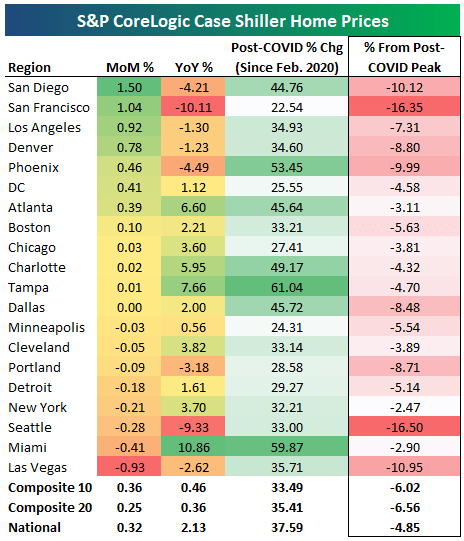

March data on home prices across the country were released today with updated S&P CoreLogic Case Shiller numbers. Case Shiller home prices had been falling rapidly in many of the twenty cities tracked, but in March we actually saw a pretty big month-over-month bounce in some of the hardest-hit areas like San Diego, San Francisco, LA, Denver, and Phoenix.

Some cities still saw declines, however. Las Vegas saw an m/m drop of 0.93%, while Miami fell 0.41%, and Seattle fell 0.28%.

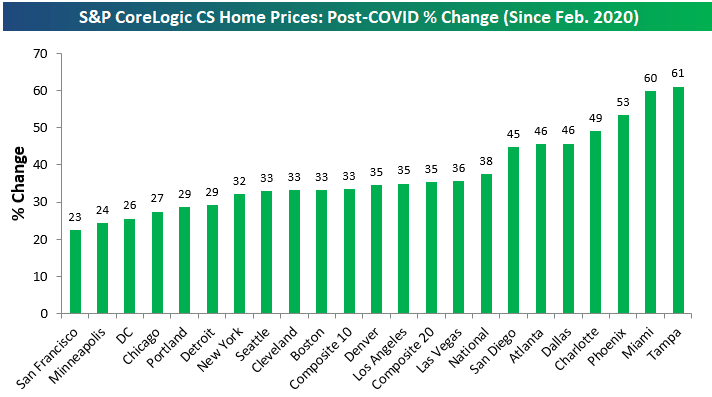

On a year-over-year basis, Miami is still up the most with a gain of 10.86%. As shown in the table below, Miami home prices are up 59.87% from pre-COVID levels in February 2020, and they’re only down 2.9% from post-COVID highs.

Only Tampa is up more than Miami from pre-COVID levels (+61.04%), but Tampa prices are down more from their post-COVID highs (-4.70%) than Miami (-2.90%).

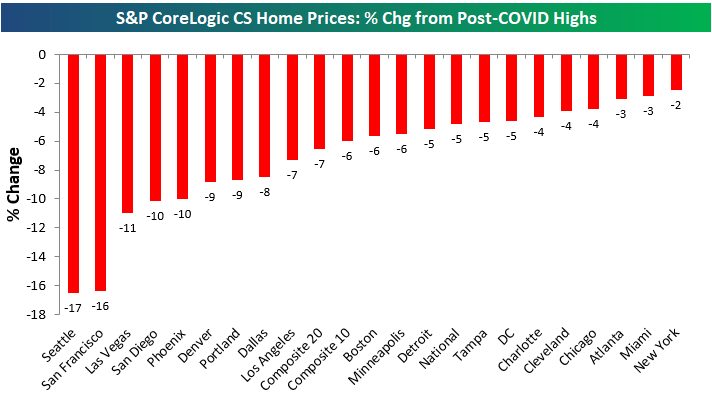

Four cities are down more than 10% from their post-COVID highs: San Diego (-10.12%), Las Vegas (-10.95%), San Francisco (-16.35%), and Seattle (-16.50%). New York is down the least from post-COVID highs of any city tracked at just -2.9%.

