Investment Summary

The opening to Catalent, Inc (NYSE:CTLT)’s Q3 FY’23 business update – finally released after much delay – says it best for the company’s near-term expectations [per CEO Alessandro Maselli]:

I’ll cut to the chase. This is not at all the call we expected to have now, and we are not at all where we expected to be. Our financial performance and operational execution have all fallen significantly short of our expectations and our February forecast, and we accept responsibility for disappointing you.

After a tumultuous start to the year, the firm revised its expectations to $4.25Bn in top-line revenues in FY’23, and you’re looking at a substantial paring of 11.8% in turnover from last year if that’s the case. Not to mention, management expected $4.87Bn in prior revenue guidance. It appears investors aren’t happy to see $620mm wiped from the income statement and seem relatively undecided on a consensus market value in CTLT’s share price, as seen with the 3x gaps in marked pricing since January 1 this year [Figure 1]. Since my last CTLT publication, shares are down 20%.

Still, since the Q3 business update was eventually posted, the stock has rallied ~15%, suggesting that investors have found at least some comfort with the clarifications provided on the business update.

Figure 1. Market Uncertainty on value area with the Q3 earnings debacle

Data: Updata

As to the recent events (delayed earnings release x3), my discerning eyes have been glued to CTLT’s Q3 FY’23 numbers, meticulously analyzing what their impact on forward income, earnings and returns on capital could be. As you’ll see today, despite attempts to overcome its operational headwinds, the medium-term remains uncertain for CTLT, more so for its investors.

Alas, in the realm of drug product manufacturing, CTLT, a titan in the industry, is not impervious to further downsides going forward. As I delved into its 2023 numbers, a tale of productivity challenges and unexpected costs emerged, warranting a recalibration of, 1) my forward estimates, 2) risks [known and unknown], and 3) CTLT’s valuation.

Nevertheless, thinking in first principles, with CTLT you’ve still got a robust set of company fundamentals, quality core assets producing these, and a strong underlying business ex-Covid. Plus, we’ll now get to see management’s resolve in getting the firm out of the mud here. In my opinion, CTLT is a company that can adapt swiftly enough back to long-term trends, and shouldn’t be sold short just yet.

Net-net, there’s not enough scope for a contrarian stance just yet in my opinion, but I remain constructive on CTLT’s ability for a turnaround. I revise my rating to a hold for now, and look forward to the firm addressing the many challenges outlined in this report. I’m also looking forward to providing future coverage.

Productivity Challenges and Soaring Costs

A thoughtful analysis of CTLT’s operating headaches follows. Notably, there is a sequence of unfortunate events leading us to the present day:

One, at the core of it, it is simply a case of ‘revenues amiss, costs persist’ for the company. As the world gradually emerged from the clutches of the pandemic, CTLT found itself caught in a tumultuous spiral of delayed and missed revenues, tied to Covid-19 performance obligations:

- It failed to hit productivity numbers in its Bloomington and Brussels [Belgium] manufacturing sites. This, after regulatory citations found both sites needed to implement “operational and engineering controls”. I’d assume further capital diverted into rectifying these issues as well. You can expect Bloomington revenues to be hit by this in FY’23, confirmed by management.

- More broadly, the cataclysmic decline in top-line revenue, affectionately labeled by management as “the cliff,” has been a major detractor to CTLT’s market valuation in 2022/2023, whilst the pandemic’s grip loosened over the broad economy. For example, looking to the start of FY’23, CTLT bore witness to an expected, but staggering, 50% drop in Covid-related revenues compared to the previous first half. Further, with over half of these revenues hinged on take-or-pay (“TOP”) agreements, the company’s growth route now stands at the precipice of uncertainty, undoubtedly contributing to the earnings delays in my view.

- Alas, whilst the cash faucet ran dry in these past 12-months, the relentless torrents of labor costs (a major headwind in the healthcare sector during 2022/’23) and manufacturing costs remained firmly in situ. If you think of CTLT’s earnings party, these costs are like two guests who’ve overstayed their welcome, consuming all the food and drink, leaving CTLT grasping at straws to restore balance at the margin. For instance, trailing gross margin is at 32%, more than 41 percentage points below the sector, leaving plenty of headroom to expand.

