A Quick Take On Kaltura

Kaltura, Inc. (NASDAQ:KLTR) went public in July 2021, raising approximately $150 million in gross proceeds from an IPO that priced at $10.00 per share.

The firm provides enterprises with a video capture and streaming platform.

Based on management’s low revenue growth projection and continued operating losses, I am Neutral [Hold] on Kaltura, Inc. for the near term.

Kaltura Overview

New York, New York-based Kaltura, Inc. was founded to develop a unified horizontal technology offering for powering real-time, on-demand video applications across the enterprise.

Management is headed by co-founder, Chairman and CEO Ron Yekutiel, who was previously co-founder of VisualGate Systems, a video surveillance company.

The company’s primary offerings include:

-

Video Portal

-

Town Halls

-

Video Messaging

-

Webinars

-

Virtual Events

-

Meetings

-

Learning Management System

-

Lecture Capture

-

Virtual Classroom

-

TV Solution.

The firm acquires customers across a variety of industries, including financial services, technology, education, healthcare, telecom, media and the public sector.

Kaltura’s Market & Competition

According to a recent market research report by MarketsAndMarkets, the global market for enterprise video applications was estimated at $16.4 billion in 2020 and is expected to reach $25.6 billion by 2025.

This represents a forecast CAGR of 9.3% from 2020 to 2025.

The main drivers for this expected growth are a growing demand for video streaming and communicating across distributed workforces.

Also, North America was estimated to have the largest market share in 2020 and is forecast to remain the largest market size of the major global regions.

Major competitive or other industry participants across all of the platform’s functionalities include:

-

Microsoft

-

Amazon

-

Twilio

-

Cisco

-

Zoom

-

Adobe

-

Intrado

-

Hopin

-

Synamedia

-

MediaKind

-

Comcast Technology Solutions.

Kaltura’s Recent Financial Trends

-

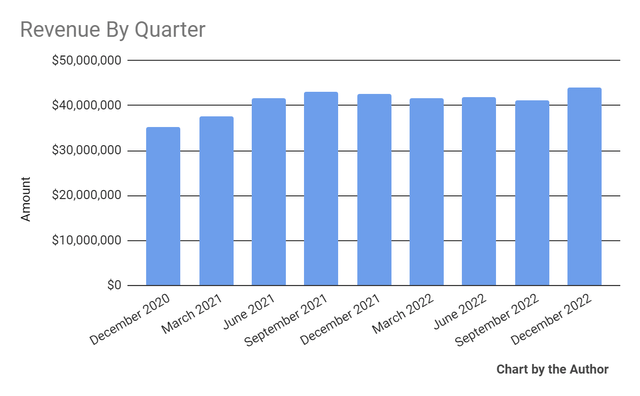

Total revenue by quarter has risen according to the following chart:

Total Revenue (Seeking Alpha)

-

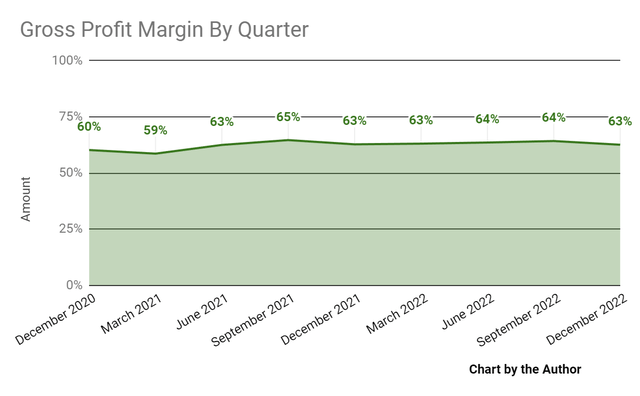

Gross profit margin by quarter has largely plateaued in recent quarters:

Gross Profit Margin (Seeking Alpha)

-

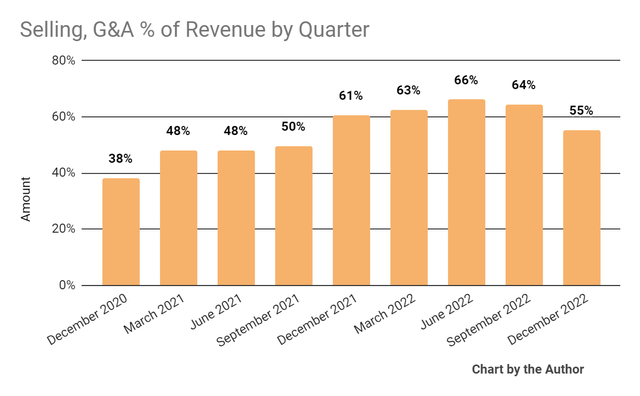

Selling, G&A expenses as a percentage of total revenue by quarter have grown and fallen in the most recent quarter:

