ZIM Integrated Shipping Services (NYSE:ZIM) is set to report earnings for the first fiscal quarter on May 22, 2023 before the ring of the bell. The shipping company has suffered greatly from a decline in shipping rates during last year’s post-pandemic correction and I expect continual declines in average freight shipping prices as well as free cash flow.

ZIM Integrated Shipping already issued a depressing outlook for FY 2023 EBITDA as falling freight rates are excepted to hurt the company’s profit margins this year. Shipping rates have continued to trend down in the first quarter and earnings estimate trends are likely to remain negative for the foreseeable future as well. I believe shares are vulnerable in the short term and could make new lows if the shipping company sees broad deterioration in its key metrics!

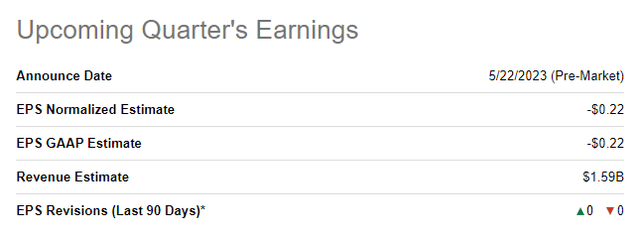

Market expectations for ZIM Integrated Shipping’s Q1’23, negative estimate trend

Analysts expect a loss of $0.22 per-share in adjusted earnings for the first fiscal quarter on revenues of $1.59B as deteriorating market conditions likely weighed on ZIM Integrated Shipping’s container business in Q1’23.

Source: Seeking Alpha

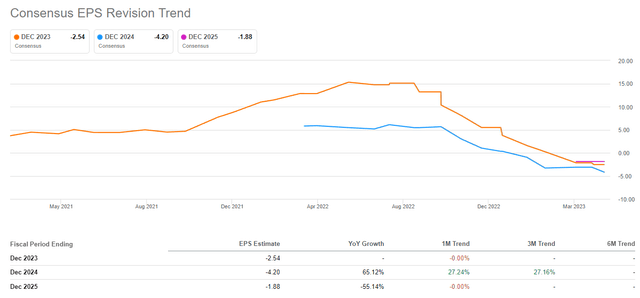

Analysts have greatly revised ZIM Integrated Shipping’s EPS estimates to the downside in recent months and they overwhelmingly expect negative full-year EPS for FY 2023, FY 2024 and FY 2025 as well. For the current year, analyst expect $(2.54) per-share in earnings while the consensus view is that the shipping industry is set to experience a major earnings recession in FY 2024. The estimate trend is clearly negative, as shown below, and if a recession comes down on the world economy in 2023, ZIM Integrated Shipping’s EPS estimates are set to get further revised to the downside.

Source: Seeking Alpha

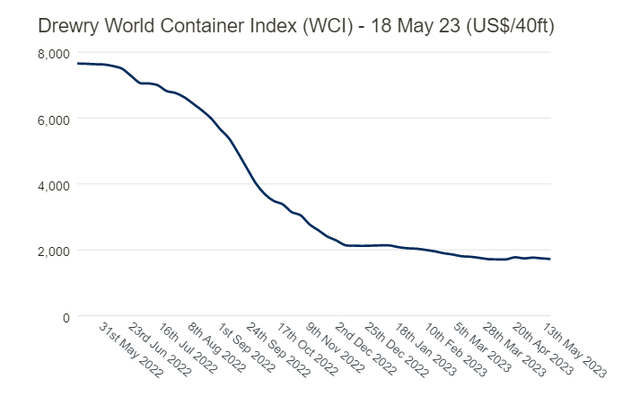

Brace for impact: shipping rates are still dropping, my personal outlook

According to the Drewry World Container Index, which shows the cost of shipping a 40-foot container, shipping costs continued to fall in the last week. The price of shipping a 40-foot container set back customers $1,720 in the week ending May 18, 2023, showing a 1% week over week decline and a 78% price decrease compared to the same week in the year-earlier period. Since January 5, 2023, shipping rates declined 19% due to cratering consumer demand in a high-inflation world. This drop in shipping rates will at least be partially reflected in ZIM Integrated Shipping’s Q1’23 earnings results.

