Please note all figures are in CAD unless otherwise noted.

Introduction

Those who follow my work may recall that I have written in InPlay Oil (TSX:IPO:CA) a few times with the most recent article being in May 2022.

Everything about InPlay screams “cheap”, and with their low leverage position should remain in a sound financial position should there be a freak event that causes even a meteoric plunge in oil prices.

The analyst community agrees with this assertion, they believe InPlay trades at the cheapest valuation of its Canadian E&P peers relative to its 2022E debt adjusted cash flow, and even foresee its cash position overtaking its debt.

The main reason this stock is so “cheap” is its lack of liquidity which makes it unattractive for most institutional funds. That being said, these stocks have a tendency to explode as institutional investors do take notice.

This stock is also not a fit for income investors as it has never paid a dividend. On October 30, 2020, InPlay entered into a term loan with the Business Development Bank of Canada under their Business Credit Availability Program (BCAP) which provided them with a non-revolving $25 million, second lien, four-year term loan facility to enhance liquidity.

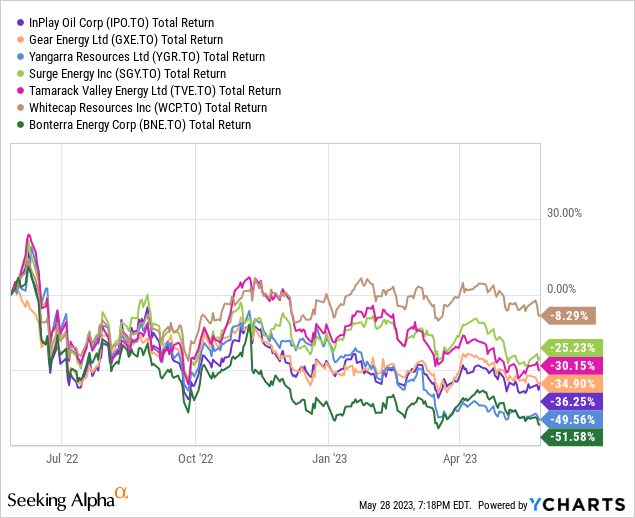

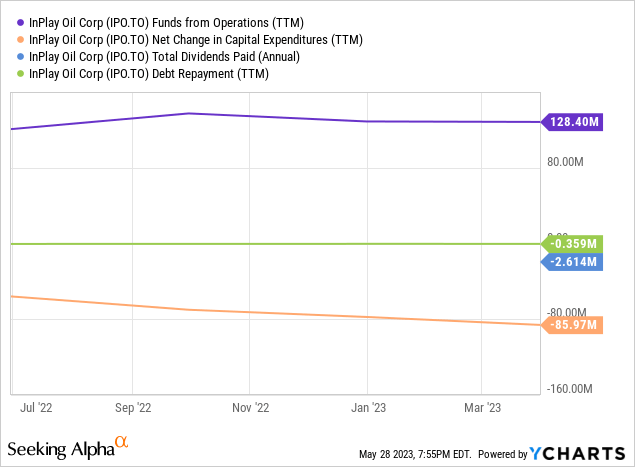

