SLR Investment (NASDAQ:SLRC) appears to be one of the best stocks for investors looking for consistent returns over the short- and long-term. The company’s double-digit yielding dividend is safe due to its earnings growth potential and favorable market conditions. Due to the growing need for alternative financing and the focus on developing a portfolio of floating-nature investments, the company’s outlook also seems promising. Moreover, the SLR stock is trading at attractive valuations right now, offering new investors a great entry point.

Why Does SLR Investment Look Attractive in the Financial Sector?

So far in 2023, the S&P 500 financial index has fallen by a mid-single-digit percentage due to economic weakness and Fed’s policies. Several regional banks and consumer finance companies have been dealing with liquidity issues as well as a significant increase in provision for credit loss. Meanwhile, one industry in the financial sector that has benefited from difficult conditions is business development. Due to restrictions imposed by traditional lenders, demand for alternative financings such as loans from business development companies has increased significantly. During the first quarter earnings call, SLR Investments Chairman and Co-CEO Michael Gross also hinted at the high demand for alternative financing:

We believe the current investment environment remains as favorable as any we’ve seen in several years, in particular, our specialty finance businesses are benefiting from the regional banking turmoil, as those banks have historically competed with their commercial finance strategies.

During the most recent conference calls, many other CEOs said similar things. Given the record investment income and earnings growth in 2022, these claims are difficult to refute. For example, SLR Investment’s net investment income increased from $60.9 million in 2021 to $76.4 million in 2022. The upward trend continued in the March quarter of 2023, with net investment income increasing to $22.1 million from $13.5 million in the year-ago period.

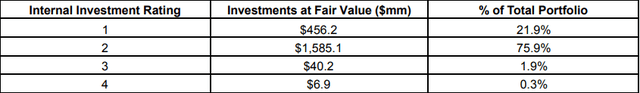

Internal Portfolio Risk Rating (SLRC’s Earnings Release)

On the other hand, its portfolio holdings pose little risk of bad debt. According to the company’s internal portfolio risk rating at the end of the March quarter, the average rating for its portfolio holdings was just under two on a scale of one to four. Only slightly more than 2% of its holdings had a high-risk rating, while 75% earned a risk rating score of 2. During the March quarter, the company had added only one investment on non-accrual, bolstering the view that its portfolio holdings are not at risk of default. Furthermore, 99.8% of the portfolio was made up of senior secured loans, with 98.6% invested in first-lien loans. Its net debt-to-equity ratio was 1.12, falling within the company’s target leverage range of 0.9 to 1.25 times. Overall, SLR Investment appears to be one of the fastest-growing companies in the business development industry, with a solid balance sheet and low credit risk.

The Double Digit Dividend Yield is Safe

Last year, it was unclear whether SLR Investment could maintain its dividends due to the high payout ratio. In November, I stated that SLR Investment’s solid investment portfolio would help increase investment income while lowering the dividend payout ratio below 100%. Over the last two quarters, the business development firm appears to have made progress in that direction. Its dividends appear to be more secure than they were two quarters ago, thanks to its floating nature investment portfolio. In the March quarter, SLRC’s net investment income of $0.41 per share exceeded its quarterly dividend payment of $0.40 per share.

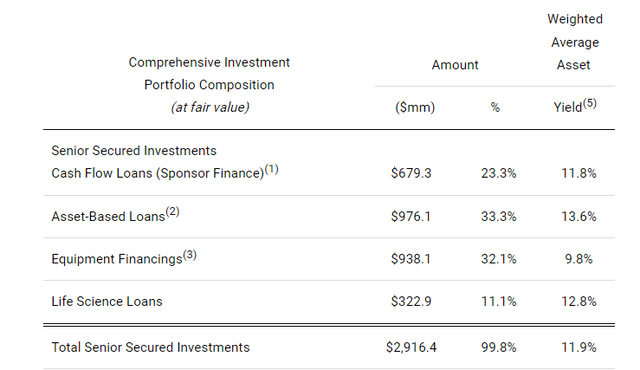

Earnings are expected to exceed dividends in the near future because of its portfolio growth strategy and higher interest rates. Since the end of March, the Fed has raised its fund rates by 0.50%, with another hike expected in June. This means that the yield on its $2.9 billion senior secured loan portfolio, which was 11.9% in the March quarter, could increase to 13% in the second half of 2023.

Loan Portfolio Composition (Q1 earnings Release)

In an earnings call, the company stated that it has originated over $249 million in new investments with an average yield of more than 12%. Furthermore, because the Fed is still far from meeting its 2% inflation target, interest rates are likely to remain higher in the second half of 2023 and the following year. As a result, SLRC’s earnings are expected to benefit from rising interest rates and continue to outpace dividend payments.

A Buying Opportunity with Significant Upside

SLR Investment Vs. VFH Vanguard Financial Index (Seeking Alpha)

Shares of SLR Investment have underperformed the S&P 500 index so far in 2023, but they have outperformed the (VFH) Vanguard Financials Index Fund ETF by a significant margin. I am convinced that SLRC’s recent underperformance relative to the S&P 500 represents a good entry point for a new investor. This is because the company’s stock has significant upside potential due to its earnings growth potential and favorable market fundamentals. Furthermore, an A-plus quant grade on valuations indicates that the stock is trading at a discount. A high quant grade on a growth factor also bodes well for share price growth in the coming months.

In Conclusion

With a double-digit dividend yield and significant share price upside potential, SLR Investment appears to be a solid stock to buy in volatile market conditions. Its well-diversified, first lien and floating nature portfolio is likely to benefit from higher interest rates, while almost half of the outstanding debt at a fixed rate would lower interest expense. With $800 million in capital available and no debt maturing until the end of 2024, the company seems to be well-positioned to benefit from the current favorable investment climate.

Read the full article here