Introduction

It’s time to talk about an industrial stock I have never covered before. The Illinois-based IDEX Corporation (NYSE:IEX) is a fantastic wealth compounder with a satisfying dividend track record.

This well-diversified industrial company has figured out how to consistently grow its business through various cycles. While the company is currently struggling with economic headwinds and healthcare de-stocking, I believe we could get attractive buying opportunities in the months ahead, which might benefit investors seeking high-quality compounders in the industrial space.

So, let’s dive into the details!

Buying Compounders To Generate Wealth

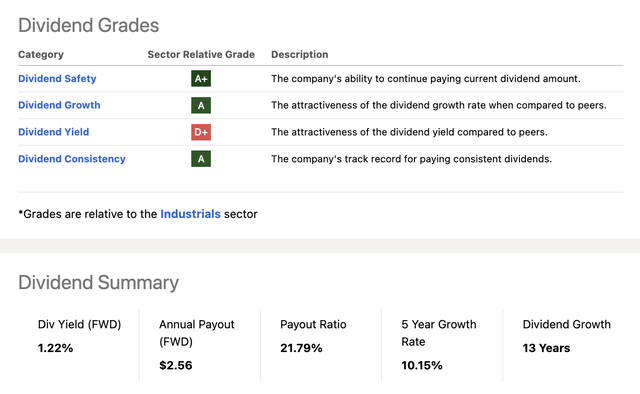

Let’s start by taking a closer look at the company’s dividend scorecard. What we see are four categories: safety, growth, yield, and consistency.

The company scores extremely high on safety, growth, and consistency.

Seeking Alpha

Unfortunately, its dividend yield scores very low, as IDEX Corporation shares yield only 1.2%.

While this, unfortunately, makes IEX shares unsuitable for income-seeking investors, the company behind the IEX ticker is a total return star.

The other day, I read a paper titled The Anatomy of a Compounder, which looked into the factors that make a stock a long-term compounded.

Here’s its conclusion (emphasis added):

It is said that Albert Einstein described compounding interest as the most powerful force in the universe. We firmly believe that the long-term trend in company earnings with high cash conversion determines the generation of returns, and that finding compounders is the holy grail of investing. The mindset of being on a constant search for compounders is a better use of time than exhausting one’s intellectual capital and time on trading in and out of stocks and segments of the market in a desire to look good in the short term.

Essentially, the paper states that the best stocks combined with the best strategy result in the most wealth. In this case, they focus on companies with consistent earnings growth and high cash conversion. These companies are often the dividend growth stars of the market, even if they sometimes come with a low yield.

Furthermore, the paper makes the case that investors’ only job should be to find the right picks and buy them at the right price. That’s it.

Don’t trade good stocks. Own them.

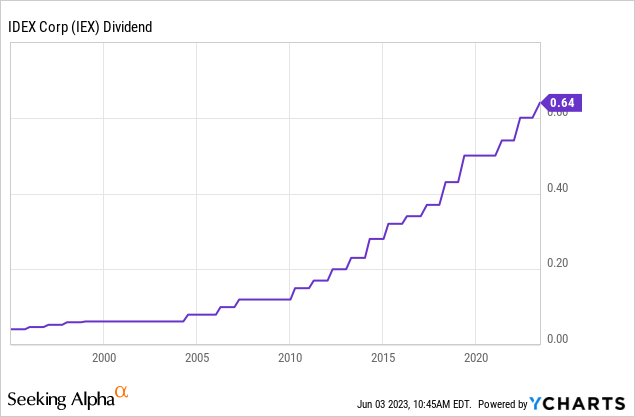

With that said, going back to IDEX’s dividend, the company has grown its dividend by 10.2% per year over the past five years – on average, that is.

The ten-year average is 11.6%, which shows that the company’s dividend growth has been very consistent in the past.

The most recent hike was announced on May 25, when the company hiked by 6.7%. That’s despite economic challenges, but more on that later.

While the company has had prolonged periods without hikes – mainly during recessions – it has never cut its dividend.