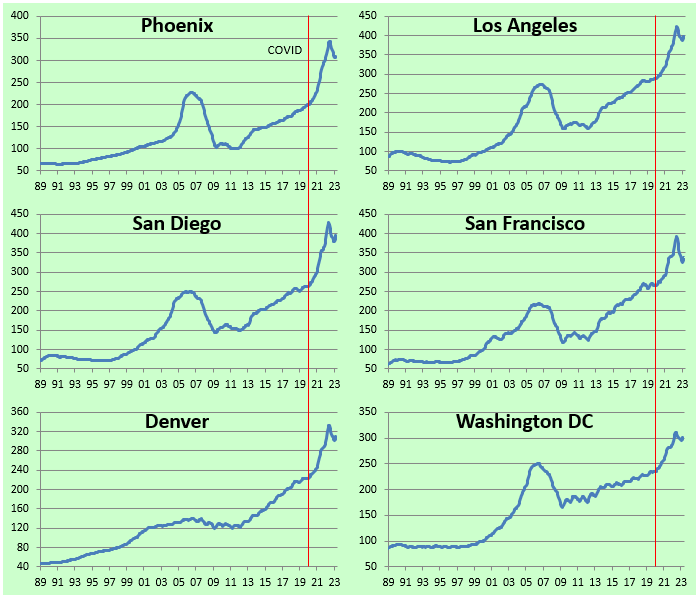

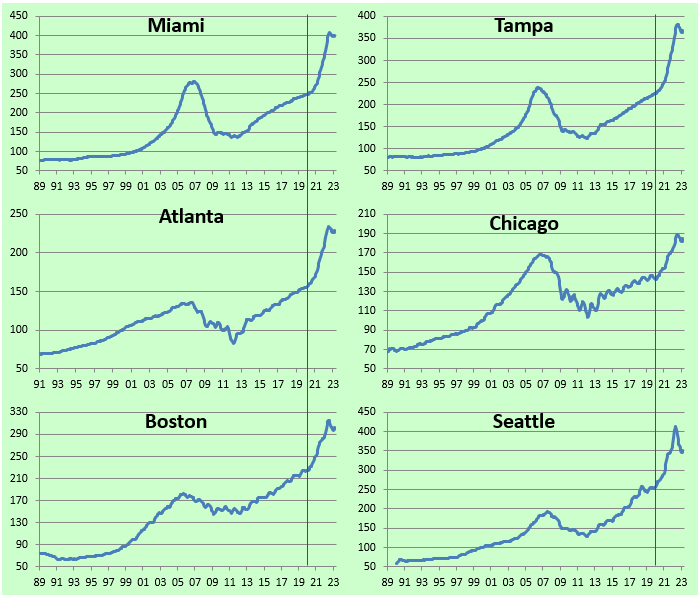

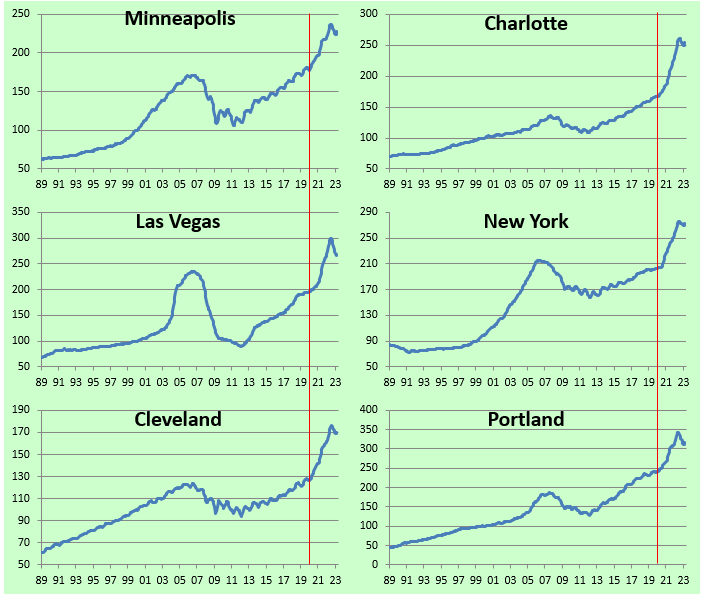

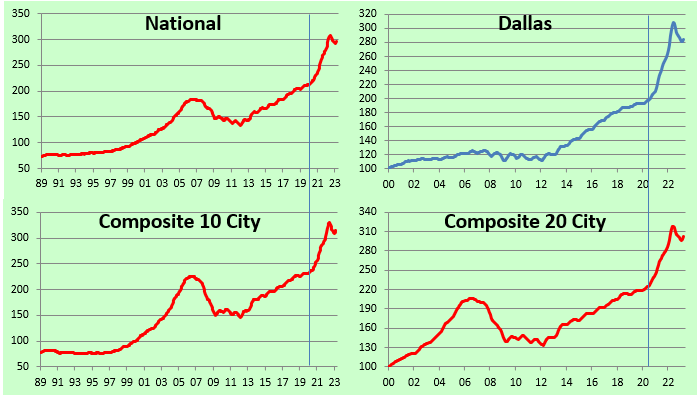

Below we include charts of home price levels across all 20 cities tracked by Case Shiller along with the three composite indices. We’ve included a vertical red line on each chart to highlight pre-COVID levels.

When looking through the charts, you can see this month’s small bounce-back in most cities after a 6-9 month pullback in prices from peaks seen early last year.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here