Thesis

The past one-and-half-year or so has been rather rough on previously high-flying growth stocks, as the market seems to have rotated towards more in favor of a value positioning. In this environment, investors’ attention has refocused on high-quality, dividend-paying companies that can provide stability and superior performance during uncertain times.

As the dividend yield of the S&P 500 and of almost all other broad market indexes has decreased over time, more and more investors become keen on the idea of adding some high-yield ETF to their portfolios. iShares Core High Dividend ETF (NYSEARCA:HDV) is a popular choice in the high dividend space, offering a very generous 4.03% yield. In this analysis, I explore the importance of dividends in overall stock market returns, while evaluating HDV’s characteristics and performance.

The Importance of Dividends

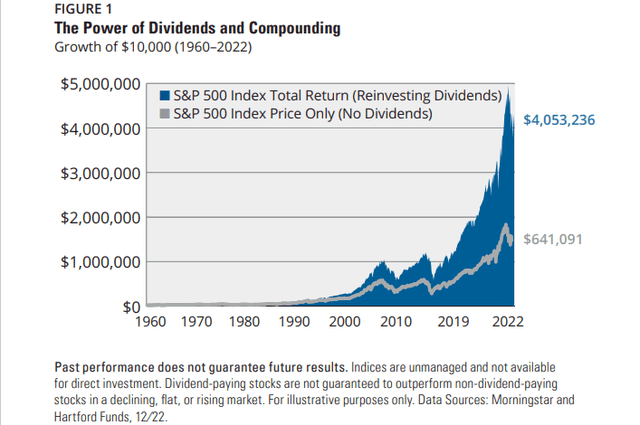

Dividend reinvesting has been a major component of S&P 500 total returns over the past 50+ years. In fact, it accounts for the majority of long-term gains. From 1960 up to 2022, a $10,000 initial investment into the S&P 500 would have yielded $4,053,236 with dividend reinvesting vs $641,091 relying solely on price appreciation. Approximately 69% of the total return of the S&P 500 index is attributable to reinvested dividends, compounding over a prolonged period of time.

Even though dividends have been somewhat de-emphasized after the 90s, accounting for a smaller portion of total return over the last couple of decades, still reinvesting them leads investors to significantly improved gains over time. The exponential nature of stock returns dictates that long-term investors should incorporate some type of dividend reinvesting in their strategy.

Hartford Funds

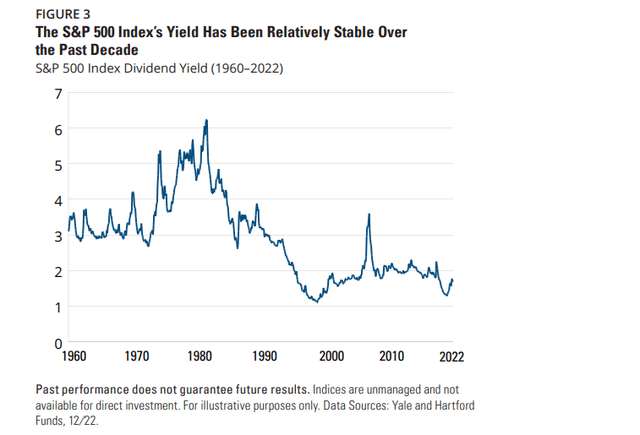

For the better part of the 20th century, the S&P 500 offered large dividend yields, steadily above 3% and even surpassing 4% for extended periods of time. The beginning of the 90s marked a change in investing mentality, caused by the rise of technology growth stocks, as the internet era began. Many investors have since focused on aggressive growth companies, often in the early cycle of their business, which offer very low or no dividends at all. As a result, the average yield of the S&P 500 dramatically decreased throughout the decade, stabilizing after the early 2000s (except for the global financial crisis era in 2008-2010) near the 1% – 2% level.

Apparently, in the current market environment, where low dividend yields prevail across all major indexes, high-yield ETFs can be useful to match yields from previous decades and hopefully help investors achieve superior returns through reinvesting.

Hartford Funds

Fund Identity

The iShares Core High Dividend ETF offers investors direct exposure to large-cap, established, dividend-paying companies in the United States. The fund aims to track the Morningstar Dividend Yield Focus Index. Overall, the fund maintains over 70 holdings, charges a low 0.08% expense ratio and pays a 4.03% dividend yield, more than double the market average. HDV also carries a beta 0f 0.7, which indicates its defensive nature.

