Diversified, large-cap master limited partnership, MPLX LP (NYSE:MPLX) has been a stock market laggard over the last five years. However, looking under the hood shows that the business generates so much distributable and free cash flow that the partnership’s distributions have been able to earn unitholders market exceeding returns. This aspect of the business means that not only should income-seeking investors look at it as an investment, but those unitholders can look forward to higher-than-market returns. The market has so underappreciated this aspect of the business that its free cash flows are trading at a nearly 8% yield.

Stock Market Laggard Saved by Distributions

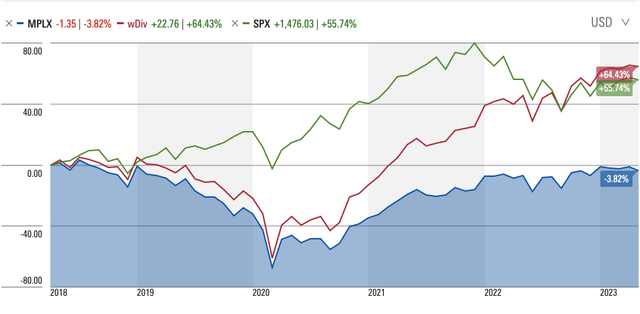

In the last five years, MPLX share price slumped 3.82%, while the S&P 500 (SPX) rose by nearly 56%. However, the magic of dividends is such that the firm’s total unitholder returns (TUR) exceeded 64%.

Source: Morningstar

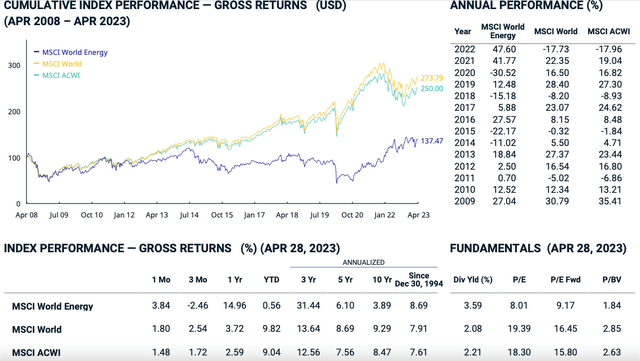

The partnership’s poor share price performance is out of step with the energy sector’s performance. In the last five years, the MSCI World Energy Index has earned 6.1% gross returns per year, compared to 8.69% for the MSCI World and 7.56% for the MSCI ACWI.

Source: MSCI

A Stable, Predictable Business Model

Energy firms tend to follow a boom-and-bust cycle, due to their dependence on energy price movements, and the perverse incentives to oversupply oil and gas during booms. At a granular level, this is true of upstream and downstream firms, but this is less so of midstream firms, whose revenues are less dependent on the price of oil and gas, and follow a kind of subscription model.

MPLX’ major source of revenue comes from its relationship with Marathon Petroleum Corporation (MPC), who formed the company in 2012 and owns its general partner and 65% of MPLX’ common units. The relationship with Marathon adds a further level of stability to the business. This is because the partnership makes up most of Marathon’s midstream segment, so MPLX has a guaranteed customer for its services. In addition, the firm is able to distribute its refined products using the Marathon brand, and by tapping into a large network of retail locations that are owned or operated by independent entrepreneurs across the country.

The partnership has many long-term, fee-based contracts with minimum volume commitments with Marathon. This results in a very predictable revenue and cash flow stream, which makes the business eminently understandable by investors. It also protects the business from the boom and bust cycles associated with energy firms.

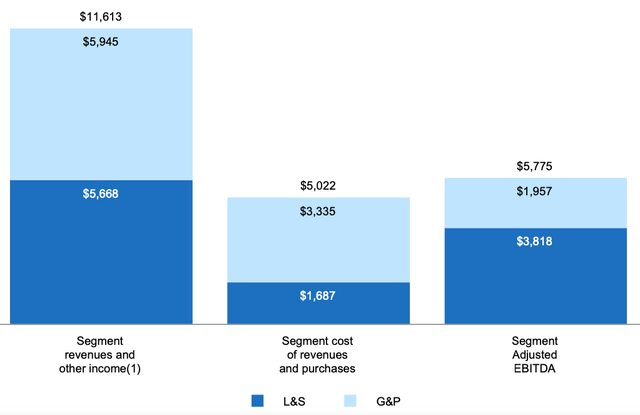

At a macro level, MPLX earns revenue from its energy infrastructure and logistics assets and provides fuel distribution services. The company has two segments, the Logistics and Storage (L&S) and Gathering and Processing (G&P) segments. Marathon is responsible for 47 of total revenues and other income mostly in the L&S segment. In 2022, the L&S segment was responsible for 48.8% of revenue, and the G1P segment for 51.2% of revenue.

Source: MPLX LP 2022 Annual Report

The L&S segment charges a tariff gathering and transporting crude oil, refined products, other hydrocarbon-based products and renewables through its pipelines and at its barge docks, and earns fees from storing crude oil, refined products, and renewables at its storage facilities. The marine business earns revenue from a fee-for-capacity contract with Marathon Petroleum Corporation. The fuel distribution earns revenue based on the volume of products that MPC sells each month. The G&P segment gathers, processes and transports natural gas, as well as transporting, fractionating, storing, and marketing natural gas liquids (NGLs).

