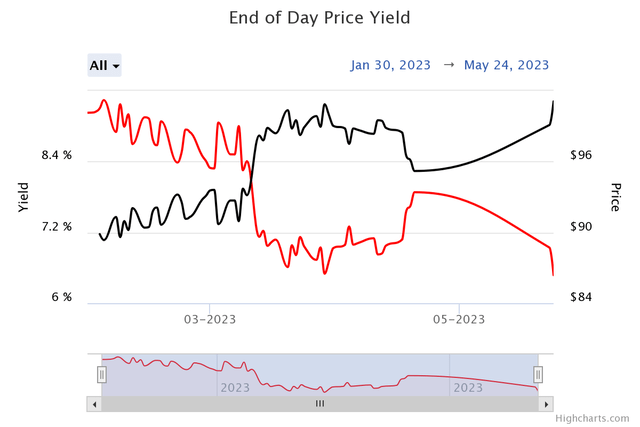

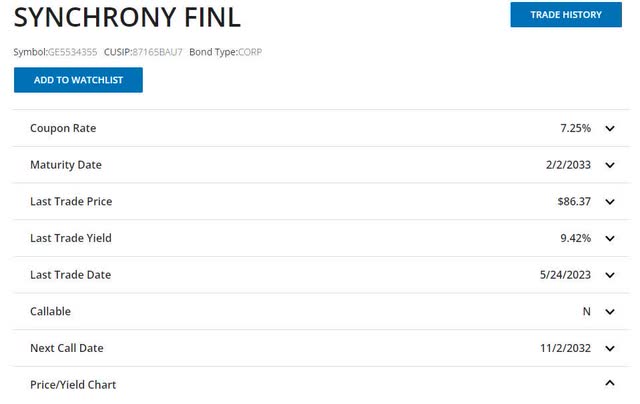

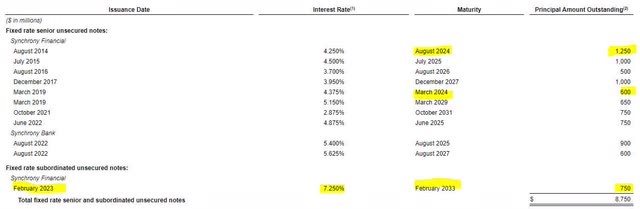

Synchrony Financial (NYSE:SYF) is a depositor bank that specializes in consumer lending. Earlier this year, the company issued 7.25% coupon bonds maturing in 2033. During the regional banking crisis, the bonds sold off and after a brief recovery, sold off again following the failure of First Republic Bank. The bonds are now priced at 87 cents on the dollar and yielding over 9% to maturity, representing a good opportunity for high yield investors.

FINRA FINRA

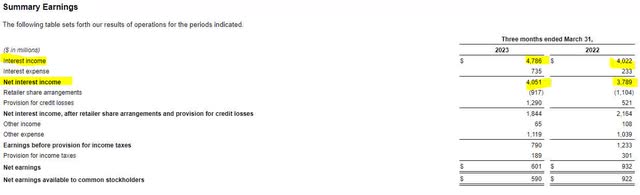

Synchrony Financial may have a different business model than many of the regional banks I’ve profiled, but the company reports its financials in a similar manner. Like many financial institutions, Synchrony saw an increase in interest income in the first quarter compared to a year ago. This was due to higher interest rates. Higher rates also led to higher interest expenses, but net interest income (interest income less interest expense) did increase by more than $250 million to over $4 billion for the quarter. Synchrony did increase its provision for credit losses by 2.5 times, which led to a decrease in net earnings by one third to $600 million.

SEC 10-Q

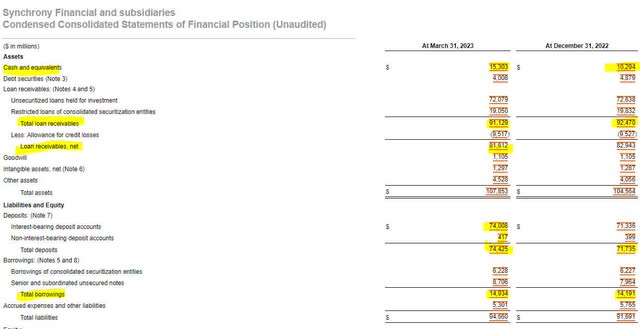

Synchrony Financial’s balance sheet highlights some changes the bank made in the first quarter. Unlike many regional banks, Synchrony’s deposits increased by $2.6 billion, or 3% in the first quarter. Compared to a year ago, deposits are up by $10 billion, or 16%. The bank also increased its cash on hand by $5 billion to $15 billion while decreasing its total loans by $1 billion. Total borrowings edged up by about $800 million, led by the issuance of the 2033 maturing notes. Overall, shareholder equity grew slightly to over $13 billion.

