Investment Thesis

Sea Limited (NYSE:SE) reported its Q1 results and its share price promptly fell more than 13%. However, I believe over the next few days and weeks, once calmer tides prevail, investors will return to Sea Limited stock. After all, Sea Limited’s Q1 results saw a dramatic improvement in cash flows.

What’s more, even if Sea’s Digital Entertainment segment left a lot to be desired, I believe that investors can now start to give Sea’s Digital Financial Services slightly more consideration. In fact, I believe that Sea’s DFS segment could, in a few quarters time, be Sea’s next growth engine.

Why Sea? Why Now?

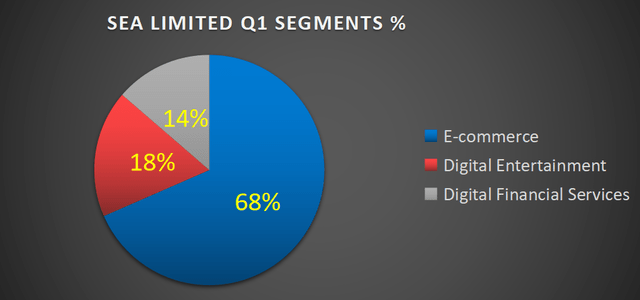

Sea is a digital economy consumer business, headquartered in Singapore. Sea has 3 segments, which I depict below.

SE Q1 2023

Sea’s E-commerce business continues to rapidly grow and shows no signs of slowing down. Q1 2023 saw Sea’s e-commerce segment jump 36% y/y. That’s the good news.

The bad news is that Sea’s Digital Entertainment segment saw its booking continue to shrink, yet again.

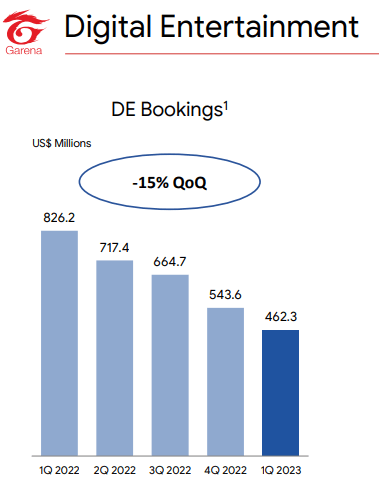

SE Q1 2023

Bookings are a leading indicator of future revenues. And with bookings falling 44% y/y, investors are going to be quick to ”write off” Sea’s Digital Entertainment segment until they are convinced that the business has stabilized.

Meanwhile, for bulls, the story will continue to be all about Sea’s rapidly growing Digital Financial Services.

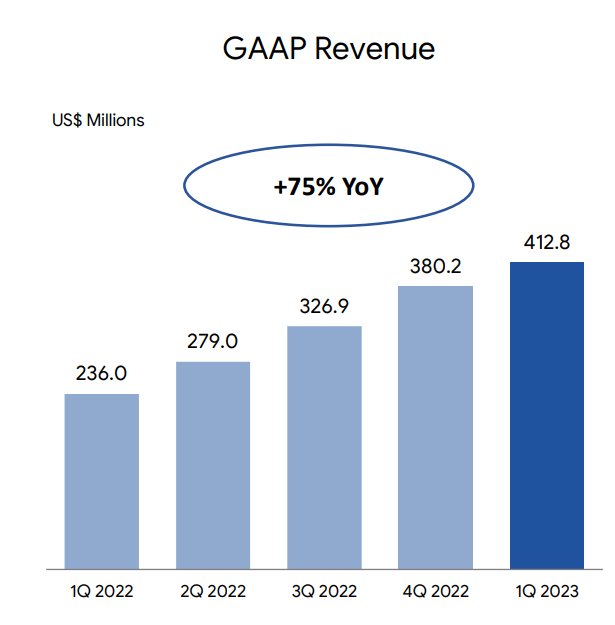

SE Q1 2023

Sea’s Digital Financial Services (”DFS”) was up 75% y/y on a GAAP basis. But the most promising aspect was that this growth was achieved while Sea’s non-performing loans 90 days past due have stayed around 2% delinquency rates.

More specifically, I argue that Sea’s DFS segment could, over the next 2 quarters, become Sea’s second most important segment. If that were to be the case, investors would be quick to look beyond the decline in Sea’s Digital Entertainment bookings towards Sea’s DFS as the Sea’s second significant growth engine.

Revenue Growth Rates Slow Down, What’s Next?