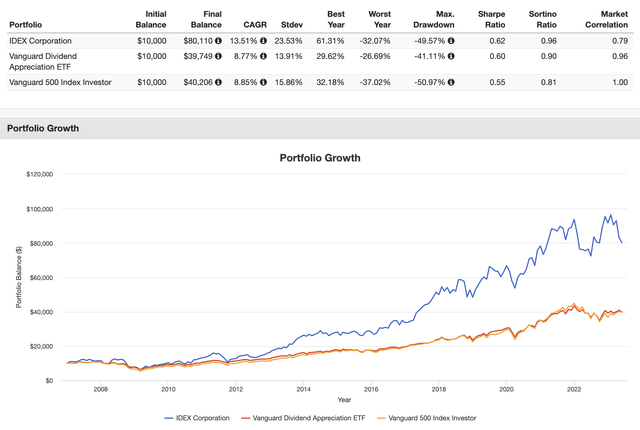

Additionally, the stock has returned 13.5% since the start of 2007. It has outperformed both the S&P 500 and the Vanguard Dividend Appreciation ETF (VIG) by a wide margin and with subdued volatility. Since 2007, the standard deviation has been just 23.5%. This gives the stock a favorable risk-adjusted return (Sharpe Ratio) of 0.62%.

Portfolio Visualizer

Now, with that said, let’s take a look under the hood and uncover why IEX is a long-term compounder.

What Makes IDEX So Special

The Company Behind The IEX Ticker

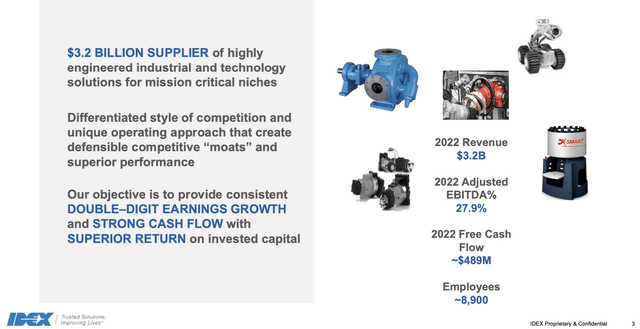

With a market cap of $15.8 billion, IDEX is one of the biggest players in the Specialty Industrial Machinery industry, which is a part of the industrial sector.

IDEX Corporation

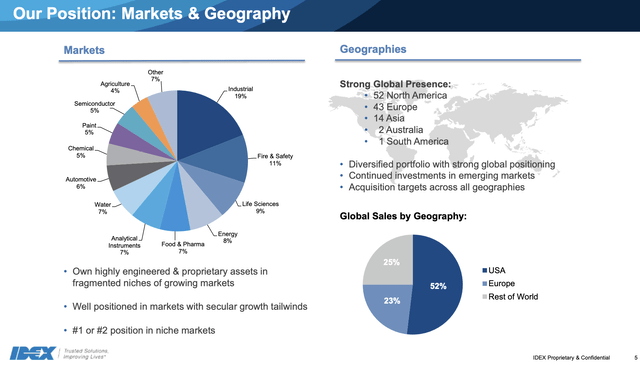

The company is an applied solutions provider that serves niche markets worldwide. The company operates through over 50 wholly-owned subsidiaries, united by the philosophy of embracing its 80/20 principle and prioritizing customer service.

IDEX Corporation

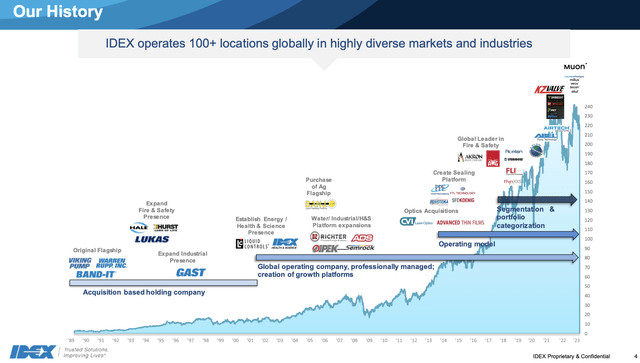

Looking at the chart below, we see that IEX has a history of aggressive M&A, which is common among compounders in that sector. Essentially, successful companies use free cash flow to acquire new businesses. Once these companies are integrated, free cash flow improves, debt is reduced, and new M&A projects are initiated. It’s a bit like playing Monopoly. At some point, there’s no stopping the best players.