- Specifically, for its BWI manufacturing site, the company was unable to roll out a new enterprise resource planning (“ERP”) system. Further, due to manufacturing delays at BWI, it won’t make up revenue from all unfinished batches of inventory in FY’23. This will directly impact Q3 turnover, and will hurt Q4 as well.

Two, CTLT did in fact have major plans to trim down its cost base last year, but these were waylaid shortly afterwards. Recall that, following a set of regulatory inspections over its biologic segment, CTLT was required to implement a set of corrective actions to meet code, each at a reasonable price tag. Added to that, it was forced to mark down inventory reserves for expiring bio-manufacturing components during the previous quarter (discussed below). These were originally procured during the pandemic to meet demand, but now cast an unexpected shadow on the firm’s profitability going forward in my view.

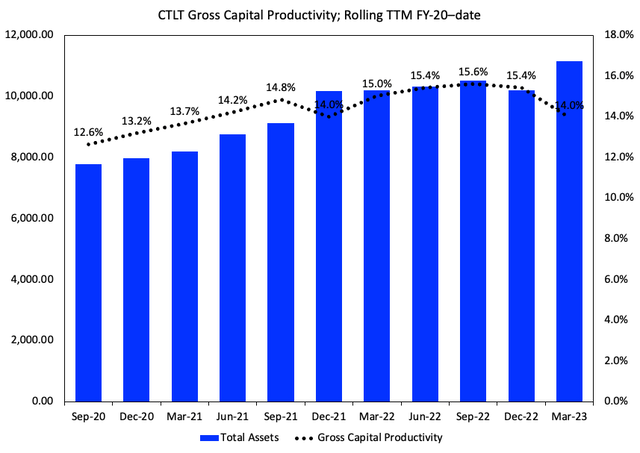

How the points (1) and (2) are seen in the numbers for CTLT is observed in Figure 2. Here, the gross capital productivity is taken by the rolling TTM gross profit divided by the total assets each quarter. Note, the 12–14% figure suggests that it produces $0.12–$0.14 on the dollar from its productive asset base, a figure that has rolled over in recent times as well. This tells me earnings growth may be expensive for CTLT going forward. Either it pares back some capital at risk, or has to wind up the profitability dial, in order to see these productivity numbers improve.

Figure 2.

Note: Dates correspond with date of release, and are rolled 1 period forward. (Data: Author, CTLT SEC Filings)

Three, in view of this, my astute readers, let’s not be blindsided by the veil of plummeting revenues alone. I’d also make serious note of the OpEx tied to CTLT’s workforce – bolstered by an influx of 7,000 new recruits, and $3.5Bn investment, bought on to navigate the dark ocean waters of the pandemic. In my opinion CTLT over-invested here. For starters, consensus view on how long Covid-19 would ‘last’ was mixed at best. Second, trends in CTLT’s underlying business had not changed that much.

Four, the vertiginous fluctuations in supply chain, raw materials and consumer spending caused by Covid-19, meant so many players who chalked up Covid-related inventories for FY’22–’25, have been forced into sharp markdowns as demand waned, and Covid-PPE costs correct back downwards. CTLT had sized up inventory levels to meet demand and capture Covid-19 market share, from $265mm value in FY’19, to $724mm by last year – 173% total increase, on the lower margin Covid-19 segment.

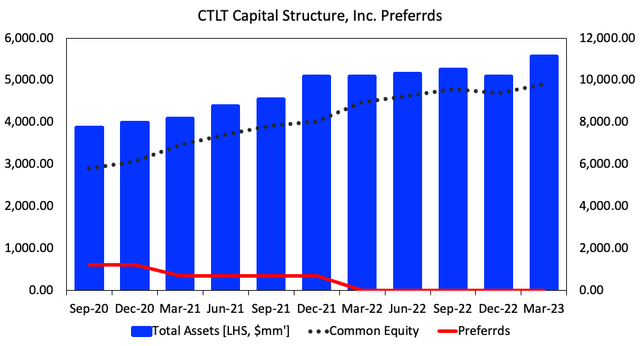

This inventory growth required reinvestment and consumed sizeable cash, due to the overpriced raw material and input costs, and left CTLT with overpriced finished product that now needs to be reconciled. As seen in Figure 3, total assets have curled higher in the last 2-years, and there’s now $4.9Bn in equity holding, and the company is up $11.14Bn in assets. Yet, inventory as a percentage of total assets increased from 4% in 2020 to 7.5% in Q2 FY’23.

