It was a mixed Q1 Earnings Season for the precious metals sector, with most producers reporting flat to lower production, which combined with higher costs (inflationary pressures) led to reduced cash flow generation year-over-year. And while the royalty/streaming companies were immune from the margin compression, Wheaton Precious Metals’ (NYSE:WPM) Q1 results were weaker than its peers from a headline standpoint, with attributable production down 14% year-over-year, revenue down 30% year-over-year, and quarterly earnings per share down from $0.35 to $0.25. However, while these results might have disappointed investors in the stock, there are some nuances worth pointing out that led to the softer results. Plus, while Q1 might have been softer than hoped, Wheaton Precious Metals (“Wheaton”) is set up to deliver a strong H2 and deliver into its annual guidance. Let’s take a closer look below.

Constancia Mine (Hudbay Minerals Website)

Q1 Production & Sales

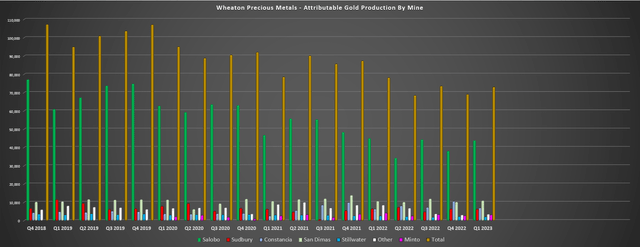

Wheaton released its Q1 results last month, reporting quarterly attributable production of ~141,800 gold-equivalent ounces [GEOs], made up of ~73,000 ounces of gold and ~4.93 million ounces of silver. This translated to a 14% decline year-over-year, and ounces sold plunged to ~117,400 GEOs, a 26% drop year-over-year. Regarding the softness in its gold business relative to Q1 2022, Salobo saw a slight decline in output with increased grades and throughput offset by lower recoveries and planned and corrective maintenance during the quarter. Meanwhile, the company saw a ~4,000 ounce shortfall from the 777 Mine (closed in June 2022), and a decrease in output from Stillwater, with the potential for Q2 deliveries to be impacted due to a five-week shutdown (mining below 50 level at Stillwater West Mine) resulting from structural damage to the shaft headgear, winder house, and winder rope. And while these weren’t significant declines, they offset higher throughput from Constancia, San Dimas, and Sudbury.

Wheaton – Attributable Gold Production by Mine (Company Filings, Author’s Chart)

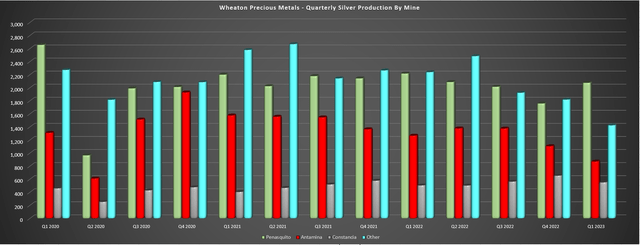

As for Wheaton’s silver segment, we saw a massive decline in attributable production, which fell from ~6.22 million ounces to ~4.93 million ounces. In addition to lower grades due to mine sequencing at Antamina and lower recoveries at Penasquito, we saw a significant decline in Wheaton’s ‘Other’ segment, which included Keno Hill, Yauliyacu, and the 777 Mine. However, two of these streaming assets were sold (Keno Hill, Yauliyacu) which led to a ~660,000-ounce headwind, and the 777 Mine was closed, with a headwind of 20,000 ounces. So, while the decline year-over-year in attributable output was quite significant, more than half of it was related to lappping assets that produced in Q1 which did not produce in the current quarter (mine closure or asset sales). On a positive note, high-grade ore is expected ahead of plans at the Pampacancha satellite pit at Hudbay’s (HBM) Constancia Mine in Peru.

Wheaton – Quarterly Attributable Silver Production by Mine (Company Filings, Author’s Chart)

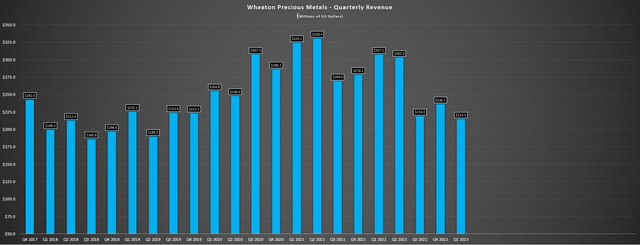

Given the sharp decline in output and ounces sold, it’s no surprise that Wheaton’s revenue fell off a cliff. In fact, this was the weakest quarter for revenue since Q2 2019 for Wheaton Precious Metals, a considerable divergence from its peer group. And given the amount of capital that has been deployed over the past four years, this is understandably an ugly headline result. However, the majority of Wheaton’s capital has been deployed on development assets which have not yet kicked in, and as discussed above, this was an unusual quarter with a weak silver price, an exceptionally weak palladium price, and lower production at key assets. However, with Voisey’s Bay set to ramp up next year (cobalt), Blackwater set to pour its first gold next year, and the Salobo III Expansion on track to be ramped up to full capacity within 18 months, we should see a much better 2024, and potentially record revenue if metals prices can cooperate.

