Co-authored with “Hidden Opportunities”

We saw a swift stock market decline in 2022, and 2023 has been quite the roller coaster. If your stomach tightens when you go to check your investment accounts, you are not alone. Wall Street is playing a guessing game, and you are getting pulled into the casino. The worst part is that it isn’t your budgeted gambling money at stake but your financial future and retirement. Wall Street always wins this game.

You can find good reasons to scuttle your equities in every morning paper and on every broadcast of the nightly news – Peter Lynch

Loss aversion is a natural human cognitive bias. Watching our hard-earned money evaporate before our eyes during a market crash is terrifying. When headlines say the market has another 60% downside, investors will do whatever it takes to take their cash out.

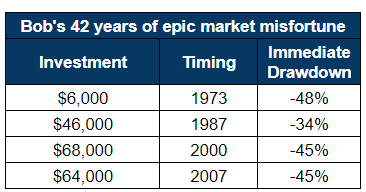

Where did that magical number come from? Is it as reliable as the projection of the S&P 500 hitting 5000 by Dec 2022? Let us quickly discuss the tale of Bob, the worst market timer in the history of the markets. Bob began his investing career in early 1973 with $6000. He made two more additions in September 1987 and March 2000. Finally, Bob retired in September 2007 and made a final contribution to his investment portfolio.

Author’s Calculation

Everyone ridiculed Bob for his methods and his timing. But Bob never sold any of his holdings. He was riding the stock market for the longer term.

In 2015, Bob’s portfolio value was $1.16 million, a 9% annualized return for 42 years!

Market timing doesn’t work as you think, but everybody wants to find out for themselves. If you think you can dance in and out of securities to not experience drawdowns on your portfolio, we wish you well. For those who seek to produce income in bull and bear markets, we can lend a helping hand, starting with these two excellent picks.

Pick #1: RVT – Yield 8.4%*

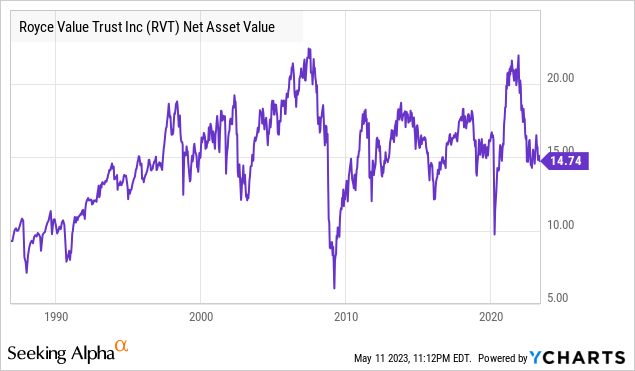

Royce Value Trust (RVT) is a Closed-End Fund (‘CEF’) born in 1986. Whatever most investors are worried about – stagflation, high inflation, recessions, terror attacks, financial system failures, pandemics – RVT is one of the few funds that has “seen it all.” The CEF has rewarded shareholders handsomely through the years, averaging around 10% in annual returns since its inception.

The relative valuations for small-caps versus large-caps are at their lowest in 20 years, and market experts predict a reversal in the near term.

We think small cap is ready to roll and expect the next three to five years to be strong on both an absolute and relative basis – Chuck Royce, April 2023

RVT provides the best possible income-focused exposure to small caps and trades at an attractive 13% discount to NAV. Small-cap firms carry risks, but the CEF effectively mitigates this through adequate diversification across 479 entities. RVT does not rely much on leverage, and its current portfolio composition only carries a 2.1% leverage.

*RVT pays variable distributions at the annual rate of 7% of the rolling average of the prior four calendar quarter-end Net Asset Values (‘NAVs’). We expect the CEF to declare $0.25/share in June. With that and the past three distributions, RVT’s TTM yield calculates to 8.4%.

Looking at RVT’s distribution composition since 2015, we have generally seen a large portion come from long-term gains. However, recent quarters show a rising Return of Capital (‘ROC’) component. As we have discussed several times, ROC isn’t automatically a negative factor as long as we have a well-managed fund.

Despite nerve-racking drawdowns during uncertain market conditions, RVT has demonstrated NAV preservation and growth over the years due to its active management. Remember, the portfolio management team’s bonuses are determined by the CEF’s outperformance vs. its benchmark index, the Russell 2000.