Selling, G&A % Of Revenue (Seeking Alpha)

-

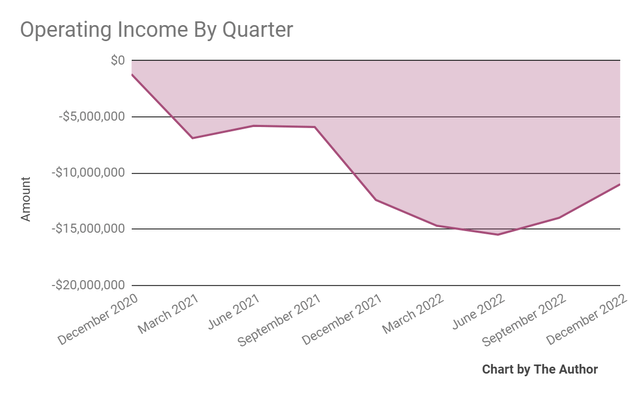

Operating losses by quarter have remained substantial:

Operating Income (Seeking Alpha)

-

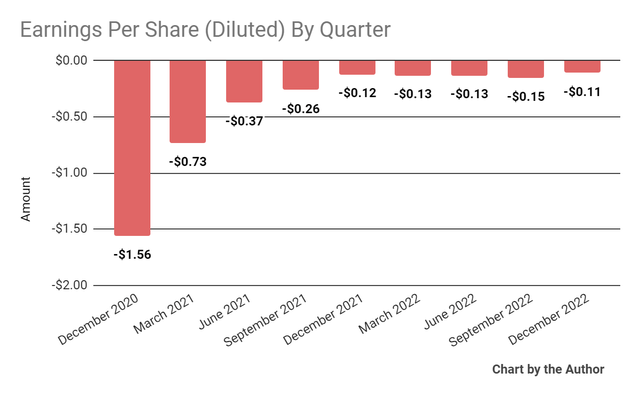

Earnings per share (Diluted) have remained negative as well:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

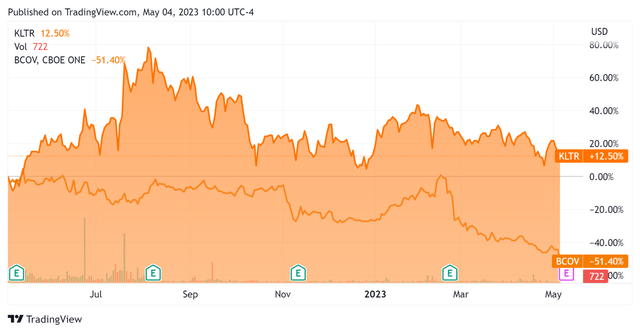

The chart below shows that KLTR’s stock price has increased by 12.5% in the past 12 months, while the price of Brightcove Inc. (BCOV) stock has decreased by 51.4%.

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $86.0 million in cash, equivalents and short-term investments and $35.8 million in total debt, of which $5.8 million was categorized as the current portion due within 12 months.

In the last twelve months, the company used $48.0 million in free cash, of which only $1.2 million was spent on capital expenditures. The company paid out a hefty $23.6 million in stock-based compensation, or SBC, in the last four quarters, the most in the last eleven quarters.

Valuation And Other Metrics For Kaltura

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.3 |

|

Enterprise Value / EBITDA |

NM |

|

Price / Sales |

1.4 |

|

Revenue Growth Rate |

2.3% |

|

Net Income Margin |

-40.6% |

|

EBITDA % |

-31.1% |

|

Market Capitalization |

$245,540,000 |

|

Enterprise Value |

$218,420,000 |

|

Operating Cash Flow |

-$46,830,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.52 |

(Source – Seeking Alpha.)

As a reference, a relevant partial public comparable would be Brightcove; shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

Brightcove |

Kaltura |

Variance |

|

Enterprise Value / Sales |

0.8 |

1.3 |

69.7% |

|

Enterprise Value / EBITDA |

NM |

NM |

–% |

|

Revenue Growth Rate |

0.0% |

2.3% |

–% |

|

Net Income Margin |

-4.3% |

-40.6% |

850.1% |

|

Operating Cash Flow |

$2,542,000 |

-$46,830,000 |

–% |

(Source – Seeking Alpha.)

