Introduction

Although I’m not a big fan of hotel real estate investment trusts (“REITs”), I have been invested in the preferred shares of Sunstone Hotel Investors, Inc. (NYSE:SHO) for the past few years as this hotel REIT’s strong and conservative balance sheet has allowed it to get through the COVID pandemic without too much damage. The REIT was even able to expand its empire by adding assets without compromising the financial stability of the REIT. Now that Sunstone has published its Q1 results, I wanted to have a look at its performance from the perspective of a preferred share investor.

The first quarter was decent for Sunstone

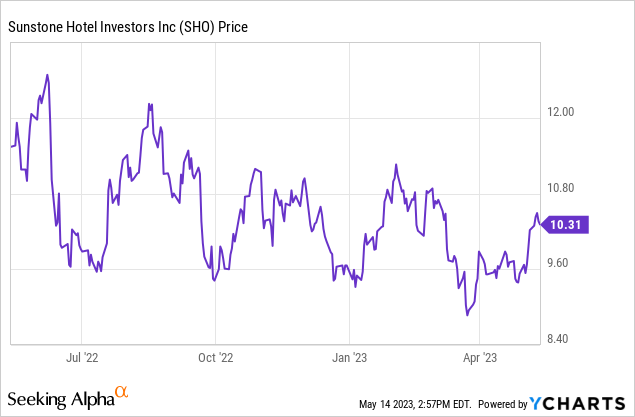

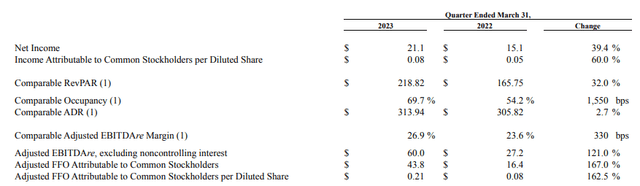

I was pleasantly surprised when the results of the first quarter rolled in. Sunstone was able to increase its occupancy rate from 54.2% in Q1 2022 to a very respectable 69.7% despite seeing an increased in the average daily room rate. The Revenue Per Available Room (RevPAR) jumped by 32% to almost $220 thanks to the stronger occupancy numbers.

Sunstone Investor Relations

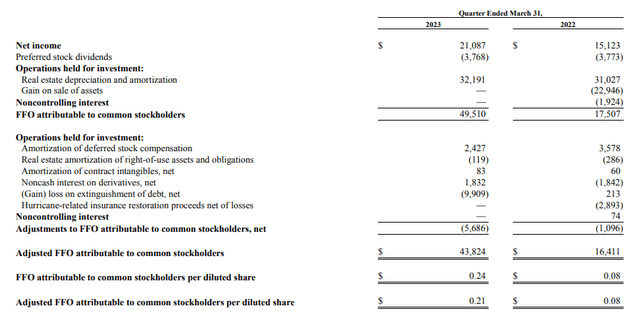

As Sunstone is a REIT, we need to focus on the FFO (funds from operations) and AFFO (adjusted FFO) rather than the reported net income. The FFO calculation obviously starts from the net income and the depreciation and amortization expenses are added back to the equation, while the preferred share dividends are obviously deducted. This resulted in a FFO of $49.5M, which is almost three times higher than in the first quarter of last year.

Sunstone Investor Relations

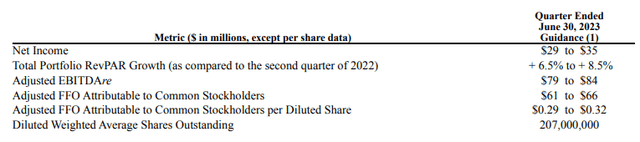

I prefer to use the more conservative AFFO result, and although the AFFO of $43.8M or $0.21 per share is pretty good, it is lower than the previous few quarters. That’s pretty standard considering the first quarter is traditionally relatively weak for hotel REITs as the demand for hotel rooms is pretty low. That’s also confirmed in the REIT’s Q2 guidance. As you can see below, Sunstone is guiding for an AFFO of $61-66M for an AFFO per share of $0.29-0.32, which would be a strong improvement compared to the first quarter.

Sunstone Investor Relations

What does this mean for the dividend and asset coverage level?

As explained in my previous article, there are currently two series of preferred shares listed. The H-series are trading with (NYSE:SHO.PH) as ticker symbol and offer a 6.125% preferred dividend for a total of $1.53125 per year, while the I-Series are trading with (NYSE:SHO.PI) as ticker symbol offering a 5.7% preferred dividend for a payment of $1.425 per year. Both issues are cumulative and can be called by Sunstone from May 2026 and July 2026 on.