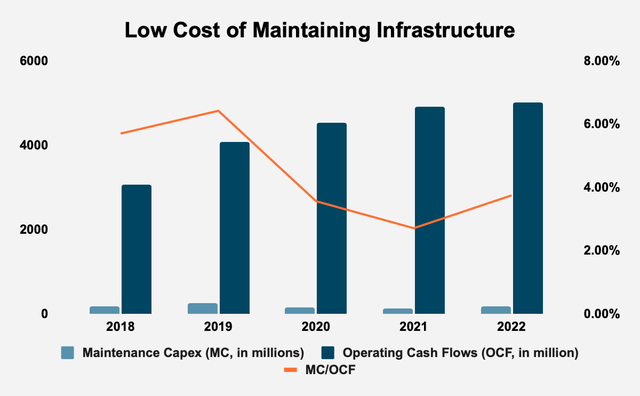

It has to be stated that the industry is fairly robust in terms of keeping out new entrants, given the immense costs of building out rival infrastructure, and the regulatory difficulties of getting any such project off the ground. The beauty of the business is that, when you have the infrastructure in place, it is very cheap to maintain. In the last five years, maintenance capex has been around 4% of operating cash flows (OCF).

Source: MPLX LP Filings and Author Calculations

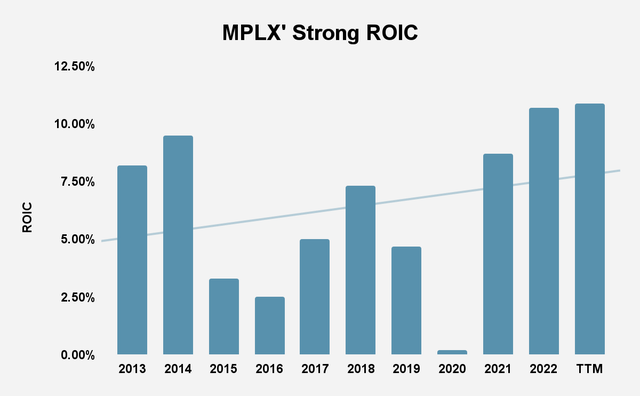

This model ensures that the business enjoys strong returns on invested capital (ROIC) which have been punctuated by the pandemic. In the last decade, the business has only had negative ROIC during the pandemic period, and the trend has been toward growth, from 8.2% in 2018 to 10.9% in the trailing twelve months (TTM).

Source: Author Calculations

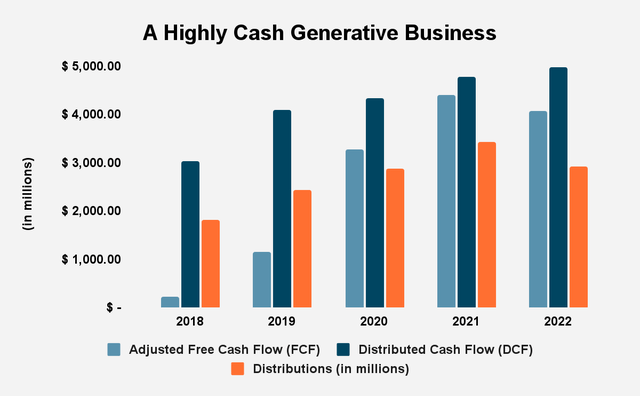

A Cash Machine Supporting Distribution Growth

MPLX is able to generate a consistent and strong stream of cash flows, which supports dividend issuance and any capex growth that is needed. In the last five years, MPLX has grown free cash flow (FCF) from $228 million in 2018 to $4.07 billion in 2022, compounding at 77.96% a year, and amounting to 38.6% of its market cap. In 1Q23, the firm earned $1 billion in FCF compared to $850 million in 1Q22. The firm’s distributable cash flow (DCF) has grown from $3.04 billion in 2018 to $4.98 billion in 2022, compounding at 10.42% a year and amounting to 62.4% of its market cap. In 1Q23, DCF was $1.27 billion compared to $1.21 billion in 1Q22. The partnership has grown distributions to unitholders and general partners from $$1.82 billion in 2018 to $2.92 billion in 2022, compounding at 8.77%. In 1Q23, the firm distributed $821 million compared to $$858 million in 1Q22. Distributions are clearly very supportable given the rich cash generation by the business. There is ample room for the partnership to increase distributions, which will counteract any market resistance to the business, and provide an income for investors looking for an income stream.

Source: MPLX LP Filings and Author Calculations

Valuation

MPLX has a price/earnings (P/E) multiple of 8.76, compared to 8.01 for the MSCI World Energy Index, 19.39 for the MSCI World, 15.80 for the MSCI ACWI, and 23.87 for the S&P 500. This suggests that the firm is relatively attractive compared to the market, while being slightly higher valued than its peers. However, the company has a gross profitability of 0.18, which is well below the 0.33 threshold for attractiveness, however, this has risen from 0.1 in 2018. The firm’s FCF in the TTM is $4.26 billion, which gives us an FCF yield of 7.84%, compared to an FCF yield of 2.7% for the 2000 largest firms in the United States, as measured by New Constructs. Overall, then, the firm is attractive and can be expected to perform better than the market going forward.

Conclusion

Despite being unable to beat the market by unit price performance alone, the company’s ability to generate strong DCF and FCF means that it can provide high distributions that lead to market-beating TUR. Going forward, with undervalued FCF, the firm is likely to beat the market on unit price performance alone, which should lift TUR even further. MPLX should definitely be considered by income-seeking investors.

Read the full article here