Introduction

T-Mobile US, Inc. (NASDAQ:TMUS) has experienced three consecutive years of declining EPS due to costs associated with their merger with Sprint. However, 2023 has a strong probability of being a bounce back year in profitability. My valuation approach estimates a fair value of $191.19, implying ~44% upside from current price levels.

Post Merger T-Mobile

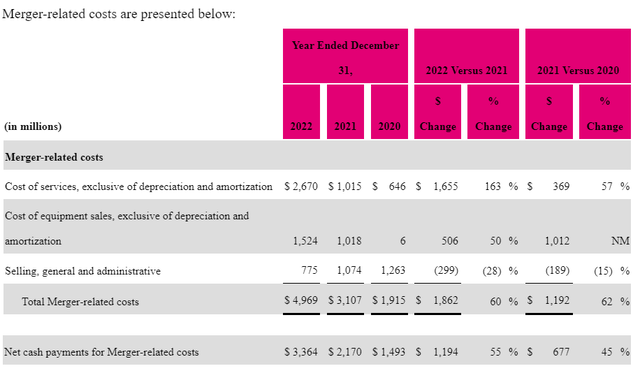

TMUS is positioned well to begin to benefit from their merger with Sprint as management has handled the integration well. Since 2020, TMUS has incurred substantial costs in trying to integrate the two companies. 2022 was the highest year of merger related costs yet with over $4.9 billion. The company’s bottom line has taken a hit due to this process, but the company is now transitioning to a position where the benefits will begin to outweigh the costs. According to the most recent annual report, management expects that the last $1 billion of merger related costs will be mostly realized by the end of 2023. However, management’s recent guidance is that they will realize 7.3 to 7.5 billion in merger synergies in 2023. Overall, the merger seems to have gone very well as management has contained the costs to a 3-4 year period while adding 40 million customers to their platform. I would expect TMUS’s bottom line to improve substantially over the next couple of years as a result.

2022 10k

Earnings Expectations

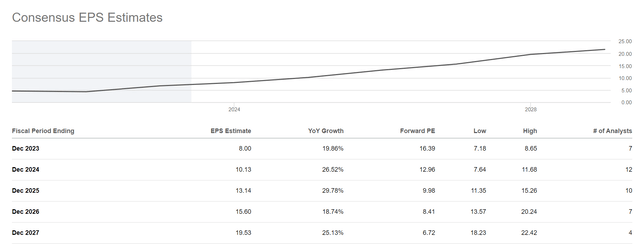

Seeking Alpha

Before I dive into my scenario analysis, I will use this section to explain how I chose my growth assumptions. As we can see from the chart above, consensus expectations are for EPS to increase substantially in 2023 and then continue to grow. Overall, the implied EPS CAGR from 2022 to 2027 is 56.81%. However, I do not believe that the EPS figures during the merger period are an accurate reflection of TMUS’s actual earnings power. For that reason, I will replace the 2022 EPS figure with the 2019 figure of 4.06 to be conservative. After this change, the EPS CAGR over the next 5 years is expected to be 36.91%. I will use 30% as the growth rate in my best case scenario, which is only assigned a probability of 10%. I will use a growth rate of 25% for my base case to be conservative relative to consensus.

Valuation & Scenario Analysis

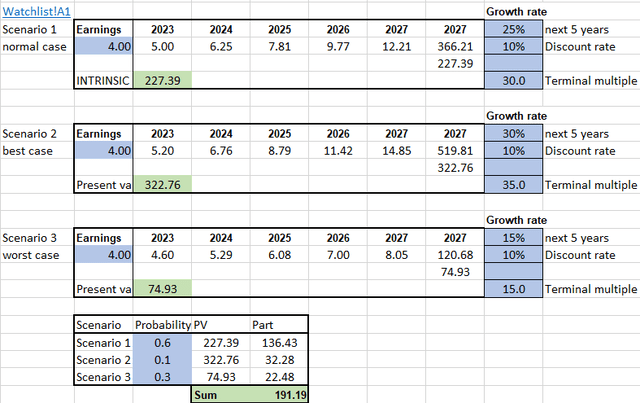

Author’s Representation

For all my calculations of value, I will be using a discount rate of 10%. 10% is my minimum required return because this has historically been the return you can expect if you decide to just put your money in an index fund that tracks the S&P 500. Lastly, keeping the discount rate the same allows for comparability between different investments.

Also, I assign a weight of 60% to my base case, 10% to the best case, and 30% to my worst-case scenario. I am using an EPS of 4.00 as my base figure as this is what TMUS was able to earn before the merger. This is also to remain consistent with my analysis of consensus growth expectations above. With that out of the way, I will move to the individual scenarios.

Scenario 1 is my base case, which assumes 25% growth for the next 5 years with a terminal multiple of 30x. Discounting the 2027 sales price back to present value yields a fair value of $227.39 for an investor with a target return of 10%.

Scenario 2 is my best case, which assumes 30% growth for the next 5 years with a terminal multiple of 35x. Discounting the 2027 sales price back to present value yields a fair value of $322.76 for an investor with a target return of 10%.

Scenario 3 is my worst case, which assumes 15% growth for the next 5 years with a terminal multiple of 15x. Discounting the 2027 sales price back to present value yields a fair value of $74.93 for an investor with a target return of 10%.

The sum of the weighted PVs is $191.19, implying ~44% upside from current levels.

PEG Analysis

I like to use PEG analysis to compare what the market is pricing in and compare that to consensus estimates. To start I will take the average of the consensus EPS expectations from the above sections. I will exclude the 2027 estimate from this average as it seems excessively bullish and has the least amount of analysts contributing to it. The average of the other four EPS figures comes out to 11.71. Currently, TMUS trades at 11.29x this number. However, we already established that consensus growth is currently at 36.91%. Based on these numbers, the PEG ratio also tells us the TMUS is undervalued due to the ratio being well below 1.00.

Risks

Competition

TMUS operates in an industry where there are only a couple of large players fighting for share. If multiple smaller players successfully enter the space, profitability could take a hit.

Indebtedness

TMUS currently has a debt to equity ratio of 1.64x. Although not ideal, it is not outside the norm for the industry. The company has 9.6 billion in cash and 9.8 billion in current debt. However, the majority of the debt is long-term, with over 98 billion.

Conclusion

Overall, I expect TMUS to improve profitability in 2023 due to increased synergies and reduced costs from their recent merger. Both my scenario analysis and PEG analysis point to TMUS being undervalued.

As a result, I rate TMUS stock a buy.

Read the full article here