Marvell Technology, Inc. (NASDAQ:MRVL) stock is up roughly 49% since our upgrade to buy in late March, outperforming the S&P 500 Index (SP500) by around 41%. We believe MRVL stock has captured the expectation of recovery and A.I. tailwinds running up nearly 28% post-1Q24 earnings results, more than Nvidia Corporation (NVDA) post-earnings. We’re downgrading Marvell Technology stock to a sell now as we believe the stock is over-priced, trading at 38x C2023 on a P/E basis.

Additionally, we see a downside ahead due to the potential net loss of connectivity ports due to the A.I. boom. Investors are getting overly excited about promises of A.I. growth exposure, causing the stock to rally after the earnings call, where CEO Matt Murphy noted expectation for “AI revenue to at least double in fiscal 2024” and management referred to A.I. as a “key growth driver for the company.” Our downgrade is driven by our belief that the A.I. hype is unjustified and comes with hidden risks. The following outlines the key data points on which our downgrade is founded:

1. Doubling a low-digit percent of revenue

Marvell Technology’s estimated A.I. revenue in FY2023 is $200M, and the company expects its A.I.-related sales to double to ~ $400M in FY2024. We’re constructive on Marvell benefiting from the A.I. boom and surging demand for A.I. servers that utilize a higher ratio of GPUs to CPUs. Still, we’re cautious about getting too excited about the “doubling” in FY2024. Even if management successfully doubles A.I. sales, we don’t believe it’ll boost top-line growth meaningfully, as A.I.-related sales make up such a small percentage of revenue now. We expect MRVL to outperform in 2H23 once industry inventory digestion completes and industry demand rebounds in early 2024. However, we believe the A.I. narrative has made the stock over-priced at current levels.

2. GPU-based A.I. servers to cannibalize compute servers

A.I. hyper-growth is spiking demand for GPUs, evidently after Nvidia Corporation’s 1Q24 earning results and guidance of $11B in revenue next quarter. The most advanced A.I. applications require much more parallel computing power and, hence, utilize a higher ratio of GPUs to CPUs. NVDA’s DGX Systems, basically an A.I. computer for training, uses eight GPUs to two CPUs. A.I. servers utilize eight ports for every server, which is significantly higher than compute servers that use two ports. At face value, the surge in demand for A.I. servers is good news for MRVL. The catch, however, is the ASP of A.I. servers versus compute servers. A GPU-based A.I. server will cost more than 10-15x that of a traditional compute server; A.I. server ASP is ~$200K versus compute server ASP of ~$15K.

Hence, with a limited server capex, we expect more capital to be allocated to A.I. servers over compute servers. We see a higher risk profile for MRVL as A.I. servers cannibalize compute servers because we believe the company is at risk of experiencing a net loss of connectivity ports as CPU units drop in 2H23. For the same capex spending, ten compute servers provide 20 ports (2×10) versus a single A.I. server providing eight ports (8×1). We believe MRVL will be pressured in 2H23 as it loses the CPU ports as GPU demand spikes and eats up capex spending from cloud providers and enterprises. We now see more spending channeled to A.I. servers but fewer ports.

We see an unfavorable risk-reward scenario of MRVL in 2H23 and believe the stock is over-priced at current levels. We see favorable exit points after last week’s stock rally, and recommend investors explore exit points at current levels.

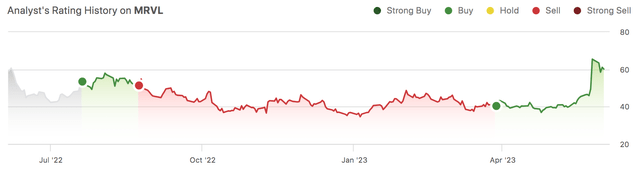

The following chart outlines our rating history on MRVL.

Seeking Alpha

Valuation

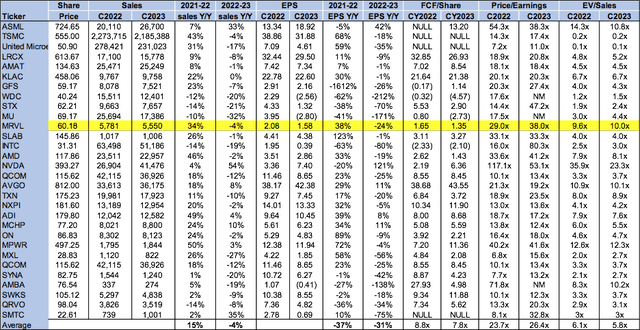

MRVL is over-priced, trading at 38x C2023 EPS $1.58 on a P/E basis compared to the peer group average of 26.4x. The stock is trading at 10x EV/C2023 Sales, versus the peer group average of 5.8x. We recommend investors avoid the stock at current levels as we believe the high valuation is unjustified and don’t see MRVL being the next NVDA.

The following chart outlines MRVL’s valuation against the peer group.

TechStockPros

Word on Wall Street

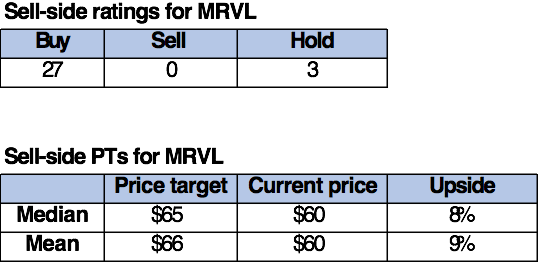

Wall Street doesn’t share our bullish sentiment on the stock. Of the 30 analysts covering the stock, 27 are buy-rated, and the remaining are hold-rated. Where Wall Street often feeds into market noise, we diverge and filter through. We expect MRVL will benefit from the A.I. boom, but also face pressure with connectivity ports if CPU units drop as we forecast.

The following chart outlines MRVL’s sell-side ratings.

TechStockPros

What to do with the stock

We’re moving Marvell Technology, Inc. to a sell after 1Q24 earnings results and the stock run-up driven by A.I. hype. We expect management’s outlook of doubling A.I.-related sales Y/Y is not far-fetched, but we believe this will have an underwhelming impact on top-line growth. We also expect a higher risk profile for MRVL due to the potential net loss of connectivity ports due to the A.I. boom. We believe Marvell Technology, Inc. stock is over-priced and see favorable exit points at current levels. We recommend investors sell the stock on a short opportunity and revisit once the near-term headwinds are factored in.

Read the full article here