Alas, the cost burdens plaguing CTLT’s operating performance could not be shed as swiftly as desired in Q2–Q3, like I had hoped. Personal, material, and inventory costs clung to the company’s shoulders, dragging down its scope for a more rapid recovery.

Figure 3.

Note: Dates correspond with date of release, and are rolled 1 period forward. (Data: Author, CTLT SEC Filings)

Market Generated Data

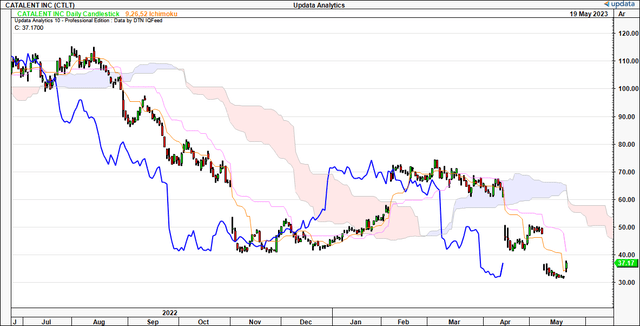

Looking to the trend analyses, Figure 4 illustrates the daily cloud chart spanning back to FY’22. You can see the price line and lagging line are below the cloud, suggesting the trend is in fact bearish and we can expect this over the coming weeks.

I’d expect $45 by June and to still be within the neutral/bearish camp based on this data. The lagging line (blue line) is also well below the cloud, and this suggests an almighty rally is required in order to see the stock be attractive on a momentum basis once again. A $60 level would have my interest, that’s for sure.

Figure 4.

Data: Updata

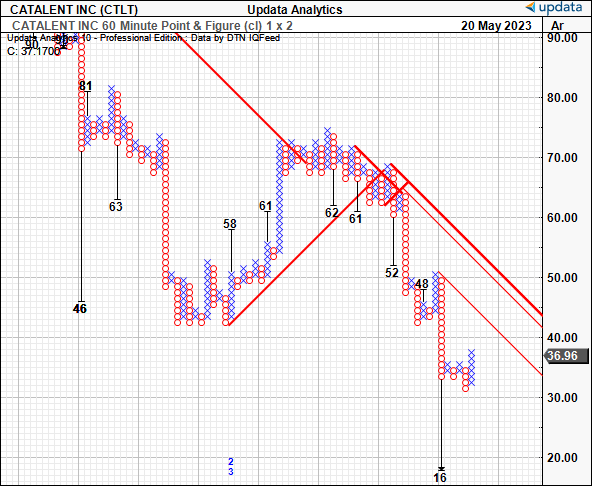

Looking to the point and figure studies below, objective targets are thrown off to a downside of $16, as seen below. Note, the trajectory of these targets has served as a beneficial tool to guiding price visibility. In that vein, the $16 is a risk that, if prices push lower, could in fact be activated.

Figure 5.

Data: Updata

Path to Redemption

Naturally, the conversation steers to what actions CTLT have taken to get the ship back on course. Management’s actions, discussed below, are a welcomed display of fortitude in my view. Whilst there’s no way of salvaging the stranded revenues tied to the production miss in Q1–Q3 FY’23, going forward, there may be opportunity if they resume on target next year. Key factors underpinning this in my view:

- Enhancing manufacturing process: CTLT recently welcomed back Sridhar Krishnan, an industry expert in ‘Lean Six Sigma’, to spearhead “The Catalent Way.” This is a company-wide initiative, and focuses on lean manufacturing, and aiming for efficiency (this translates to margins in my view).

