A few months ago, I wrote an initiation article on the Unlimited HFND Multi Strategy Return Tracker ETF (NYSEARCA:HFND). I was cautious on the strategy, as I feared HFND’s strategy of replicating the hedge fund industry’s gross of fees return will end up delivering a mediocre product.

With a few more months of performance data to analyze, has my view on the HFND ETF improved?

Brief Fund Overview

First, since HFND is a new fund concept, I will go over the details of the strategy for readers who are not familiar. The HFND ETF aims to replicate the gross returns of the hedge fund industry through a proprietary machine learning (“ML”) algorithm that attempts to map the most recent month’s returns (return, volatility, correlation with other assets) of various hedge fund styles like long/short equity, global macro, and event-driven, onto an investment universe of ETFs and futures contracts.

For each hedge fund style, the manager feeds publicly reported returns data into its ML algorithm to create a portfolio of 10-20 positions that best match the style’s reported returns characteristics. This process is repeated for all the various hedge fund styles, and the resulting portfolios are aggregated and netted into an overall ‘total hedge fund industry’ model. Generally, the resulting portfolio will consist of 30-50 positions.

Over time, the ‘total hedge fund industry’ model is expected to deliver returns that approximate the hedge fund industry’s gross returns. Given HFND’s simple fee structure (0.95% management fee, 1.03% total expense ratio), the HFND ETF is expected to outperform the hedge fund industry net of fees.

HFND is managed by Bob Elliott, a frequent ‘fintwit’ personality and former executive at Bridgewater Associates, one of the largest hedge fund managers in the world. Mr. Elliott is the CEO and CIO of Unlimited, the fund manager of HFND, and has more than two 2 decades of experience building investment strategies including for Bridgewater’s Pure Alpha fund.

HFND Continues To Lag The Equity Markets…

Since my article, the HFND ETF has delivered -4.0% total return, significantly trailing the S&P 500 Total Return Index with 3.6% returns in the same time frame, partly justifying my caution (Figure 1).

Figure 1 – HFND has lagged equity markets (Seeking Alpha)

However, since the HFND ETF is aimed at replicating the hedge fund industry, perhaps it is an ‘apples’ to ‘oranges’ comparison to compare the HFND ETF to the S&P 500 Total Return Index.

…Ditto For Eurekahedge…

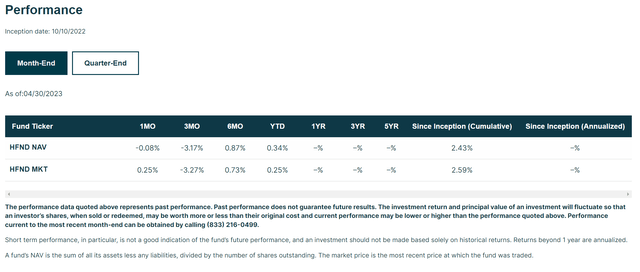

Unfortunately, the comparison against the hedge fund industry is also unfavourable for HFND. While HFND aims to replicate the hedge fund industry’s gross returns, it has actually lagged behind the industry’s net returns. YTD to April 30, 2023, the HFND ETF has delivered 0.3% in returns (Figure 2).

Figure 2 – HFND returns performance (unlimtedetfs.com)

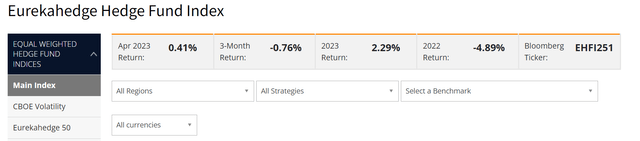

In comparison, the Eurekahedge Hedge Fund Index, an equal-weighted index of 3137 constituent hedge funds, has returned 2.3% YTD to April 30 (Figure 3).