Since the end of WWII, most down years for small caps have been followed by positive performance. Moreover, data since the late 1980s show that small caps generated significantly better returns than large caps during recessions. RVT presents among the best income-oriented small-cap investments and is available at a steep discount as this recession fear strikes the market.

Pick #2: PFFA – Yield 10.9%

When it comes to actively managed securities, we seek three essential requirements.

1. Focus on Current Income

2. Diversified exposure to an income-oriented industry/sector

3. Reputable management team with a strong track record of shareholder returns

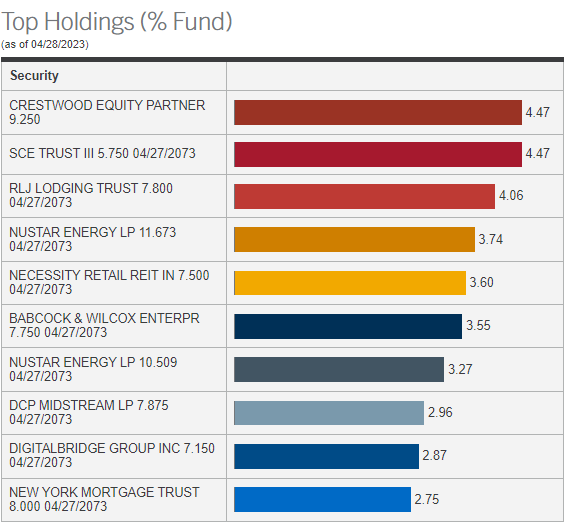

Virtus InfraCap U.S. Preferred Stock ETF (PFFA) checks all these boxes. As the name suggests, this ETF is built with a portfolio of preferred securities issued by American companies with over $100 million in market capitalization. PFFA’s portfolio is invested across 213 issues, making it adequately diversified in this important income-oriented asset class.

PFFA is actively managed by Infrastructure Capital Advisors, an investment management firm specializing in energy infrastructure, real estate, and option-enhanced income strategies. The InfraCap team prides itself on being long-term investors seeking to maximize investment returns across all market cycles. PFFA’s guiding principles include risk minimization through investment in securities backed by long-lived assets that generate substantial streams of free cash flow.

Notably, the HDO preferred portfolio has favorably covered at least 75 of the 213 holdings. We directly hold seven out of the top 10 holdings in PFFA’s portfolio, which indicates a close alignment of the ETF’s strategy with our investment style. Source

Virtus.com

PFFA is actively managed and modestly leveraged (20-30%) with careful security selection and weighting based on qualitative, quantitative, and valuation factors. For example, the ETF actively eliminates preferred securities with low or negative yield-to-call ratios, a strategy we closely pursue in our preferred portfolio.

PFFA mimics HDO’s fixed-income selection style, with added leverage to boost returns in a market condition where these securities are set to make a strong comeback. All we need to do is wait patiently, and it is easy because PFFA rewards us with reliable monthly income.

With preferreds at steeply discounted prices amidst higher interest rates, PFFA shareholders stand to benefit from their steady monthly distributions and modest capital upside as the Fed decides to step back. PFFA’s $0.165/share monthly payment calculates to a 10.9% annualized yield.

Conclusion

Time and again, the average investor buys when the markets are greedy and sells when the markets are fearful. This is the byproduct of the fears and emotions generated by the headlines. The same outlets will not tell you when to re-enter the market; when they do, it will be late, and you will have lost out on substantial gains.

The idea that a bell rings to signal when to get into or out of the stock market is simply not credible. After nearly fifty years in this business, I don’t know anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has. – Jack Bogle

Remember that your portfolio will likely see uncomfortable drawdowns during market sell-offs, but these are only on paper and relevant if you want to sell. And if you sell with goals to time the bottom, you will cause permanent damage to your portfolio. You could instead choose to pursue your passion while those dividend payments keep accumulating.

At High Dividend Opportunities, we are net buyers of dividend-paying companies. Our “model portfolio” comprising REITs, BDCs, MLPs, CEFs, C-Corps, preferred shares, and baby bonds carries a +9% overall yield. We see what you perceive as a bloodbath as bargains and will use them to amplify our income stream. Grab these +8-10% yields from RVT and PFFA for a rich retirement through thick and thin.

Read the full article here