Source: Drewry

Economic risks are growing, in part due to headwinds from inflation that are resulting in weakening consumer demand. The Worldbank warned of a recession earlier this year in which case I would expect shipping rates to fall further. I believe shipping rates could fall towards $1,000/container if the world economy faces a deep contraction which would obviously negatively affect ZIM Integrated Shipping’s EBITDA outlook.

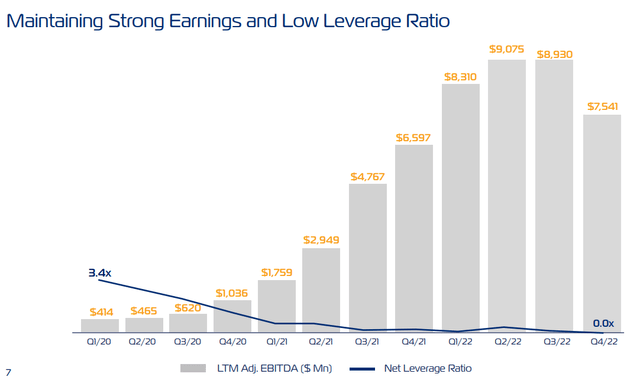

EBITDA risks are growing

The EPS estimate trend reflects expectations that the shipping industry is set for a harsher pricing environment which will affect ZIM Integrated Shipping’s free cash flow and EBITDA prospects. In FY 2022, the shipping company achieved $7.54B in adjusted EBITDA, showing an increase of 14% year over year. However, ZIM’s Q4’22 adjusted EBITDA declined 59% year over year to $973M… indicating that the down-turn in the shipping industry hit the company with full force just in the second half of FY 2022.

ZIM’s LTM EBITDA has declined two straight quarters in a row and with a light forecast in place for FY 2023, I believe it is safe to say that the company’s EBITDA has cyclically peaked last year. For Q1’23, I expect adjusted EBITDA of $850-900M as consumer demand and pricing continued to weaken. While I consider the company’s strong net cash position to be an asset, the EBITDA trajectory is not looking great.

Source: Seeking Alpha

I also expect a quarter over quarter decline in free cash flow for ZIM Integrated Shipping as pricing power kept eroding in the first-quarter. The company saw an average freight rate of $2,122/container in Q4’22, showing a massive decline of 42% year over year. The average freight rate likely dropped below $2,000/container in Q1’23 which should result in a drop-off in free cash flow as well. I estimate that ZIM Integrated Shipping will report Q1’23 FCF of around $900-950M compared to a Q4’22 free cash flow of $1,048M.

EBITDA outlook for FY 2023 may get downgraded

ZIM Integrated Shipping submitted its outlook for FY 2023 earlier this year which calls for $1.8-2.2B in adjusted EBITDA. This guidance implies a steep decline of 73% year over year in adjusted EBITDA. The very light outlook for FY 2023 is driven by a fundamental change in the operating environment, which is reflected by decline in freight rates and slowing consumer demand post-pandemic. ZIM Integrated Shipping was also downgraded by JPMorgan & Chase in April due to an uncertain pricing environment. If the world economy were to fall into a recession in 2023, I would estimate expect the shipping company to further downgrade its adjusted EBITDA outlook for FY 2023.

Risks with ZIM Integrated Shipping

The biggest risk for ZIM Integrated Shipping, as I see it, is the potential beginning of recession in 2023 which could negatively impact container shipment volumes as well as average freight rates for the shipping company. ZIM Integrated Shipping may also have to downgrade its EBITDA outlook for FY 2023 if shipping rates continue to fall and the shipping industry would be forced to deal with a recession. While I don’t see any risks regarding ZIM Integrated Shipping’s balance sheet, which carries practically no debt, there is a risk that analysts will continue to revise EPS estimates to the downside after the firm’s Q1’23 earnings on Monday.

Final thoughts

The main reason why I remain pessimistic on the shipping company ahead of Q1’23 earnings is that the industry continued to see a negative pricing environment in the first-quarter which is driven by weakness in consumer demand. Since shipping rates continued to decline in the first-quarter, I would expect to have a negative impact on ZIM Integrated Shipping’s financial performance. Additionally, I am concerned about the EPS estimate trend that shows a steep decline in profitability, especially in the next two years. With pricing pressure persisting in Q1’23, I believe investors will have to brace for impact when the shipping company reports earnings for its first fiscal quarter on Monday and new lows must be expected, especially if ZIM downgrades its EBITDA outlook!

Read the full article here