Investment Thesis

CrowdStrike’s (NASDAQ:CRWD) share price sold off premarket and has returned to the price it was at the start of May.

The stock is now priced at around 58x forward non-GAAP EPS. This may sound expensive, but given the consistency in its rapidly growing revenues, I believe that investors were simply too eager as they headed into this earnings report.

I believe that this was a sparkling report and hence I’m taking this opportunity to raise my rating on CRWD stock to a buy.

Why CrowdStrike? Why Now?

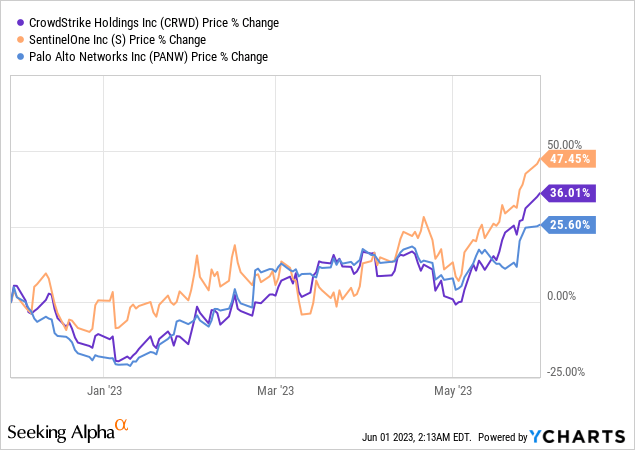

CrowdStrike’s earnings come on the back of Palo Alto Networks (PANW). A set of results that I believe were very compelling. Although, I should disclose, Palo Alto Networks is a stock that I’ve been recommending to premium members.

The graphic above reflects the overall enthusiasm that investors have had for cybersecurity stocks in the past 6 months. This set of companies is believed to be in very high demand, given the rapid uptake and proliferation of AI and the need to protect one’s business from all kinds of cyberattacks.

During the earnings call, we heard from CrowdStrike’s co-founder and CEO George Kurtz drive the message that CrowdStrike possesses a sustainable data advantage given its unique set of correlated human and machine-generated data, which yields better models. Here’s a quote,

CrowdStrike has a sustainable data advantage, the most powerful and unique set of correlated human and machine-generated data across all of cyber.

Our data advantage creates a unique competitive moat yielding better models, better automation and better outcomes. We see the rapidly growing adoption of generative AI as a democratizing force within cyber security from both an adversarial and protection standpoint.

Kurtz also used the earnings call to echo what Palo Alto Networks had said in their earnings call. More specifically, that vendor consideration continues to take place.

Another mega-trend continuing to unfold in cyber security is consolidation. The macro backdrop has only accelerated the need for customers to reduce vendor sprawl, reduce agents, reduce costs, and protect their businesses with a best of SaaS platform.

In simple terms, IT budgets have been stretched to the brink and there’s a period of software digestion. Incidentally, this is an echo of what Marc Benioff from Salesforce (CRM) also said yesterday on their earnings call. Plus, another bellwether to make this declaration was Snowflake (SNOW) last week.

Revenue Growth Rates Remain Alluring

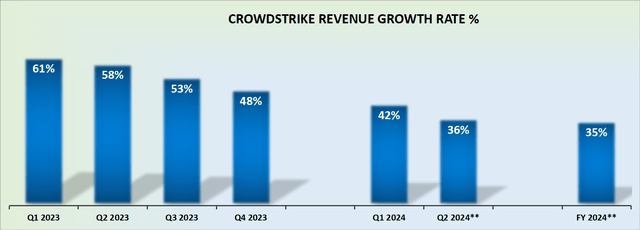

CRWD revenue growth rates

CrowdStrike’s outlook for fiscal 2024 was not significantly upwards revised. And that’s something that investors truly wanted to see. After all, as I’ve already alluded to CrowdStrike’s share price was pumped up and ready to be dazzled as it headed into this earnings report.

Next, we’ll turn to discuss CrowdStrike’s profitability profile.

Profitability Profile Continues to Improve

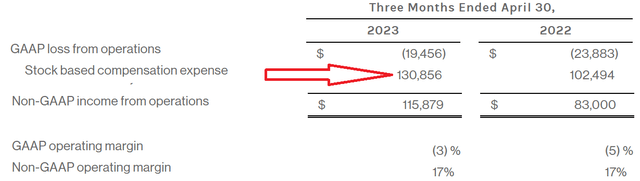

CRWD Q1 2024

CrowdStrike’s profitability profile shines strongly. In fact, this really is one of the most compelling aspects to consider an investment in CrowdStrike. Here’s a business that has always been focused on driving profitable growth.

And despite growing at significantly faster than 30% CAGR, the business is already on the cusp of reaching GAAP profitability.

Furthermore, as I highlight above, CrowdStrike’s SBC expense hasn’t dramatically increased. In fact, for fiscal Q1 2024, while revenues were up 42% y/y, SBC expense was slightly more muted and up 27% y/y.

Looking further ahead to the year as a whole, CrowdStrike’s non-GAAP net income line points to 20%. This means that the second half of fiscal 2024 should see an improvement in profitability, given that fiscal Q1 2024 saw just under 18% non-GAAP net income margin.

The Bottom Line

CrowdStrike’s share price returned to its May level, but I believe the stock is worth buying due to its consistent revenue growth.

The cybersecurity industry is in high demand, and CrowdStrike’s CEO emphasized their sustainable data advantage and how CrowdStrike will benefit from the trend of vendor consolidation.

Lastly, CrowdStrike’s profitability profile is strong, with CrowdStrike on track to reach GAAP profitability soon and is expected to deliver improvement in profitability in the back half of this fiscal year.

Read the full article here