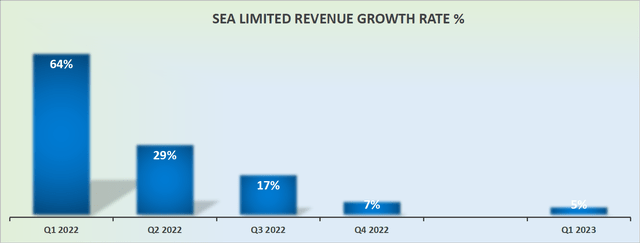

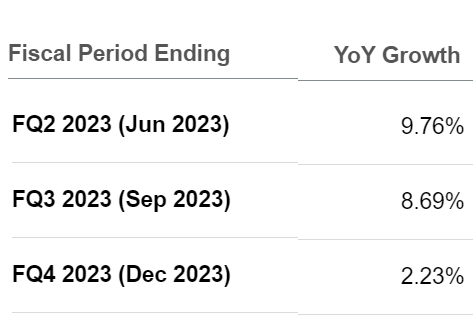

SE revenue growth rates

Sea’s Q1 2023 eked out a paltry 5% in GAAP revenue growth rates. That being said, look back to Q1 2022 and that quarter posted tremendous growth. Meaning that Q1 2023 was always going to be a challenging quarter for Sea.

SA Premium

With this context in mind, I ask readers to consider what the rest of 2023 is likely to look like. I suspect that investors looking out to 2023 as a whole are perhaps too bloomy.

Given Sea’s management’s focus and the company’s overall momentum, I believe that Sea could end up positively impressing investors over the next several months.

Profitability Profile Continues to Gain Momentum

Next, let’s move on to the most positive part of this quarter’s performance.

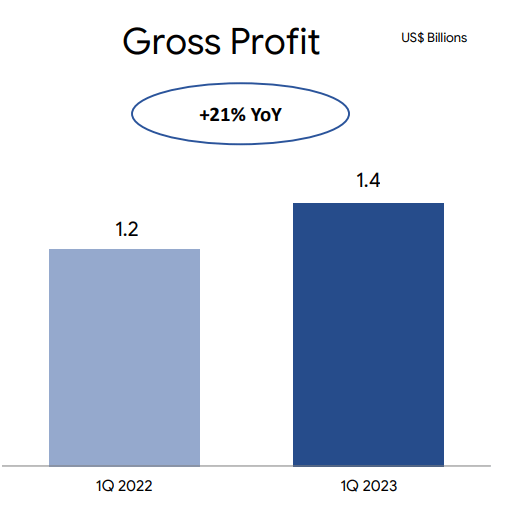

SE Q1 2023

Sea’s efforts to be mindful of its cost structure have started to pay dividends. More concretely, we can see that Sea’s efforts to improve its monetization and drive greater operating cost efficiencies saw its gross profits increase by 21% y/y, even on the back of minimal revenue growth rates of 5% y/y.

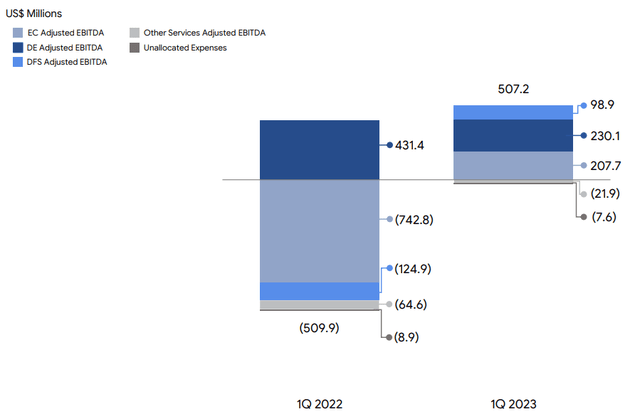

SE Q1 2023

In fact, what see above is that Sea’s E-commerce segment not only turned positive compared with the same period a year ago, but there’s a swing of more than $900 million in just 12 months.

SA Premium

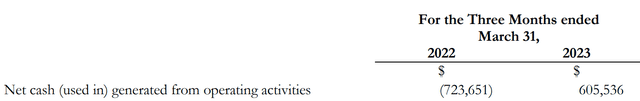

If you remember, last year investors couldn’t get past the fact that Sea’s balance sheet carried more than $4 billion worth of convertibles, while it was burning significant amounts of cash flow.

Today, not only have the convertibles on its balance sheet dropped to around $3.3 billion, but the business is evidently reporting attractive cash flows.

The Bottom Line

At the time of writing, Sea Limited stock is down approximately 13%, as investors didn’t welcome its uninspiring mid-single-digit revenue growth rates.

However, given the progress that Sea Limited has made in improving its profitability profile, I believe that once the dust has settled, investors will once again return to reappraise its long-term potential and be inclined to take the opportunity to buy a cheaply valued, fast-growing and diversified digital consumer business.

Read the full article here