Dear readers/followers,

In February I published an article on Granite Point Mortgage Trust (NYSE:GPMT) outlining my bearish thesis for the stock. The thesis was predicated on the fact that the company was losing money with each interest rate increase as they were unable to increase their net interest income and also on the fact that some of their lower rated loans were starting to show signs of weakness which was recognized by management via a significant increase in their provisions for credit losses. As a result of this, distributable earnings for the whole 2022 have dropped to only $0.28 per share while the dividend was $0.95 per share. It’s not difficult to see that this is not sustainable unless the situation improved materially very soon.

Despite this, in March management confirmed the full $0.20 per share dividend for the first quarter. That means my dividend cut thesis hasn’t materialized (at least not yet), but still the price tanked by 30% since my original article, mainly on commercial real estate fears. Now that we’re much lower and post Q1 2023 results, it’s time for an updated longer-term outlook.

Seeking Alpha

Q1 results

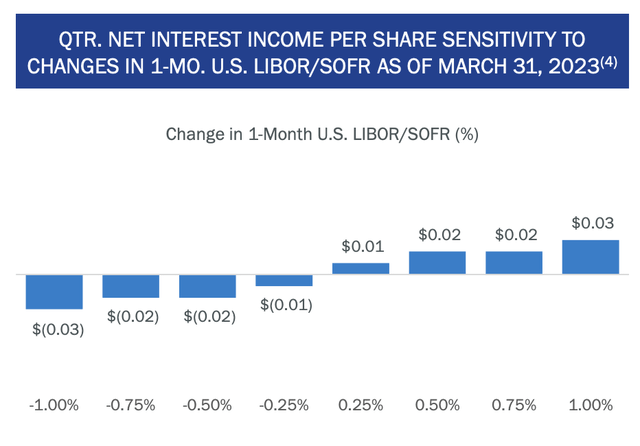

Let’s start by addressing their net interest income (NII) which is the main driver of their business. Last year the company struggled on this front as their interest expense increased more than interest received on their outstanding loans. In Q1, however, they managed to grow their NII by 9% QoQ to about $22.9 Million (about $0.44 per share). This is more in line with what we should be seeing from a 98% floating rate portfolio. Management also included a nice sensitivity analysis which shows that going forward a further 0.25% increase in LIBOR/SOFR would result in $0.01 per share increase in NII. Again this is good, as a healthy mREIT should at the very least be able to grow their NII in an increasing rate environment which is not what they were doing last year.

GPMT Presentation

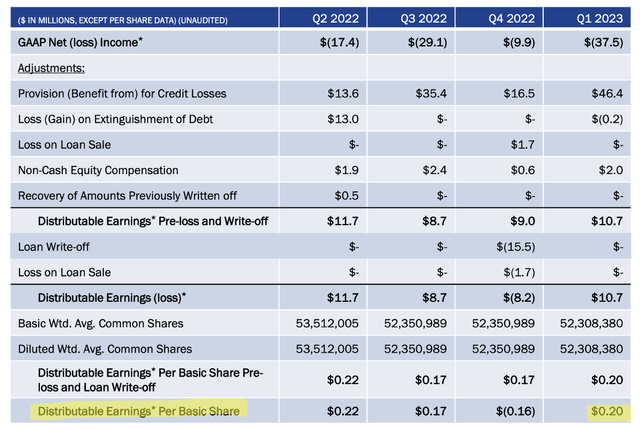

Beyond NII increases, it comes down to their ability to collect on their outstanding loans which obviously gets more difficult in a tough economic environment and at higher rates. The good thing is that following a write-off of $15.5 Million in Q4 2022 which was a result of a default on a $114 Million loan, there were no further write-offs in Q1. Still management decided to increase their provisions for credit losses by $46.4 Million to a total of $133 Million ($2.54 per share) or about 3.8% of total portfolio commitments. This should cover a significant portion of potential losses on their five 5-rated loans which have an aggregate principal balance of $274.8 Million.

In particular about half of the CECL reserve is allocated specifically towards these five risky loans, implying an estimated loss rate on the loan balance of about 25%. Considering these office loans had an origination LTV of 65-75% and were issued between 2017 and 2019, the level of CECL reserve assumes that Granite Point would be able to resell the distressed properties for half of the value at origination (if not, there would need to be additional write-offs). I argued in my recent article on Blackstone Mortgage Trust (BXMT) that valuations on good quality office space have been roughly cut in half since 2019 so I believe that management is making a realistic (though not conservative) assumption.

