Thesis update

This is an update to my original Xponential Fitness (NYSE:XPOF) thesis. My opinion that XPOF is undervalued remains unchanged. In fact, XPOF’s strong performance thus far has only strengthened my opinion of the company and the stock. While share price have corrected, which I think is simply a function of profit taking in combination with a weak overall investor’s sentiment (US debt ceiling issues, etc.), I think this is another buying opportunity to size up. Membership and unit growth were both solid, and comparable sales growth exceeded expectations in 1Q23, making it another successful quarter for the company. Consequently, management raised FY23 guidance these results which is a healthy indication that no slowdowns are expected for the rest of the year. Since I last wrote about XPOF, it has exceeded my expectations and is performing better than the numbers I had anticipated. All of these are supported by consistent additions of new partnerships and brand-building initiatives, as well as by the excellent execution on development and driving membership. Overall, I reiterate my buy rating on XPOF, and I believe that if the strong performance continues, we could see more upside for FY23 guidance, which is likely to lead to revision in consensus estimates, thereby driving share price up.

Raised guidance

XPOF has updated its revenue forecast for FY23, now anticipating a range of $290 million to $300 million, up from the previous forecast of $285 million to $295 million. I note that this guide assumes minor acceleration in revenue over the coming quarters based on 1Q23 $70.7 revenue (run rate of $282 million). The company has also revised its projection for North American system-wide sales, which was previously pegged at $1.34–$1.35 billion, to a range of $1.37–$1.38 billion. In addition, XPOF has raised its adjusted EBITDA forecast from $101 million to $105 million to between $102 million and $106 million. My belief is that the momentum is still very strong so far in 1Q23, and that if 2Q23 continues with such strength, there is a good chance that management will raise guidance again in 2Q23 earnings (which will be sometime in August). If management raise guidance in August, I think it is a strong catalyst for the share price as management would already have 8+months of data. The remaining 4 months are less likely to move the needle.

Strong KPI performance

So far, XPOF’s underlying performance has been nothing short of spectacular. With increased foot traffic and momentum carrying over into 2Q23 (based on 1Q23 earnings call), it’s reasonable to assume that key metrics like sales and membership renewals will continue to perform strongly in 2Q23. Store comparable sales growth has been robust at >20%, up from 17% over the previous two quarters. Another impressive feat is that membership in NA grew 31% to 665K with studio visits up 38% y/y, which I think is a big surprise to many investors as consumer sentiment was supposed to be weak (and hence less discretionary spend). Importantly, comparing these two metrics reveals that growth was driven primarily by volume, with pricing serving as a complementary factor. The opposite is true in many sectors, where declining volumes and rising prices are used to sustain expansion. Both were robust for XPOF, but volume was the primary factor. This further confirms my belief that XPOF is still expanding rapidly and shows no signs of slowing down anytime soon.

Unit growth performance

During 1Q23, XPOF opened 115 new studios, bringing the total number of studios in operation around the world to 2,756. This success shows how well XPOF has been able to implement its strategic plan for growth. It’s important to remember that XPOF has maintained its FY23 studio opening guidance, setting its sights on a number between 540 and 560, which is also another indicator that growth is not slowing down. I believe XPOF will be able to hit this target due to its growth model. In contrast to larger franchise networks like Planet Fitness, XPOF is owned and operated by many small businesses. This has some benefits over a small, tightly knit group of franchisees. Studios used by XPOF are typically modest in size and design, and are financed through equipment leases rather than traditional loans. Therefore, unlike larger operators, XPOF is less vulnerable to difficulties caused by rising interest rates. During the first three months of the year, XPOF was able to sell 188 franchise licenses, bringing the grand total of licenses sold to 5,638. This strong performance in franchise license sales not only contributes to the company’s revenue growth but also serves as a reliable indicator of future expansion (5,638 licenses against 2,750 units). The steady increase in new franchise licenses issued shows that interest in XPOF’s franchise opportunity remains high. I have faith that the XPOF franchisee system will continue to be robust and capable of adapting to changing market conditions.

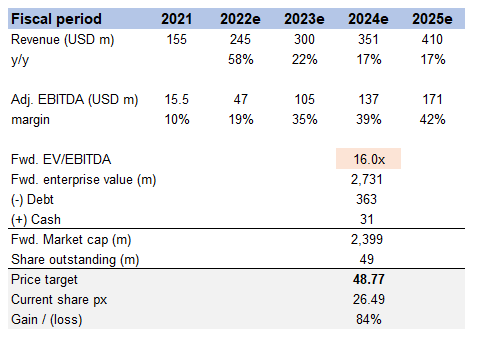

Valuation

My model suggests a price target of ~$48.77 or ~84% upside in FY24 from today’s share price of $26.49. There is no difference in the valuation multiple that I have used (16x forward EBITDA, which is the mid-point between its average and where it is trading today (this is fair given the rates environment should have some impact on valuations). The key difference is the expected growth. I now expect XPOF to achieve $410 million in revenue in FY25 as the business continues to show momentum.

Own model

Risks

Growth dependent on franchisees

A point of risk is that the growth of the business depends on the growth of the franchises. Think of franchises as the cells of a body. The body can’t exist outside cells, so can XPOF not exist outside its network of franchises? If franchises can’t find and secure sites for new studios, it will have a big effect on the rate of revenue growth.

Conclusion

In conclusion, my original thesis on XPOF remains unchanged, and I continue to view the company as undervalued. Despite a recent correction in share prices, likely driven by profit-taking and overall investor sentiment, I see this as a buying opportunity. XPOF’s solid performance in terms of membership and unit growth, along with better-than-expected comparable sales growth in 1Q23, indicates another successful quarter for the company. Management’s decision to raise FY23 guidance further supports the notion that XPOF anticipates sustained growth throughout the year. The impressive KPI performance, including robust store comparable sales growth and significant increases in membership and studio visits, further solidifies my confidence in XPOF’s expansion trajectory.

Read the full article here