IDEX Corporation

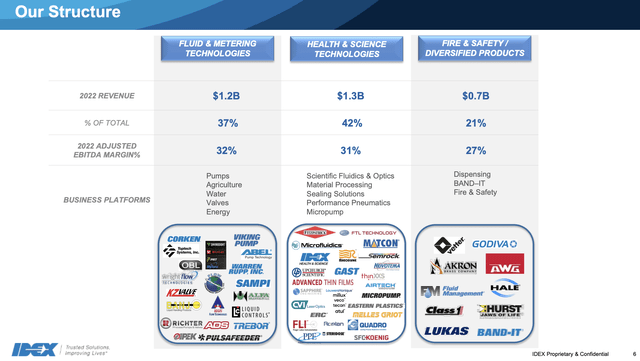

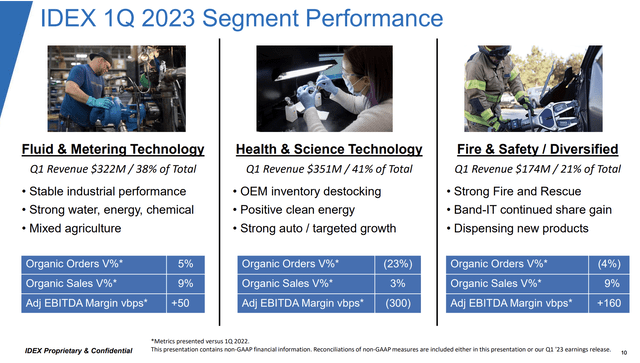

As we can see below, IDEX has three reportable segments: Fluid & Metering Technologies (“FMT”), Health & Science Technologies (“HST”), and Fire & Safety/Diversified Products (“FSDP”).

These segments are structured to best serve customer needs and provide management efficiency, aligning with organic growth, strategic acquisitions, and capital allocation priorities.

- The FMT segment designs and distributes fluid-handling pump modules and systems, serving industries such as food, chemical, industrial, water and wastewater, agriculture, and energy.

- The HST segment offers precision fluidics, pumps, sealing solutions, medical devices, optical components, and more, serving markets like food and beverage, life sciences, pharmaceuticals, and aerospace/defense.

- The FSDP segment includes businesses related to fire safety, dispensing, and diverse products.

IDEX Corporation

Now, let’s take a closer look at the company’s capital spending plans.

How IEX Spends Its Capital

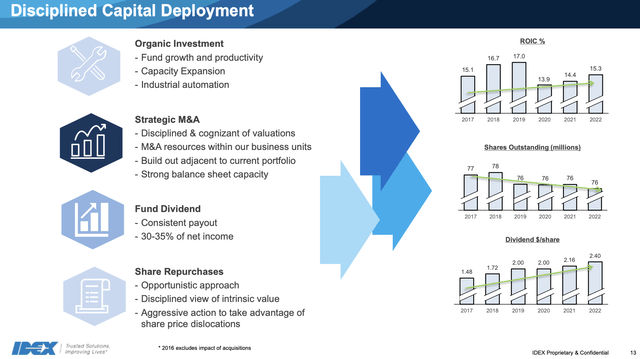

IEX’s capital deployment priorities are perfectly aligned with its long-term goals. The company’s main priority is organic growth, which includes expanding existing capacities and enhancing products and services through, i.e., automation. Over the past six years, the company has achieved returns on invested capital of 14% to 17%.

IDEX Corporation

The second priority is M&A. The company aims to buy companies whenever it sees opportunities to create synergies. As we just briefly discussed, the company has a huge portfolio of companies that all bring something unique to the table.

Priority number three is its dividend. The company aims to maintain a steady payout ratio of 30% to 35% of its net income.

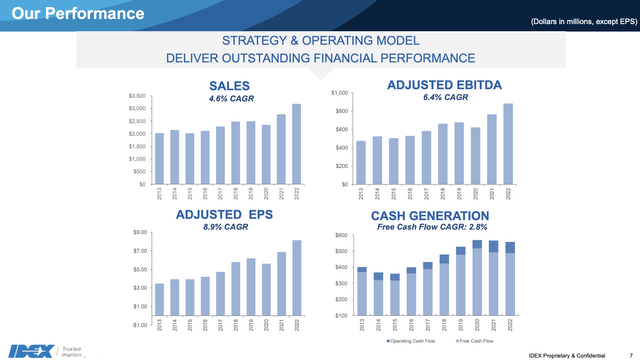

Over the past ten years, the company has grown its EPS by 8.9% per year. The company struggled a bit in 2014 and 2015 when manufacturing entered a recession. It also suffered in 2020 due to the pandemic.