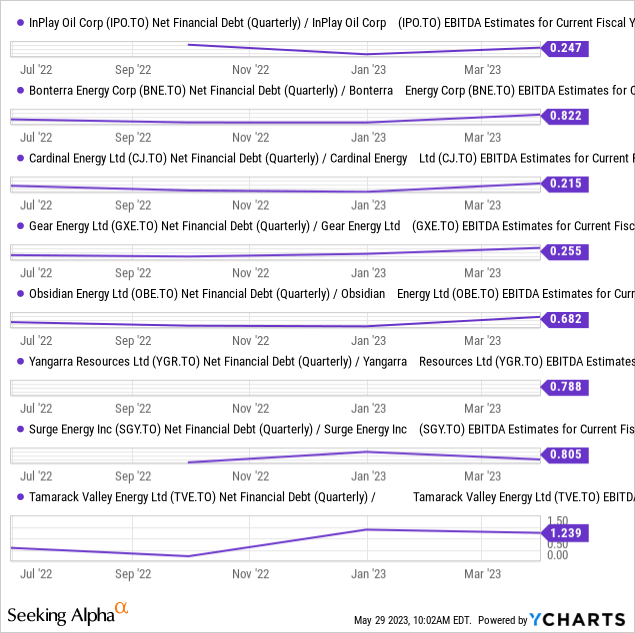

Source: InPlay Oil: The Price Is Still In Play For Market-Beating Returns

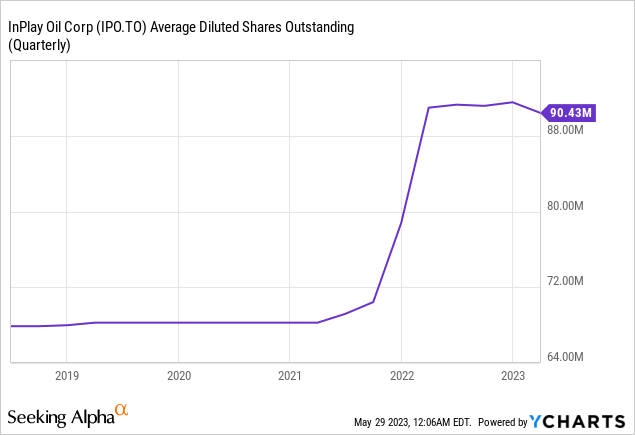

Since last writing the stock has unfortunately delivered -35% since then which is inclusive of the $0.015/share monthly dividend that was initiated in 2022. Although the returns have not been as bad as some of its peers like Bonterra Energy [BNE](OTCPK:BNEFF) and Yangarra Resources [YGR](OTCPK:YGRAF) this it is somewhat perplexing that the share price has declined as bad as it has as they showed record results in 2022 and have among the lowest leverage in the industry at 0.2x net debt to EBITDA.

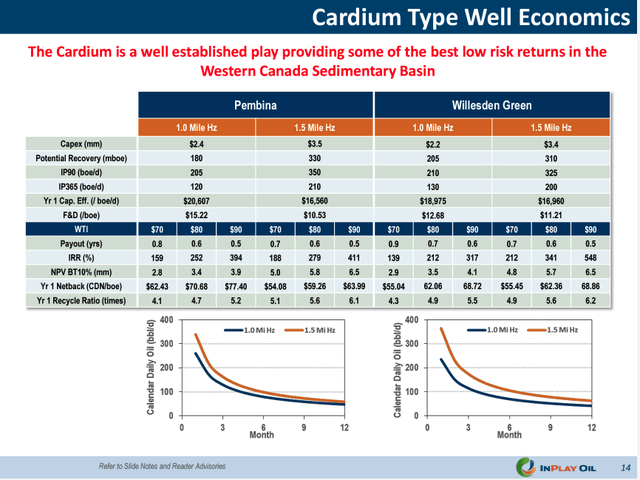

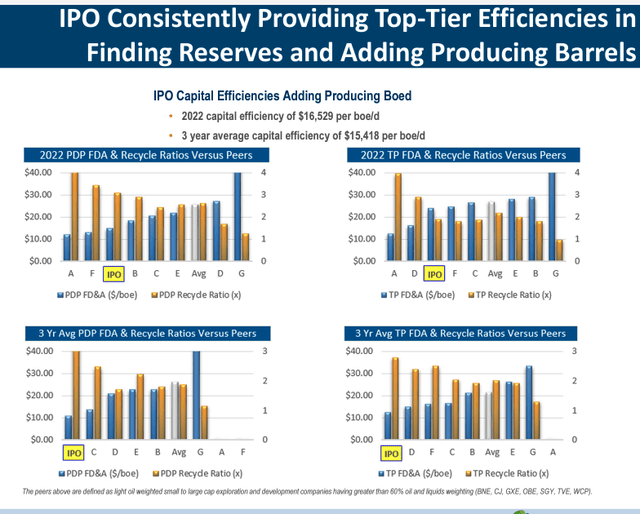

InPlay’s cardium assets require more CAPEX to develop than traditional oil and gas plays which creates barriers to entry, but the higher initial production from these wells results in very low payback periods (less than 1 year even at WTI $US 70 WTI) and very high IRR at more than 159%. This provides IPO one of the lowest Finding, Development & Acquisition Costs (FDA) costs per barrel and among the highest recycle ratios at 3x (Recycle Ratio: $1 capital invested returns $x) among its peer group.

Q1 2023 Investor Presentation (InPlay Oil)

Q1 2023 Investor Presentation (InPlay Oil)

