By James Smith

UK growth numbers have been pretty difficult to interpret recently, and the latest data for March is no exception.

Monthly GDP shows an unexpected 0.3% fall in activity during March, owing to weakness across a range of sectors. March was memorably wet, so some of this underperformance can be attributed to bad weather, and to some extent also strike action. But that doesn’t seem to explain all of the disappointment, with a 0.8% fall in consumer-facing services, and casts doubt over the Bank of England’s tentative finding in yesterday’s Monetary Policy Report that private sector activity had staged a modest recovery throughout the first quarter.

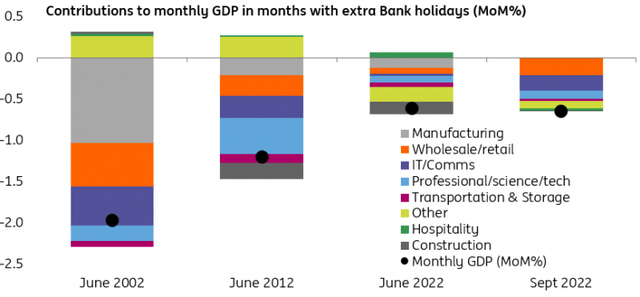

Ultimately, the recent figures have been thrown around by several one-off factors, ranging from the Queen’s funeral last year, to strikes and even some knock-on effect from the World Cup at the end of last year. That volatility will continue, given that the extra Bank Holiday this month for the Coronation will likely temporarily shave 0.5% off monthly GDP, only to be regained in June. While the impact of these additional holidays appears to have lessened compared to past decades, it’s probably enough to produce a 0.2% decline in overall second-quarter GDP.

Extra Bank Holidays seem to have less of an impact than they used to

Strip out all of the volatility though, and the economy seems to be reasonably stagnant. There is some potential for some very modest growth through the rest of the year, given that the real wage squeeze is set to lessen (at least through the lens of annual wage growth adjusted for headline inflation), and consumer confidence has correspondingly come off its lows. Consumer gas/electricity prices should slip below £2,000 on an annualised basis for the average household from July, from £2,500 currently. The resilience in the jobs market also suggests the risk of a very near-term recession has faded.

None of this is of particular consequence for the Bank of England, which is still squarely focused on inflation. It’s clear that next week’s wage figures and the following week’s CPI data will be key. We don’t expect another rate hike in June, but further hawkish surprises in those numbers could potentially change that.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post

Read the full article here