The Rule of 40 is a software industry guideline that states that a company is on a satisfactory growth/EBITDA trajectory as long as the combined revenue growth rate and EBITDA percentage rate are equal to or greater than 40%.

KLTR’s most recent Rule of 40 calculation was negative (28.8%) as of Q4 2022’s results, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 Performance |

Calculation |

|

Recent Rev. Growth % |

2.3% |

|

EBITDA % |

-31.1% |

|

Total |

-28.8% |

(Source – Seeking Alpha.)

Commentary On Kaltura

In its last earnings call (Source – Seeking Alpha), covering Q4 2022’s results, management highlighted its record results for subscription and total revenue and the “lowest adjusted EBITDA loss over the last five quarters.”

Leadership noted that the previous drop in leading indicators for demand have now started to rise again.

The company’s net dollar retention rate was 96%, representing no sequential change and indicating fair product/market fit and moderate sales & marketing efficiency.

Total revenue for Q4 2022 rose only 3% year-over-year, with the subscription revenue component also rising 3%.

SG&A as a percentage of revenue dropped six percentage points year-over-year and will likely continue to fall as the firm lowered headcount by 11% at the beginning of 2023.

Looking ahead, management guided full-year 2023 revenue growth to be 1% at the midpoint of the range and adjusted EBITDA to be negative ($6.5 million).

The company’s financial position is reasonably solid with ample liquidity; however, management needs to sharply reduce its cash burn and the recent headcount reduction will help in that regard.

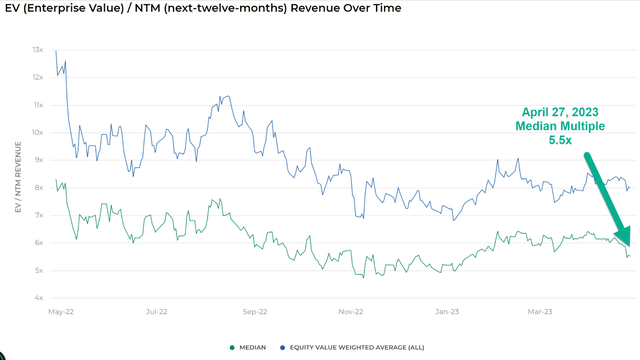

Regarding valuation, the market is valuing KLTR at an EV/Sales multiple of around 1.3x.

The Meritech Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 5.5x on April 27, 2023, as the chart shows here:

EV/Next 12 Months Revenue Multiple Index (Meritech Capital)

So, by comparison, KLTR is currently valued by the market at a substantial discount to the broader Meritech Capital SaaS Index, at least as of April 27, 2023.

This discount is for a good reason, as Kaltura’s growth rate is far below the median revenue growth rate of 22% from Meritech Capital’s SaaS index.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which would increase customer discounting while lengthening sales cycles and reducing its expected revenue growth rate, which is barely positive.

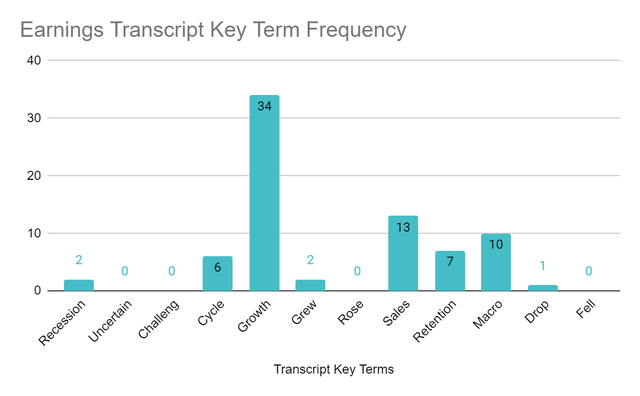

For management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below:

Earnings Transcript Key Terms Mentioned (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management cited “Recession” 2 times, “Macro” 10 times and “Drop” one time in various contexts.

A pause in U.S. Federal Reserve interest rate hikes may be near, which could produce an upside to Kaltura, Inc. stock by reducing downward pressure on its valuation multiple.

However, given the uncertainty of that outcome, management’s low growth projection and still substantial operating losses, my outlook for KLTR in the near term is Neutral [Hold].

Read the full article here