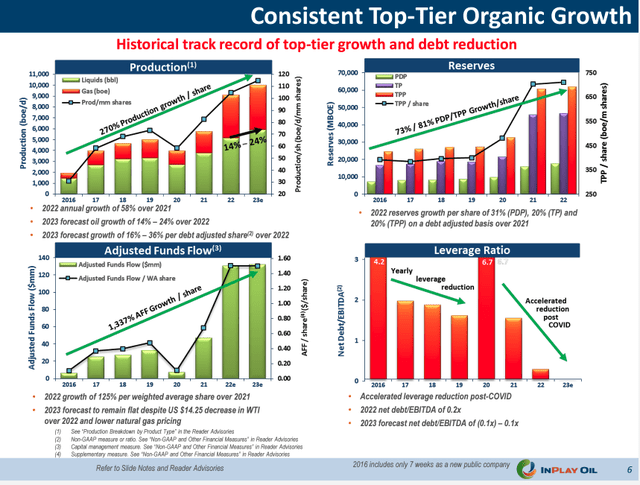

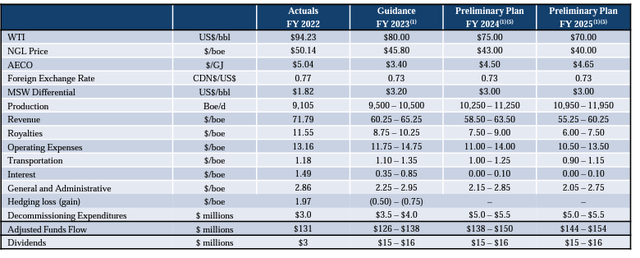

2022 Year-End and Q1 2023 Results

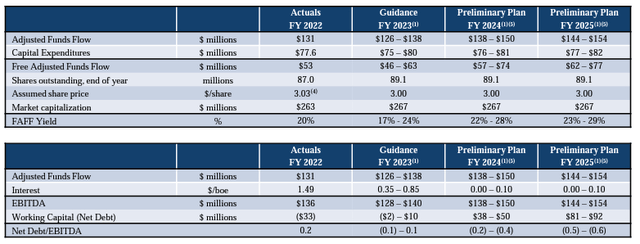

IPO had a record year in fiscal 2022 as a result of higher commodity prices than seen in more than a decade. IPO experienced record level production largely as a result of having a full year of operating results from the Prairie Storm Acquisition which was expected to increase production ~50%. Despite rising inflationary pressures, operating expenses only rose 3% so most of the revenue growth went to the bottom line as the operating netback increased 33% YoY to $45/boe. There was more than enough FAFF to cover the CAPEX, implement a $0.15/share monthly dividend and reduce net debt by $50 Million. Recall from my previous article that the analyst community foresaw the possibility that its FCF could overtake its debt which happened as FCF was $53MM relative to $33MM in net debt.

Q1 2023 Investor Presentation (InPlay Oil)

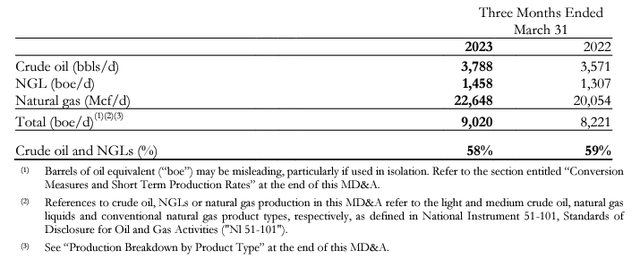

IPO’s production for Q1 2023 increased 10% compared to that of March 31, 2022, as a result of the added volumes from the 2022 and 2023 drilling programs to date. This was in spite of natural gas production curtailments of approximately 4.5 mmcf/d starting February 15th from a third party natural gas facility due to capacity constraints. IPO has guided for at least 10,000 boe/d for fiscal 2023 with 58% of production coming from crude oil and NGLs. IPO has budgeted $75-$80MM in CAPEX for 2023 but spent $29 Million of the budget in Q1 so over a third which will increase production at its various plays. IPO advanced its Q2 CAPEX into Q1 of 2023 to take advantage of the availability of services by drilling an additional Willesden Green well in March 2023 and beginning the drilling operations of an additional one Willesden Green well. During the quarter, IPO also upgraded a gas facility in Willesden Green to alleviate back pressure on the gas gathering system.

Q1 2023 Report (InPlay Oil)

