between the monetary authorities and the fiscal authorities.

For one, the Federal Reserve has been conducting a policy of monetary tightness since the middle of March 2022.

But, the federal government is conducting its fiscal policy to stimulate the economy and is building up a substantial debt load to accompany the government’s spending.

As I have been writing about over and over again, this conflict of policies within the federal government is not helpful to the investment community.

In fact, for most of the past twelve months, the investment community has been really confused about the government’s position.

The president wants the fiscal stimulus. The president wants to get re-elected in 2024 and needs a strong economy behind him to achieve victory.

In terms of monetary policy, the investment community seems to believe that the current Federal Reserve chairman, Jerome Powell, will “back off” from the tight money position and will soon “pivot” towards a easier policy stance.

In other words, the investment community sees the U.S. continuing to inflate the economy and keep the growth rate in positive territory as long as possible.

Given the upcoming presidential election, a “soft landing” for the economy would be just right.

These things lead to the thought that investors likely really believe that the value of the U.S. dollar should decline further than the 10 percent it has already achieved.

Strong U.S. Dollar

The United States needs a strong dollar.

The United States needs to keep the U.S. dollar as the reserve currency of the world.

The U.S. dollar needs to get its fiscal policy under control.

The U.S government needs to responsibly get control of its budget and substantially reduce its deficit… or even eliminate it.

Forget about the debt ceiling.

Focus on responsible fiscal policy.

Mr. Powell, stick with your policy of quantitative tightening.

This is what is needed for monetary policy right now.

But, the fiscal authorities need to “back up” this monetary authority with smaller and smaller deficits.

This must be the longer term goal of the government if it is truly going to support the U.S. dollar and see that the U.S. dollar remains the standard of the world.

So, it is not the “debt ceiling” that I am worried about.

I am worried about keeping the U.S. dollar strong so that the U.S. dollar can remain in its leadership position in the world.

The fiscal policy of the government must be consistent with the monetary policy of the government.

Debt ceiling be damned.

Going Forward

Once the government starts moving in the right direction in terms of reducing the debt, the government needs to put into place plans that will keep the yearly deficit at a minimum.

The price of the U.S. dollar is the “single most important price” in the U.S. economy.

The U.S. government must realize this and conduct its policy so as to keep the U.S. dollar strong. This is the essence of its overall global policy.

The question is not one of keeping under the debt ceiling.

The question is about whether or not the United States wants to maintain its role in the world.

Having the “top” position in the world means acting in a responsible way.

Requiring a government to act in a responsible way cannot be legislated.

So, administrations going forward need to make sure that responsible fiscal and monetary action is the foundation of any approach policy approach they build for the future.

Acting legislation like the debt ceiling is, in the end, “childish” because a debt ceiling will only produce “childish” behavior on the part of those engaged in the process.

And, the really funny thing about this childish behavior is that, at one time, one party is “on the defensive” and the other party is “on the attack,” while the next time around the roles will be totally reversed.

Let’s get back to the real issue… the value of the dollar.

Both parties want a strong dollar. Let’s save our energy from fighting about a debt ceiling and focus on what is really important… policies to keep the dollar strong or make it stronger.

Read the full article here