SEC 10-Q SEC 10-Q

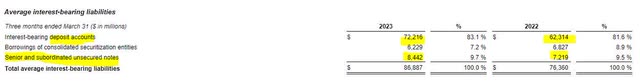

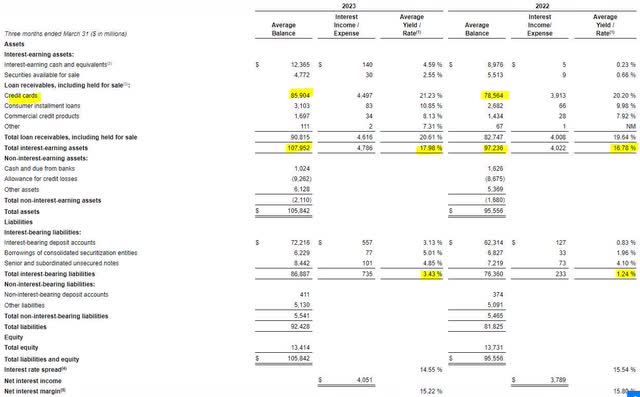

Synchrony Financial’s business is materially different than many regional banks because it invests primarily in consumer credit, and more specifically credit cards. This difference is detailed when examining Synchrony’s net interest margin, which declined nearly 60 basis points to 15.22% in the first quarter. 80% of the bank’s loan portfolio consists of credit cards with an average yield of over 21%. This is the leading reason why Synchrony’s net interest margin is much higher than its peers. When compared to its 3% cost of deposits, which make up a majority of the 3.43% cost of interest-bearing liabilities, investors can see that Synchrony is uniquely positioned to convert low cost deposits into high yielding loans.

SEC 10-Q

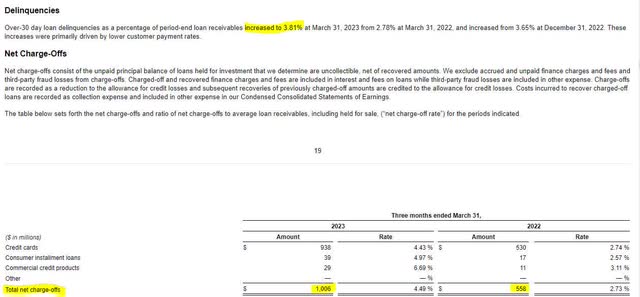

Synchrony Financial does need to lend their depositors’ money responsibly. With higher interest rate credit cards comes risk of higher defaults and Synchrony Financial is not immune from that. Net charge offs in the first quarter topped $1 billion, which was nearly double from the prior year. This has caused Synchrony to increase the contribution to its loan loss allowance and thus decrease earnings. The existing allowance for credit losses exceeds $9.5 billion, which I believe insulates the bank from the current level of charge offs, but changes in the employment market could have a negative impact on Synchrony’s financial performance if more of their customers become unemployed.

SEC 10-Q

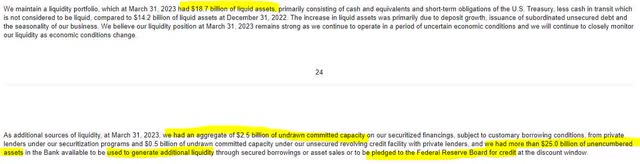

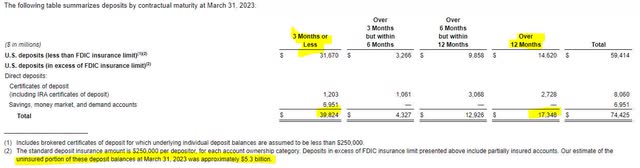

When it comes to liquidity and uninsured deposits, Synchrony’s risk is exceptionally low. The bank has only $5.3 billion in uninsured deposits, which are easily covered by $15 billion in cash on hand. Furthermore, the bank has access to $27.5 billion of additional borrowing capacity through the Federal Reserve and other securitized financing, giving it over $40 billion of available liquidity. Even more interesting is the fact that $17 billion of the bank’s $74 billion in deposits have maturities of over 12 months, meaning customers have contractually agreed to keep their money in the bank for an extended period. Over half of all deposits are on contractual terms of greater than 3 months, further solidifying the bank from deposit volatility.

SEC 10-Q SEC 10-Q

Synchrony has just under $2 billion in note debt coming due in 2024 with near $3 billion in note debt coming due the following year. Should the bank continue to perform with deposit growth and strong earnings, it could conceivably use cash on hand to pay off these liabilities and further reduce its subordinated debt. I’m guessing the bank will weigh its options as these maturities come due.

SEC 10-Q

As a consumer lender, Synchrony has the risk of badly performing in a poor economy, which is why I’m avoiding the common shares. Synchrony does have a preferred share yielding 8.3% (NYSE:SYF.PA), which I owned prior to becoming familiar with the 2033 maturing debt. The bond option is safer because interest can only be deferred in the event of a default or bankruptcy, unlike common and preferred share dividends. Also, at 87 cents on the dollar, the current coupon yield is nearly identical to the bank’s preferred shares, giving investors the same income for less risk.

CUSIP: 87165BAU7

Price: $86.37

Coupon: 7.25%

Yield to Maturity: 9.42%

Maturity Date: 2/2/2033

Credit Rating (Moody’s/S&P): NR/BB+

For more information, check out the bond’s page on FINRA.

Read the full article here