Wheaton Precious Metals – Quarterly Revenue (Company Filings, Author’s Chart)

To summarize, while the sharp decline in revenue is disappointing, it’s important to note that this was because of a lower average realized silver price ($22.85/oz vs. $24.19/oz), significantly lower palladium prices ($1,607/oz vs. $2,339/oz), and much lower ounces sold than produced in the period, with a further impact from the sale of the Yauliyacu and Keno Hill precious metals purchase agreements and the cessation of mining at the 777 Mine. However, from a production standpoint, gold production was only down 6%, even if sales were down ~20% year-over-year. And shorter-term, Wheaton should get some help from higher metals prices in Q2, with the gold price averaging ~$1,970/oz quarter-to-date, the price of silver averaging ~$24.00/oz, partially offsetting continued softness in palladium prices.

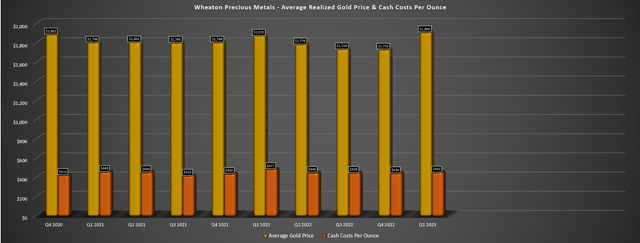

Wheaton – Average Realized Gold Price & Cash Costs Per Ounce (Company Filings, Author’s Chart)

Finally, from a margin and earnings/cash flow standpoint, Wheaton may have seen a sharp drop in revenue, but this was largely expected due to a 45/55 weighted attributable production profile this year, and it at least didn’t see the revenue hit with the combined margin compression that many producers suffered. In fact, cash costs increased less than 1% year-over-year to $443/oz (Q1 2022: $440/oz), with Wheaton maintaining its position as one of the highest-margin names sector-wide due to its superior business model. Finally, while earnings were lower ($0.25 vs. $0.35), this was mostly tied to lower revenue, higher G&A expenses, higher donations/community investments, and a slight increase in its share count. As for cash flow, it sunk to $135.1 million, but cash flow should be up substantially on a year-over-year basis, and I’d expect the company to generate at least $500 million in free cash flow despite the slow start to 2023.

Recent Developments

Regarding stream purchases and progress on development projects, the Blackwater Project received approval for its British Columbia Mines Act Permit in March, allowing the company to begin major construction activities, with the project likely to reach commercial production by Q1 2025. This will be a weighty contributor for Wheaton with the company holding a 50% silver stream (until ~17.8 million ounces delivered, before a step down to 33%) and 8% gold stream on the asset (until ~280,000 ounces delivered before a step down to 4%), with payments of 18% of spot for both metals. And while Blackwater will start out as a Tier-2 scale mine (~321,000 ounces in Phase 1), production contributions will increase materially in Phase 2, with an expansion to 12.0 million tonnes per annum in Year 6, pushing annual gold production to just shy of the 400,000-ounce mark. Notably, this will also increase Wheaton’s exposure to Tier-1 jurisdictions.

As for the Goose Project in Nunavut, while the acquisition of Sabina Gold by B2Gold (BTG) was certainly a positive for the project with a strong operator in place with experience operating mines in arctic climates (Kupol, Julietta), Wheaton lost one-third of its exposure to this asset with B2Gold buying back one-third of the stream, with Wheaton’s gold stream declining to 2.78% (until ~87,100 ounces delivered), 1.44% until 134,000 ounces delivered, and then 1.00% long-term. That said, Wheaton recognized a $5 million gain on partial disposal and a cash payment of $46.0 million for the buyback, and while this will translate to reduced attributable production to Goose, it’s likely that this could be a stronger and slightly larger asset under a better capitalized operator like B2Gold.

Meanwhile, Wheaton announced it would acquire a 6.6% gold stream on Lumina’s (OTCQX:LMGDF) Cangrejos Project in Ecuador until the delivery of 700,000 ounces, with a step down to 4.4% thereafter. This is a solid asset from a scale standpoint that’s even larger than recent gold transactions (Goose, Blackwater), with payable production of ~371,000 ounces of gold per annum, plus 41 million pounds of by-product copper, translating to GEO production of ~470,000 ounces. The initial capex of $925 million is quite reasonable for a project of this size, and Wheaton expects this to be a large contributor as well to future growth, if green-lighted, with the potential for first production as early as Q3 2028, assuming a Q4 2025 construction decision. Given the 26-year mine life with this scale, the $300 million purchase price looks like a steal relative to prices paid for some other assets sector-wide.