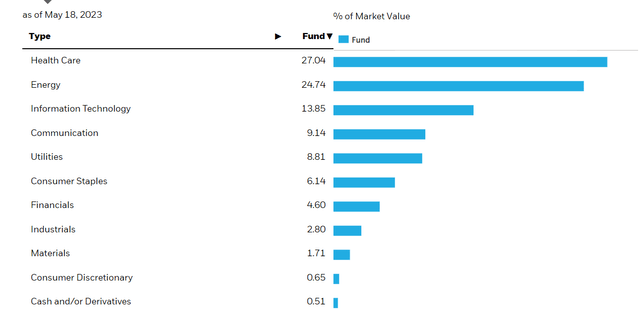

Unlike most broad index funds that are heavily weighted toward the technology and consumer discretionary sectors, HDV offers more exposure toward defensive sectors like healthcare, utilities, and communications. HDV also carries significant energy exposure. These sectors are thought to offer downside protection during market downturns and low volatility overall, generating somewhat predictable dividend payments.

SPDR

High Yield ETF Comparison

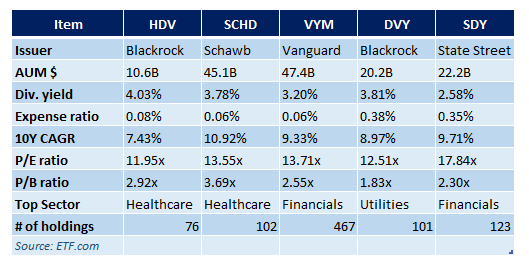

Even though HDV offers one of the highest yields in the dividend ETF space, still, many other respectable options are available, including Schwab’s U.S. Dividend Equity ETF (SCHD), Vanguard’s High Dividend Yield ETF (VYM), iShares’ Select Dividend ETF (DVY), and SPDR’s S&P Dividend ETF (SDY). A quick examination of quantitative characteristics will reveal, that in addition to its higher dividend yield and relatively low expense ratio, the fund also appears attractive in terms of its valuation. HDV trades at an 11.95x P/E while all four of its peers trade at higher multiples. The same is not true, however, on a P/B basis, where HDV is the second most expensive ETF.

While a low valuation can be a catalyst for future performance, it is important to note that, on first look, HDV seems to have significantly underperformed its peers, recording a 7.43% CAGR over the last decade. A more in-depth look into the peer group’s risk and return performance will be given below. HDV is also less diversified compared to its peers carrying 76 holdings.

ETF.com

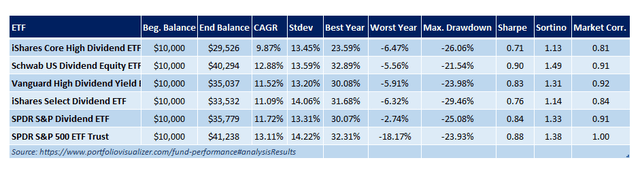

Diving deeper into the risk and return performance characteristics of the high-yield ETFs, I employed the tools offered by Portfolio Visualizer, in order to run a backtest on the performance of the high-yield ETFs mentioned above. Dividend reinvesting was assumed for the backtest, going back to late 2011.

In terms of total return performance, only Schwab’s US Dividend Equity ETF was able to approach the S&P 500 performance, yielding $40,294 (13.11% CAGR) on a $10,000 initial investment. HDV performed poorly compared to its peers, returning $29,526 (9.87% CAGR) on the same initial investment. HDV scores in the middle of the pack in terms of volatility (standard deviation), while also having the worst best-year and second-largest maximum drawdown within the group. Risk-adjusted returns, such as the Sharpe and Sortino ratios also suggest that HDV falls short compared to its peers. Detailed risk and return metrics for the peer group of high-yield ETFs are available in the table below.

Portfolio Visualizer

Final Thoughts

After all things are considered, it is clear that dividends play a crucial role in investors’ long-term returns, while high-yield funds can often be a useful addition to a portfolio. However, despite a relative preferential valuation outlook, iShares Core High Dividend ETF seems to lack in risk and return performance compared to its peers. For these reasons, I would rate HDV as a hold.

Read the full article here