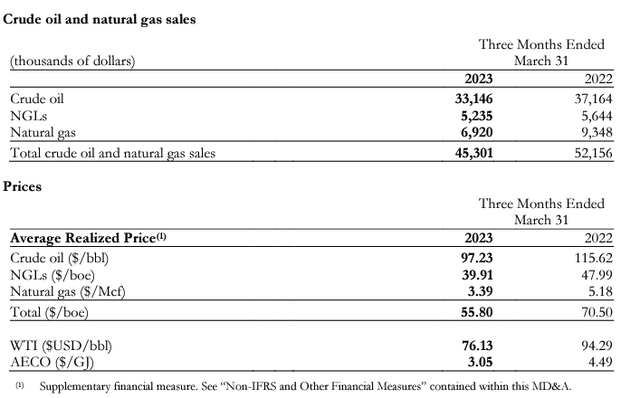

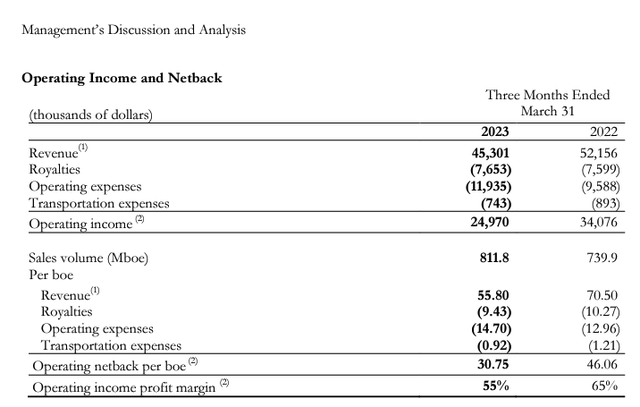

Unfortunately revenue still declined 13% from what was realized in Q1 2022 as realized commodity prices fell. The WTI and AECO prices fell 19% and 32% respectively. This resulted in a 32% decline in operating netbacks from Q1 of 2022. These results were hardly a surprise given the commodity price environment, but do note that the average WTI price was US$76/bbl that quarter relative to $97/bbl that was realized. The cardium region produces “light” rather than “heavy” crude so the oil sells at average Edmonton Par prices less quality differentials, transportation and marketing fees and therefore fetches a higher price than heavy crude.

Q1 2023 Report (InPlay Oil) Q1 2023 Report (InPlay Oil)

Outlook

EIA expects near term volatility in commodity prices, but with the United States refined product inventory levels at five year lows, oil inventory at the five year average and refineries starting back up after maintenance downtime it is anticipated that the second half of 2023 to have higher oil prices.

Natural gas prices have fallen off a cliff since Q4 of 2022 when it was well over $4.00/GJ and now sits at $2.30/GJ and accounts for ~42% of production. IPO’s downside exposure to typically lower summer prices have some protection with hedges put in place of 12,500 GJ/day through swaps at $3.73 AECO per GJ for April to October 2023 which is ~55% of their production.

I barely ever put too much stock into management forecasts and natural gas price expectations may be a little high but they are also accounting for backwardation in oil and gas prices. Revenue growth will likely be very slow on a go forward basis unless there is a significant shift in commodity prices with lost pricing revenue being made up from with increased production. This is not necessarily a bad thing as current levels of adjusted funds flow can easily cover $80 Million in CAPEX at even US$75/bbl and leave up to $40 Million in FCF that can retire their $33 Million in net debt and would leave $7 Million for dividend/share buyback increases. Even if prices remained stagnant the $40-$60 Million in free cash flow more than covers the dividend so at $30 Million a year after paying CAPEX and dividends they could buy back up to 11% of their stock each year which would prop up their undervalued stock. Not saying this will happen as IPO has not been generous at buying back stock, they have in fact increased the share count as a result of acquisitions and prioritized debt repayment. Debt repayment is largely out of the way so this becomes more of a viable option and IPO is among the most conservatively financed E&P companies so is in as good a position as any in the industry to provide consistent shareholder returns.

Q1 2023 Investor Presentation (InPlay Oil) Q1 2023 Investor Presentation (InPlay Oil)

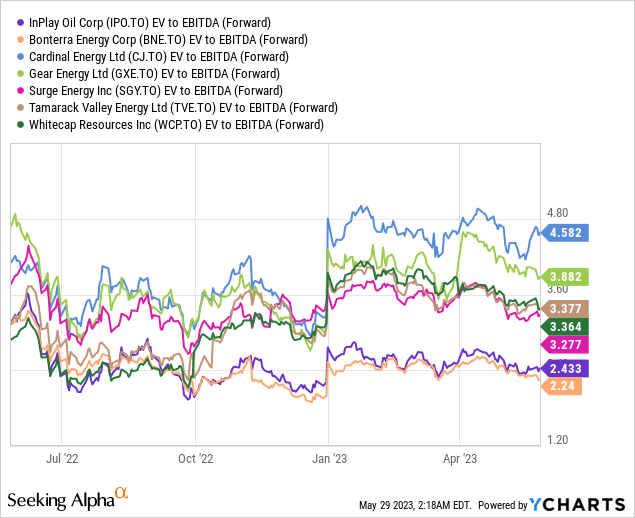

I will also note that IPO is among the cheapest in its peer group at only 2.43x its 2023 EBITDA forecast for 2023 when most in the industry trade at least 3.0x. Keep in mind its EV is almost equal to its market cap given its very low debt levels.

Verdict

The script has certainly flipped on this company as previous articles marketed IPO as more of a high growth at a reasonable price company. That is looking to no longer be the case as it looks to be positioning itself to return capital to shareholders rather than prioritizing growth. Management has indicated that this can be accomplished should WTI prices stay above US$55/BBL, I see this as optimistic given their natural gas curtailments and weaknesses in that market and would put that number at closer to US$60/bbl. I still firmly believe this is a low risk ~7% yield investment and investors should be able to realize double digit returns over the next few years through further dividend increases or share buybacks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here