Figure 3 – Eurekahedge Hedge Fund Index has returned 2.3% YTD (eurekahedge.com)

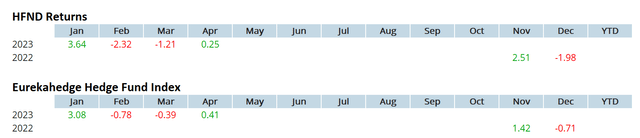

In fact, comparing HFND’s 6 monthly returns since inception against the Eurekahedge Hedge Fund Index, we can see that HFND has underperformed the Eurekahedge index 4 out of the 6 months (Figure 4).

Figure 4 – HFND has underperformed Eurekahedge 4 out of 6 months (Author created with data from Portfolio Visualizer and Eurekahedge.com)

Of course, 6 months is hardly enough data to pass judgment, but this has not been a strong start for the HFND ETF.

HFND vs. All-Weather And 60/40

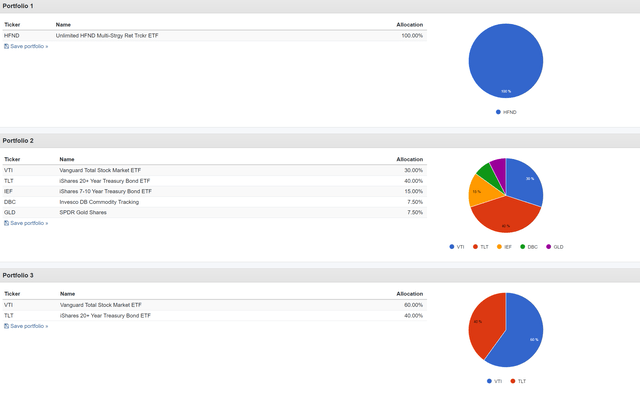

Another interesting analysis we can perform on the HFND ETF is to compare the ETF against ‘set it and forget it’ strategies like Ray Dalio’s All-Weather Portfolio or the classic 60/40 portfolio. Since Mr. Elliott is an alumni of Bridgewater, this is an especially apt comparison.

In Figure 5, we have modelled the All-Weather portfolio and 60/40 portfolio using 5 simple low-cost ETFs, the Vanguard Total Stock Market ETF (VTI), the iShares 20+ Year Treasury Bond ETF (TLT), the iShares 7-10 Year Treasury Bond ETF (IEF), the Invesco DB Commodity Tracking Fund (DBC), and the SPDR Gold Shares (GLD).

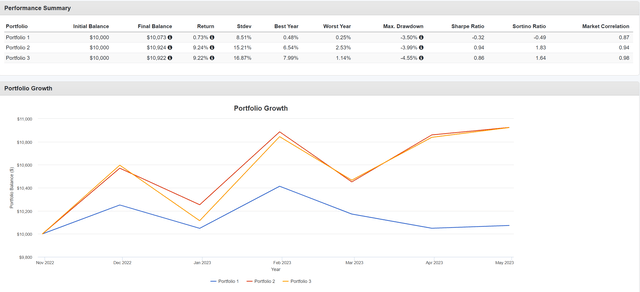

Figure 5 – HFND vs. All-Weather and 60/40 (Author created with Portfolio Visualizer)

In its short operating history, Unlimited’s HFND ETF has lagged the two classic allocation portfolios by a mile, returning a compounded 0.7% vs. 9.2% for All-Weather and 9.2% for 60/40 (Figure 6).

Figure 6 – HFND has significantly trailed All-weather and 60/40 (Author created with Portfolio Visualizer)

The HFND ETF also has far weaker Sharpe and Sortino ratios compared to the asset allocation portfolios. Again, while the dataset has been limited, the initial results have not been promising.

Conclusion

The HFND ETF has a noble aim of using machine learning to ‘democratize investing’. Unfortunately, initial performance to date have been very disappointing, with the HFND ETF significantly lagging behind the Eurekahedge Hedge Fund Index and simple asset allocation models like Ray Dalio’s classic All-Weather portfolio or the 60/40 portfolio.

I will continue to track the performance of the HFND ETF and hopefully Mr. Elliott can turnaround the fund’s performance. However, for now, I believe investors would definitely stay on the sidelines on this ETF concept.

Read the full article here