Note: Noble Corporation Plc (NYSE:NE) has been covered by me previously, so investors should view this as an update to my earlier articles on the company.

Last week, leading offshore driller Noble Corporation (“Noble”) reported better-than-expected first quarter results and maintained full-year expectations.

Company Presentation

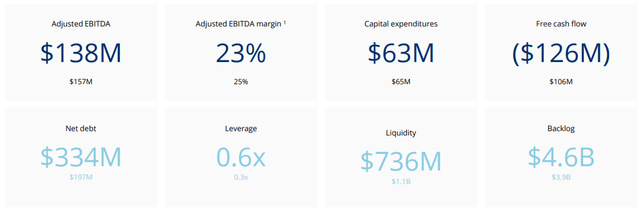

Despite a further delayed contract start for the drillship Noble Globetrotter I offshore Mexico, the company managed to outperform revenue expectations and generate $138 million in Adjusted EBITDA.

On the flip side, free cash flow was negative $126 million, but this was mostly due to a sizeable increase in working capital which management expects to reverse in the current quarter.

The company also used $10 million for share buybacks during Q1.

On the conference call, management reaffirmed the company’s outlook for the year:

Company Presentation

Since the beginning of 2023, the company has expanded its backlog by an impressive 18% to $4.6 billion, partially due to Exxon Mobil (XOM) extending the company’s drillship quartet offshore Guyana by an aggregate 6.3 years.

But the good news does not stop here.

On Thursday, a number of media outlets reported a $500 million contract award for the 7th generation ultra-deepwater drillship Noble Faye Kozack offshore Brazil with contract commencement expected in the fourth quarter.

While the calculated dayrate for the 2.5 year contract amounts to an eye-catching $548,000, investors should note that this number includes a sizeable mobilization fee and some integrated services with the “clean” dayrate likely remaining below the magic $500,000 mark.

Depending on the exact commencement date, the contract could contribute up to $50 million in revenues for Q4.

Noble also bagged a one-well contract with Shell (SHEL) for the drillship Noble Voyager offshore Mauritania with the customer retaining the option to employ the rig for an additional 24 months (emphasis added by author) :

The contract has an estimated duration of 60 days at an undisclosed dayrate, includes mobilization and demobilization fees, and is expected to commence in continuation of the Noble Voyager’s current contract with Shell.

It also includes options to extend the duration by up to 24 additional months, to be priced using an agreed fair market rate mechanism.

With a good chunk of the company’s high-specification floaters now working on long-term contracts, attention has turned to the cold-stacked 7th generation ultra-deepwater drillship Pacific Meltem, a rig that has yet to secure its maiden contract.

During the questions-and-answers session of the conference call, management explained its decision not to bid the drillship in the most recent Petrobras (PBR) pool tender:

One, the public results of the Petrobras tender would show that we’re not in the current tenders with that rig. And we have our specific reasons for that. For one thing, I don’t want to presuppose where we might end up bidding that rig or looking to put that rig into a maiden contract. It is a question of risk tolerance around some of the criteria that I’ve outlined previously, including termination rights and time to perform the shipyard work and reactivation work before liquidated damages or termination rights might kick in.

So as we looked at the now public tenders, we didn’t think that was the best fit for the Meltem. But that doesn’t mean that it would be precluded from something there in the future by any means. Generally speaking, at current rates, two to three years is a timeframe that I think works quite well for an initial contract for that rig. Again, extremely important to us are the contract terms that sit around the financials.

Given the cautious commentary, I was surprised to learn that competitor Transocean (RIG) has offered three cold-stacked 7th generation drillships inherited from Ocean Rig in the very same pool tender despite the apparent risks associated with potential contract awards. Please note also that Transocean actually pulled one of these rigs from last year’s Petrobras tender due to alleged insufficient contract economics.

Despite the encouraging contracting activity, Noble Corporation’s performance in both 2023 and 2024 will be impacted by an elevated number of special periodic surveys with a whopping 75% of the company’s fleet currently scheduled for drydocking until the end of 2024.

Fleet Status Report

With ten-year special survey costs for a drillship ranging between $20 million and $40 million and considering 30 to 60 days of off-hire time, the company will feel the pain on both the top- and bottom line over the next few quarters.

Nevertheless, management continues to see the company reaching $1 billion of annualized Adjusted EBITDA in the fourth quarter with the financial outlook for 2024 and beyond remaining “extremely robust“.

Thanks to last month’s refinancing transactions, the company has gained additional flexibility with regards to its capital allocation plans and expects to return “a significant majority” of its free cash flow to shareholders going forward:

You can expect us to continue to execute on our share repurchase repurchase program and to continuously evaluate if and when a dividend might be appropriate.

Bottom Line:

Overall, Noble Corporation reported a solid start to the year while reaffirming full-year expectations.

In addition, the company has made great progress expanding its backlog with the above-discussed long-term contract for the drillship Noble Faye Kozack carrying one of the highest dayrates in recent history.

While the company’s top- and bottom line will be impacted by an elevated number of special periodic surveys until the end of 2024, management continues to expect strong financial results for at least the next couple of years.

With shares trading below 5x estimated 2024 EV/Adjusted EBITDA, Noble Corporation remains a buy.

At this point, I remain positive on the entire industry, including leading U.S. exchange-listed players Seadrill (SDRL), Valaris (VAL), Borr Drilling (BORR), Transocean, Helix Energy Solutions (HLX) and offshore drilling support providers like Tidewater (TDW) and SEACOR Marine Holdings (SMHI).

Read the full article here