I cautioned Barrick Gold Corporation (NYSE:GOLD) investors in my previous update in April as GOLD surged, riding the optimistic wave.

Investors were likely betting on a possible Fed pause/pivot, but could have forgotten about the debt ceiling negotiations that followed in May. I urged investors who missed the steep pullback in March to avoid “buying the rip” in April, as market operators appeared to have drawn investors into a top. Moreover, its valuation wasn’t attractive, suggesting caution.

GOLD fell more than 20% from early May highs through this week’s lows, likely stunning GOLD bulls. Underlying gold futures and the VanEck Gold Miners ETF (GDX) have also pulled back, inflicting pain on bullish investors who chased the momentum surge last month.

As such, dip buyers are likely waiting patiently for the selling momentum to wane, taking out the weak momentum chasers before returning to support its consolidation.

Barrick Gold’s “soft” first-quarter earnings release also didn’t inspire confidence, as a double whammy of lower production and higher costs hit the company.

Despite that, management is optimistic that the second half should be more constructive for the leading gold miner, as it expects production to increase. Management also reaffirmed its 2023 guidance, indicating a full-year production of 4.4 Moz of gold at the midpoint.

With that in mind, we should expect improved operating efficiencies leading to margin accretion over the rest of the fiscal year. Management reminded investors that “there is a strong correlation between production and costs.” In addition, the company also expects production costs to fall, as management “anticipates meeting production and cost guidance metrics for the year.”

The revised consensus estimates concur with an improved operating performance in the second half. So while Barrick Gold posted a revenue decline of 7.4% YoY in Q1, it’s expected to reverse into positive territory moving ahead. Does it make sense? Let’s assess how gold futures have performed recently.

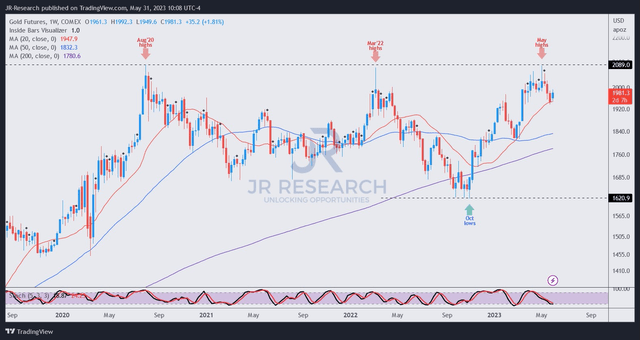

Gold futures price chart (weekly) (TradingView)

As seen above, gold futures faced intense selling pressure at the $2,090 resistance level. The level has been defended stoutly by sellers since August 2020, with buyers unable to muster sufficient buying momentum to overcome the resistance.

However, I assessed that gold futures are no longer in a medium-term downtrend. As such, with near-term optimism deflated, it could attract gold bulls who were waiting for a pullback before adding more positions.

In addition, gold prices topped out previously in March 2022, as they crashed toward the lows in October 2022 before bottoming out. Hence, management’s optimism of a better second-half operating performance is consistent with the buying momentum in underlying gold futures.

Coupled with easier comps with the lows last year, I believe high-conviction investors in Barrick Gold can consider using the near-term pessimism in the stock to add to their positions. Moreover, given GOLD’s leverage to gold prices, the bullish uptrend recovery in underlying gold futures should lend credence to management’s confident outlook for the rest of FY23.

Seeking Alpha’s Quant rates GOLD’s valuation with a “D+” grade, suggesting a premium relative to its broad mining peers. In addition, I observed that its forward EBITDA of 6x is markedly below its 10Y average of 6.9x but above its metals and mining peers’ median of 4.8x.

However, GOLD’s forward adjusted P/E of 15.3x is below GDX’s 20x multiple. As such, GOLD’s valuation isn’t aggressively configured compared to its narrower gold-mining peers.

In addition, I also observed that GOLD’s price action suggests that dip buyers returned this week after three consecutive weeks of rapid sell-down. If a consolidation zone could follow the dip buying momentum, it should proffer support for investors looking to add positions, anticipating a better performance in the second half.

Rating: Buy (Revised from Hold).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Read the full article here