IDEX Corporation

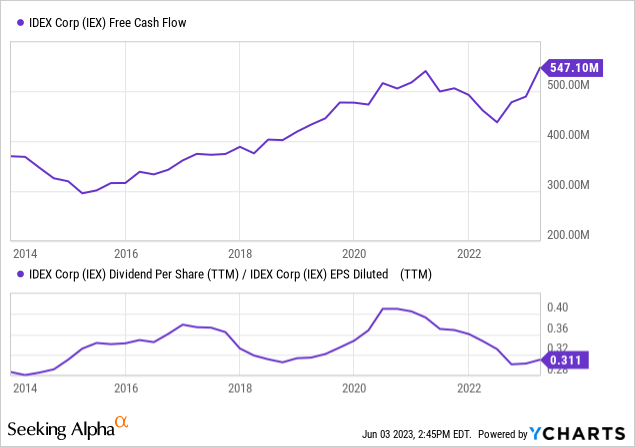

Furthermore, free cash flow growth was a bit slow, with a CAGR of 2.8%. However, free cash flow is now rebounding again. Also note that I added the payout ratio in the chart below, which shows that the company’s payout ratio is, once again, at the lower bound of its target range. That’s good for future (expected) dividend growth.

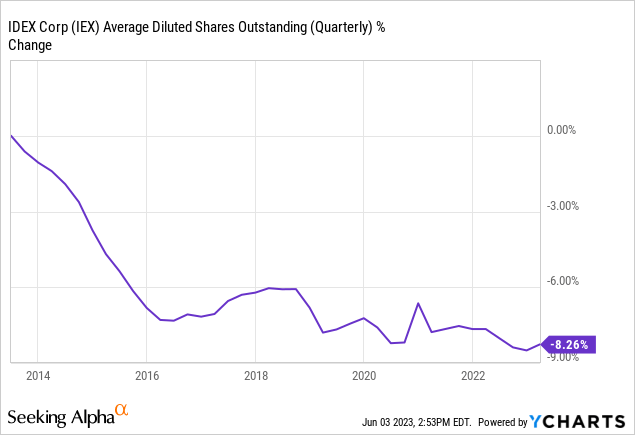

The fourth priority is repurchasing shares. The company uses an opportunistic buyback approach, which means it deploys cash for buybacks when it believes its business is undervalued.

Over the past ten years, IEX has bought back 8.3% of its shares, which isn’t a lot, but it does add up over time.

Also, the company maintains a very healthy balance sheet.

IDEX Corp is expected to end this year with $640 million in net debt. This translates to roughly 0.7x EBITDA. Hence, the company enjoys a BBB+ credit rating. I believe this rating will be boosted to A- over the next few years.

Recent Events & Valuation

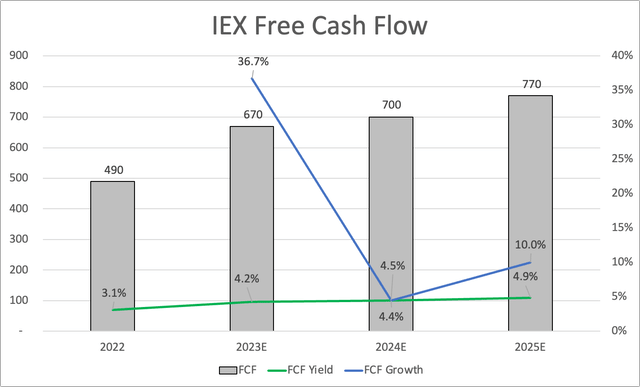

Let’s start with the best news. IEX is expected to continue the aforementioned surge in free cash flow. This year, IEX is expected to boost free cash flow to $670 million, followed by a gradual surge to $770 million in 2025. These numbers indicate a free cash flow yield rise to 4.9% in 2025.

Leo Nelissen

When looking at the IEX share price, we see that euphoria is still subdued. IEX shares are 15% below their 52-week high and down 8.4% year-to-date.

This makes sense, as investors have dumped cyclical stocks due to a steady decline in economic growth expectations.

However, IEX continues to do extremely well.