Cangrejos Mineralization (Lumina Gold)

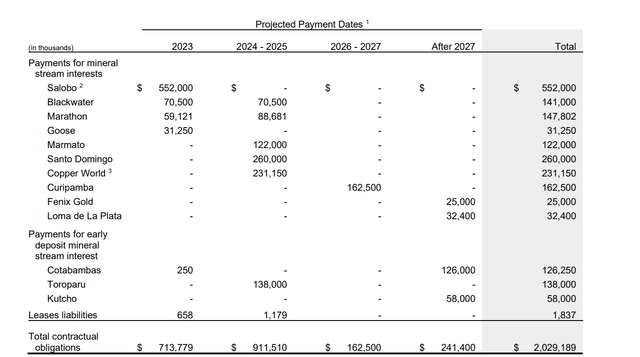

Finally, regarding the environment for deal-making, Wheaton continues to be well cashed-up to continue adding to its growth pipeline, with ~$2.8 billion in liquidity as of quarter-end, including ~$800 million in cash and no debt. Given that it continues to look for opportunities in the $150 million to $350 million range, and with the company noting that it’s seeing “a very healthy number of opportunities” out there, I wouldn’t be shocked to see another deal announced in the next twelve months. And given its strong balance sheet and significant cash flow generation, Wheaton should have no trouble continuing to pursue opportunities and adding two new streaming assets to the portfolio each year if they become available while maintaining balance sheet strength, even with significant commitments to projects not fully paid for yet over the next few years.

Projected Payment Dates – Streams (Company Filings)

Given that Franco-Nevada (FNV), Wheaton, and Royal Gold (RGLD) all have significant available liquidity, I would expect the environment to remain competitive for royalty/streaming companies, with all able to transact on medium and large sized deals that come across the plate. Plus, with higher metals prices vs. last year’s levels, many producers may not be in a position that they need to seek alternative financing and can fund expansions with cash flow and improved cash positions. That said, many gold/silver developers continue to be left for dead from a share-price performance standpoint, meaning that funding construction with equity is a last resort in most cases, and debt is certainly not getting any cheaper. Hence, while it’s competitive out there, this is certainly a tailwind, with many developers likely to be more open to streams/royalties than they might have been in 2020, when they should have been raising more money using equity, but most didn’t take advantage.

Valuation

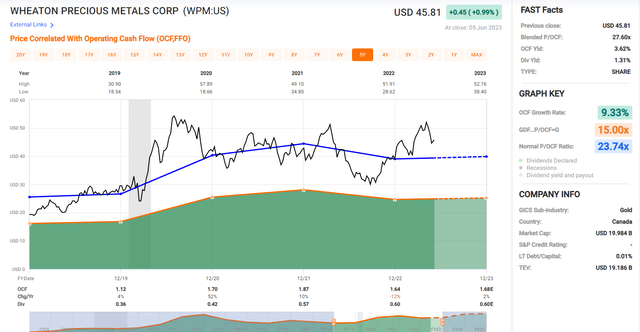

Based on ~455 million fully diluted shares and a share price of US$45.80, Wheaton trades at a market cap of ~$20.8 billion, making it one of the top-5 highest valued names in the precious metals sector. And while the stock deserves a premium valuation for its low-risk business model, peer-leading growth relative to Franco-Nevada, and capital discipline to acquire streams on many of the best assets globally with long mine lives, I don’t see nearly enough margin of safety to justify buying the stock here. This is because it trades at over 1.70x P/NAV vs. an estimated net asset value of ~$12.1 billion, and ~26.6x estimated FY2023 cash flow per share estimates ($1.72) vs. a 5-year average cash flow multiple of ~23.7. And even if we apply a 10% premium to its 5-year average (26.1x cash flow vs. 23.7x), and use FY2024 estimates of $2.05, this translates to a fair value of US$53.50 (18-month price target), representing just 17% upside from current levels.

Wheaton – Historical Cash Flow Multiple (FASTGraphs.com)

For large cap royalty/streaming companies, there’s an argument to be made to be much more lenient and require a lower discount to fair value to justify starting new positions relative to producers and certainly gold/silver developers regarding building in a margin of safety. Still, if we apply a 25% discount to fair value to ensure an adequate margin of safety, this still translates to an ideal buy zone for Wheaton Precious Metals from a valuation standpoint of $40.10, leaving it roughly 10% outside of its ideal buy zone. Hence, while I see WPM as easily a top-10 way to gain exposure to precious metals, I don’t see the stock in a low-risk buy zone, even if it has pulled back sharply with the rest of the sector.

Summary

Wheaton’s headline Q1 results may not have inspired much confidence with double-digit declines in revenue and cash flow, but results will improve materially as the year progresses and the company continues to deploy capital in a disciplined manner to grow its production later this decade. In fact, assuming plans are met with partner’s timelines, the company will grow its GEO output ~40% in the 5-year period ending 2027 on an average output basis vs. the FY2023 guidance mid-point with expected attributable production of 810,000 GEOs. This is above that of Franco-Nevada, and it’s not having to lap high energy prices from 2022 that could weigh on results, making it a more attractive bet in my view than FNV. That said, I don’t see enough margin of safety at current levels for WPM, so while I continue to watch the stock, I see more attractive bets elsewhere currently.

Read the full article here