As explained in previous articles, I like to judge preferred shares based on two elements: how well are the preferred dividends covered and how much equity is ranked junior to the preferred equity.

The first question is easy to answer. The REIT generated $43.8M in AFFO in Q1, which already included the $3.8M in preferred dividend payments. This means the AFFO generated excluding the preferred dividend payments was approximately $47.6M, which means the coverage ratio of in excess of 1,200%. And this will increase in Q2 as the AFFO will come in at $61-66M. This increases the preferred dividend coverage level to in excess of 1,700% in the current quarter. So I’m definitely not concerned here, and even a slowdown of the economy will likely still result in an occupancy rate that should be sufficient to continue to generate a positive AFFO.

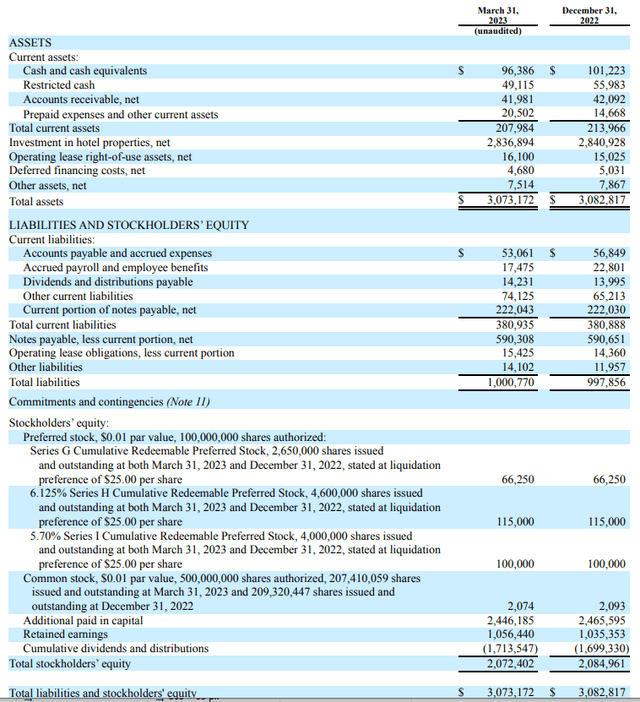

Looking at the balance sheet, there is about $145M in cash on the balance sheet (including restricted cash) while there’s $222M in current debt and $590M in long term debt. This results in a net debt level of approximately $670M. That’s approximately 23.5% based on the book value of the assets.

Sunstone Investor Relations

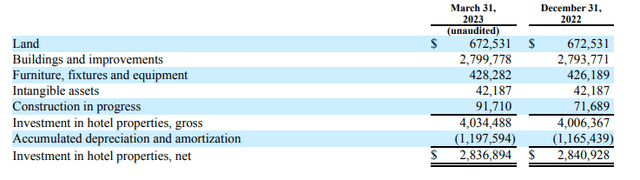

Keep in mind the book value of $2.84B already includes approximately $1.2B in accumulated depreciation, and it is reasonable to assume the market value of the hotel properties is higher than the book value.

Sunstone Investor Relations

That’s important, as this potential “hidden value” on the balance sheet would make the preferred shares even ‘safer’ than they already are based on the current balance sheet. According to the balance sheet, the total amount of equity is $2.07B, of which $281M is preferred equity. This means there is about $1.8B in equity junior to the preferred shares (based on the book value of the assets). If the market value of the assets is higher than the book value, the “safety cushion” will be even stronger.

Investment thesis

I currently have a long position in both issues of the preferred shares, but my position in the H-series with the higher preferred dividend is larger, as I just add to the position based on what makes sense. Both issues have the same risks, and the call risk for the H-series is only marginally higher: I think a cost of preferred equity of 6.125% is not a deterrent for Sunstone. Additionally, the call risk only exists from 2026 on. An additional layer of safety can be found in the prospectus: if there is a change of control and the buyer does not call the preferred shares, the preferred shareholders of the H- and I-series can convert their preferred equity into common equity and tender it to the buyer of the REIT.

Based on a share price of $18.99 for the I-series and $20.73 for the H-series, the current preferred dividend yield is respectively 7.5% and 7.4% which makes the I-Series slightly more attractive from an income perspective.

Read the full article here