In the first quarter, IDEX achieved record sales with positive organic growth across all three segments. The company reported $2.09 adjusted earnings per share and strong free cash flow. While the FMT and FSD segments performed exceptionally well, offsetting some pressure in the HST segment, IDEX experienced a broader and more prolonged recalibration within the HST segment, particularly in the analytical instrumentation, life science, pharma, and semiconductor markets.

IDEX Corporation

Moreover, despite the end-market demand remaining positive, IDEX believes its customers have a sufficient inventory of critical components in the near term.

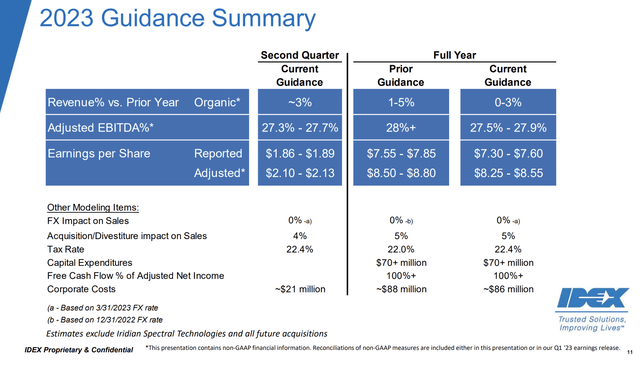

As a result of the inventory recalibration and volume impact in the HST segment, IDEX revised its full-year adjusted 2023 EPS guidance from $8.25 to $8.55.

The top-line challenges, net of the cost-containment plan, are expected to drive a $0.25 adjusted EPS headwind for the year.

IDEX Corporation

IDEX also announced its intent to acquire Iridian Spectral Technologies for CAD 150 million ($111 million). This acquisition is expected to complement and expand IDEX’s existing businesses within HST.

Also, related to HST inventory issues, the company noted that order intake is firming up in the back half of the year, with planning and methods being adjusted accordingly. While market conditions may vary, these factors provide a degree of confidence in the path to normalization.

*If* economic growth bottoms going into next year, I believe that IDEX Corp could benefit from strength in all segments and comfortably rise beyond its all-time high.

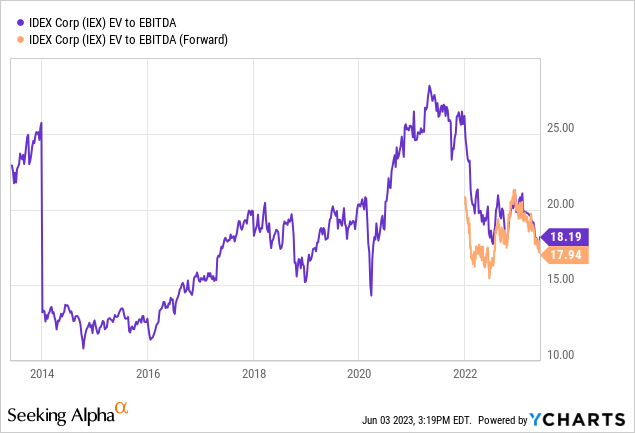

With that said, the valuation is fair. Shares are trading at roughly 18x NTM EBITDA.

IEX’s current consensus price target is $230, which implies roughly 10% stock price upside. I agree with that, given the current circumstances.

Investors interested in buying IEX as a long-term dividend growth investors should look for an entry close to $180. I believe that a market correction could push IEX shares into the $180 to $190 range. At that point, I really like the long-term risk/reward.

Needless to say, waiting for better prices comes with risks of missing long-term upside if the stock doesn’t fall that far. However, given my view on the economy, it’s a risk I’m willing to take.

Takeaway

IDEX Corporation presents an appealing opportunity for investors seeking high-quality compounders in the industrial sector. Despite the current economic slowdown, attractive buying opportunities may arise in the coming months.

IEX’s dividend track record, though with a low yield, showcases consistent growth and high cash conversion, making it a total return star. The company has never cut its dividend, and its stock has outperformed the market with low volatility.

IEX’s capital deployment priorities align with its long-term goals, including organic growth, targeted M&A, dividend payouts, and opportunistic share buybacks.

A healthy balance sheet and expectations of surging free cash flow further bolster its position.

While IEX’s current valuation is fair, patient investors might consider an entry point closer to $180, balancing long-term potential with potential market risks.

Read the full article here