Executive Summary

RLI Corp. (NYSE:RLI) is a member of the “Dividend Insurance Champion” club, with Aflac (AFL), Chubb (CB), Cincinnati Financial (CINF), and Old Republic (ORI). Despite an anemic dividend yield (below 1%), RLI is appreciated by investors, as the insurer is recognized for having increased its dividend for the last 48 straight years.

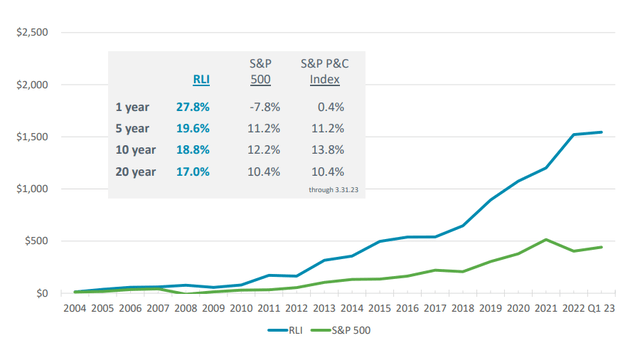

Furthermore, the stock has delivered a better total return than S&P 500 did during the previous 20 years.

2023 Q1 Presentation – RLI corp.

Last year’s performance was astonishing because of the sale of the minority interests in Maui Jim.

Although the market prices the insurer at a high P/B ratio (more than four times), the past stock performance could not be reproduced. In my last review of the stock, the company was already valued at 4.0x the book value and could be considered a “Hold and forget” stock. After almost two years, it may be time to question the company’s valuation again.

A Resilient Outperforming Insurer

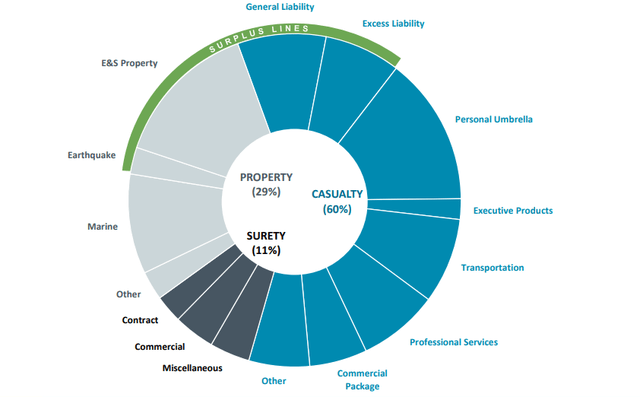

RLI provides property, casualty, and surety insurance coverages.

2023 Q1 Presentation – RLI corp.

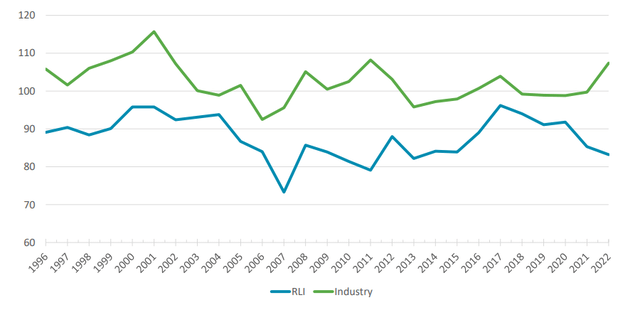

RLI has achieved 27 straight years of a combined ratio below 100 and has beaten the industry ratio by an average of 12 points over the last ten years.

2023 Q1 Presentation – RLI corp.

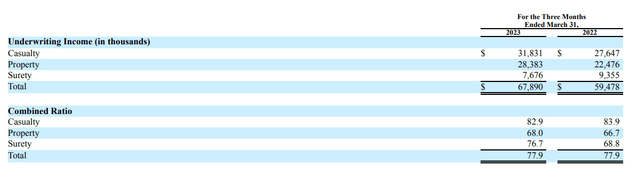

During the first quarter of 2023, RLI recorded an underwriting income of $67.9 million, resulting in a combined ratio of 77.9%.

Q1 2023 Report – RLI Corp.

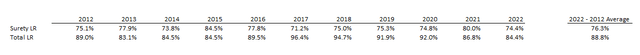

This underwriting outperformance is driven by the surety business, which has delivered a low double-digit combined ratio over the cycle. From 2012 to 2022, the average combined ratio was 76.3%, vs. an 88.8% average combined ratio for the total portfolio.

Annual reports – RLI Corp. (Data gathered by the author)

2022: An Exceptional Year With the Sale of Maui Jim

Unlike many insurers, the company retained an equity interest in an asset wholly unrelated to its core operating business, the Maui Jim brand of high-end sunglasses.

This asset came with the company’s purchase of a contact lens insurance business and was retained as a legacy asset, carried at $95.2 million.

In 2022, RLI Corp. agreed to sell its minority interest in Maui Jim, Inc to Kering Eyewear (OTCPK:PPRUF).

On September 30, 2022, RLI Corp. completed the sale of its equity method investment in Maui Jim to Kering Eyewear for cash proceeds of $686.6 million.

As a result, RLI decided to declare a $7.0 special dividend per share vs. a special dividend of 2.0 per share in 2021.

A Regular Cash Dividend Coupled With Annual Special Dividend

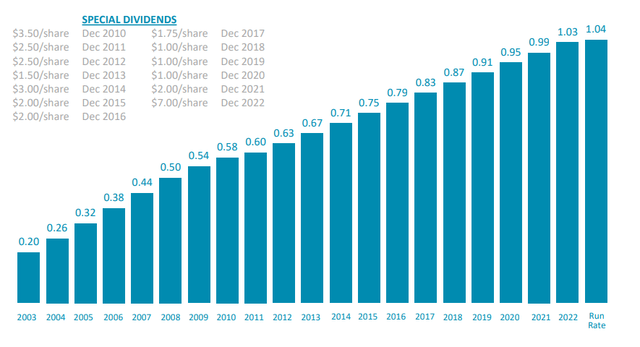

RLI is known as one of the dividend aristocrats, with 48 straight years of dividend increases. Furthermore, the company declares a special dividend on an annual basis to redistribute the capital excess to shareholders.

2023 Q1 Presentation – RLI corp.

Last year, the special dividend was $7.0 per share, resulting from the sale of Maui Jim’s minority interests.

In 2023, the special dividend will undoubtedly be lower and range from $1.0 to $2.0 per share.

RLI Valuation: A Justified Overvaluation?

The RLI shareholders’ equity is $1.3 billion vs. a market capitalization of $5.87 billion, or a price-to-book value of 4.5. Investors seem not to be surprised by this high valuation compared to other peers, which are traded from 1.5 to 2.5 times the book value.

The potential drivers of this “overvaluation” are:

- A low combined ratio oscillated between 84.4% and 96.4% from 2012-2022.

- A constant book value growth. From 2012 to 2022, the book value per share grew from $18.73 to $25.89, or a 38% increase.

- The perception change from the investors: in 2012, the company was valued at 1.7 times the book value. Since 2018, the company’s valuation has been at least 3.8 times the book value. Hence, the investors have considered that a 4.0 price-to-book was the new standard.

Final Thoughts

Although I recognize that RLI is a highly profitable and well-managed insurance company, the current company’s valuation is too high for me. The company is priced for perfection. Therefore, any drop in earnings or a market fear could significantly affect the insurer’s valuation. While RLI is a superb company with consistent growth and underwriting performance resilience, 4.5x is still a high-looking PB.

Read the full article here