- Cost reduction measures: I’d note CTLT has implemented a fairly comprehensive cost reduction plan going forward. It hopes to align margins back with historical range. It will pull another c.$150–$170mm (double the $75–84mm annualized currently) from restructuring activities into cost savings to achieve this, freeing up margin pressure. Added to that, it is limiting CapEx to maintenance investment only.

- Capital allocation/efficiency: Related to the point above, management revised FY’23 CapEx up to ~$550mm, back to FY’19/’20 range. Growth might be hampered by this, but it will also free up earnings tension at the margin in my view.

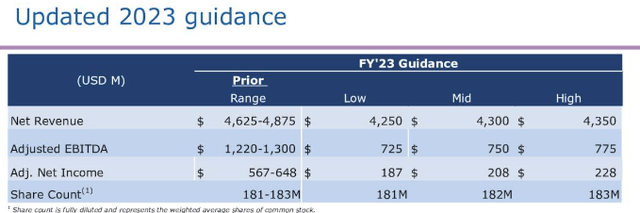

On this, management guide to $4.35Bn in FY’23 revenue at the upper end of the range, ranging back to FY’20-’21 levels, on adj. EBITDA of $725-775mm. Forward earnings don an air of mystery in my opinion, reflected in management’s $41mm variance in earnings estimates ($187-$228mm). Still, with one quarter to go, CTLT could still do ~$200mm at the bottom-line this year in my view, in-line with this guidance.

Figure 6.

Data: CTLT Q3 Investor Presentation

Valuation

The market’s heavy selloff in CTLT equity in recent months is indicative of a revised set of expectations. If I look to a 12% discount rate, which I believe is fair to represent the opportunity cost of the long-term market averages, the market expects $805mm in FY’23 EBIT at CTLT’s current market cap in my opinion ($805/0.12 = $6,700). This tells me two things:

- The market expects a c.3.5% downturn in CTLT’s pre-tax income from FY’22;

- That CTLT is likely accurately priced given that my numbers have the company to do $800–$805mm in EBIT this year as well.

Further, you’re asked to pay $28.50 for every $1 in CTLT’s forward earnings at the time of writing and I believe this is unreasonable. For starters, my numbers have no earnings growth baked in for the company, so I’m not prepared to pay any premium on that. Second, you’d be paying a 47% premium to the sector if paying that multiple. Investors have converged CTLT’s market valuation toward the book value of its equity, with the stock trading just 1.1x book value at the time of writing. Hence, it places a value on the steady-state of its operations, but no growth contribution in my opinion.

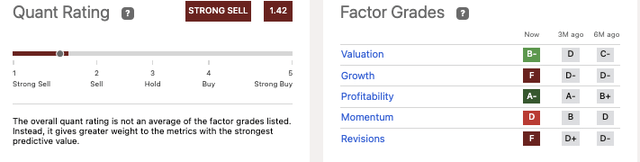

Added to that, you’ve got CTLT rated a “strong sell” by the quantitative grading system, a fact that simply cannot be ignored. The firm is rated lowly across growth, in-line with my own findings. However, these are expected, and the question is, has this already been factored into the stock price, or, do we have further downside to be priced in?

Figure 7.

Data: Seeking Alpha

In Short

With all the calamity and psychotic volatility in its share price, one might be mistaken to think CTLT is a contrarian’s dream right now. However, I’d still caution the intelligent investor.

For one, you’ve got the impeding productivity and growth issues. These cannot be ignored, and management acknowledged this will plague Q3 and Q4 and full-year earnings. To what degree, we’ll find out, but the question is, what’s already been priced in (expected), and what hasn’t?

Second to that, you’ve got unsupportive valuations, being asked to pay 28x earnings for no earnings growth. Plus, I believe the market has CTLT valued fairly at its current mark anyways. Finally, there’s no major catalysts on the horizon that could be easily seen to spark a price rally. We will see for sure, but for now, it looks like a challenging time on the chart for CTLT, supported by the shifting data in its fundamentals. Net-net, revising down to a hold.

Read the full article here