Even with such a large addition to their CECL reserve, which I see as the right thing to do in this environment, the company was able to post a solid $0.20 per share in distributable which is a major improvement compared to Q4 (which was affected by the large loan write-off) and is more in line with what we were seeing in the first three quarters of 2022. With a quarterly dividend of $0.20 per share, the company made enough to cover the dividend (though just barely). I still see a dividend cut as the right move, but if things improve quickly and there are no loan defaults above what can be covered by the CECL reserve, the company might right it out.

GPMT Presentation

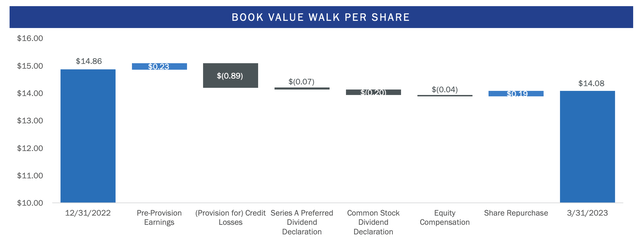

So it’s clear that while the sector remains risky, things are relatively stable at the moment, yet the stock is extremely cheap when compared to book value. In Q1 book value per share decreased to $14.08, mainly as a result of the aforementioned increase to the CECL reserve. I also want to point out that the $0.20 per share decrease from dividends was offset by share repurchases as the company accretively repurchased about 1 Million common shares, adding to the 4 Million shares they have repurchased over the couple of last years. As mentioned on the earnings call the board has increased the share buyback limit by an additional 5 Million shares which is almost 10% of all outstanding shares. Though their liquidity is limited, it’s good to see that they are thinking about buybacks at these depressed levels and when the price is at an all-time high.

GPMT Presentation

With a price of $4.21 per share, the stock is trading at just 30% of book value if the CECL reserve is included and just 25% of book value ignoring the CECL reserve. That is a major discount! To see what level of defaults the market is pricing in, we first need to look at the companies leverage. Total liabilities stand at $2.5 Billion while equity is reported at $931 Million, a total leverage of 2.7x. This means that a loss of 1% of loan principal will translate into a 2.7% loss for equity holders. Since the stock is trading at a 75% discount to book value, the market is pricing in a total write-off of 28% of the loan portfolio (75%/2.7x). For comparison 5-rated loans account only for 8.3% of the portfolio.

But remember, in case of default GPMT keeps the property and can resell it and it’s totally unrealistic that the property will be worth zero. I’m going to be conservative and assume that foreclosed properties can only be sold for 25% of the origination value around 2017-2019. With a portfolio wide average origination LTV of 66%, the implied recovery rate on defaults is 38% (assuming a building was valued at a $100 at origination, the loan principal was $66. Now that the value dropped to $25, at sale GPMT will recover 25/66=38% of the loan balance). With that the realistic level of defaults being priced in by the market is 38% higher that the aforementioned 28% which was assuming total write-off of foreclosed properties. That’s an implied default rate of 38% of the portfolio!

And the funny thing is that GPMT portfolio is “only” 40.6% office (followed by multifamily at 31.7% and hotel, retail and industrial below 10% each). So really we’re basically getting the office part of the portfolio for free. With only one default reported since the Fed started raising rates last year, 90% of office assets being Class A or recently renovated, and only a limited number of risky 5-rated loans, the drop in price feels overdone and the margin of safety is enormous.

The sell rating has done its job and although I don’t know if this is the bottom or if the stock will continue to suffer in the short-term (especially if the dividend eventually gets cut which is still a possibility), I’m fairly confident that over the medium to long-term the value will be recognized. That’s why I upgrade GPMT all the way to a “BUY” rating here at $4.21 per share. If you’re willing to stomach some pain in the short term, the return should eventually be worth it.

In addition to buying the commons, you have two way to play this:

- If you’re an income investor, the A-series preferred shares (GPMT.PA) look quite appealing as well with a yield of 11.6% until late 2026 when the yield will reset to 5.83%+SOFR (with a 7% floor on the par value). These rate above the commons which makes a yield on cost of at least 11.6% almost a guarantee unless the company goes bankrupt and since the shares trade at just 60% of par value, there is a fair bit of upside as well.

- You can do what I’m doing which is selling September puts with a strike at $5 for $1.10. If I get assigned, I’ll own the shares at $3.90 per share. If not, I’ll make 22% on my money in 4 month (annual return of 66%).

Read the full article here