Investment Thesis

GitLab (NASDAQ:GTLB) rallied more than 30% following impressive 1Q FY2024 results. In my previous initiation, I highlighted GTLB as a hypergrowth stock relies on a strong growth outlook to sustain its upside momentum. The company not only beat revenue and non-GAAP EPS estimates in 1Q but also provided forward guidance that exceeded the upper end of the street estimates. Moreover, the management also expressed enthusiasm about introducing new AI features and expanding language support for its Code Suggestions. While the company is currently unprofitable and trading at a higher-than-average valuation of 8.3x EV/Sales FY2024, I’m encouraged by a solid beat across all key metrics. I believe as long as the management continues to deliver positive surprises in terms of growth and earnings outlook, the stock is likely to maintain its premium valuation. Therefore, I upgraded GTLB stock to buy.

1Q24 Presentation

1Q24 Takeaway

1Q24 Presentation

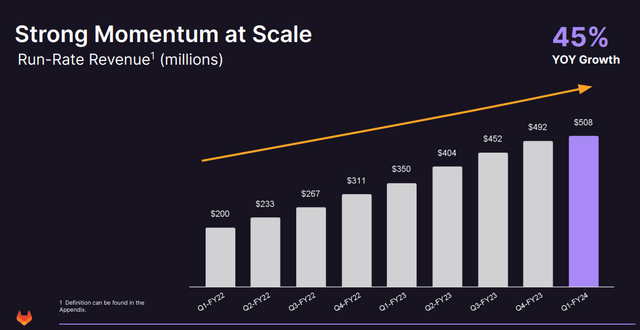

After impressive 1Q results, GTLB raised forward revenue and earnings outlooks that significantly exceeded estimates. The company reported an impressive 45.2% YoY revenue growth in 1Q FY2024, which was 8% above the consensus. The company also reported 128% net retention rate (NRR), indicating a strong customer engagement. While the company failed to achieve earnings breakeven, the non-GAAP EPS was largely above the consensus.

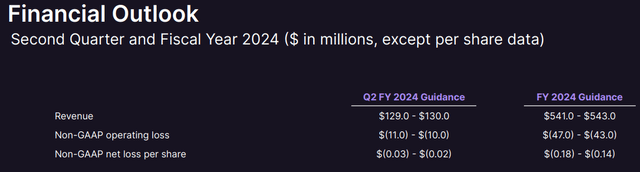

Regarding the financial outlook, the company significantly raises their revenue and non-GAAP EPS forecasts for 2Q FY2024 and FY2024, which implies the management’s confidence about their growth trajectory. According to the guidance, we can calculate non-GAAP operating margin of -8.3% and net profit margin of -4.3% in FY2024, which are significantly higher than the previous -20.5% and -15% in FY2023. Although the revenue growth shows a significant deceleration to 28% in FY2024 compared to 67.5% in FY2023, the massive improvement in margins suggests that the company is prioritizing profitability.

Additionally, GitLab announced a new AI add-on that aims to support development teams through the Code Suggestions functionality. This feature is scheduled to be released later this year and will cost a single user $9 per month. The company plans to make it available to users across all tiers. During the earnings call, the CEO addressed:

“In 1Q, we delivered five new AI features and in the first half of May alone, we delivered five additional features. All of these are available to customers now and we continue to iterate on Code Suggestions. We increased language support from the initial six languages to now 13 languages “.

With the increasing competition in the AI-enabled software development industry, offering such functionality could put GTLB in a bright spot and potentially attract a larger user base. I believe GTLB has a great opportunity to benefit from this growing market trend and accelerate its revenue growth in the near term.

Net Retention Rate

Despite 128% NRR in 1Q FY2024, first time below the 130% threshold, GTLB has still maintained high NRRs over the past quarters. According to Stats For Startups, an NDR exceeding 110% is considered best in class, highlighting GTLB’s strong customer retention. Regarding the lower NRR, the management explained:

“The dollar based net retention of 128% was driven by lower seat expansion and contraction due to seats. The ultimate tier continues to be our fastest growing tier, representing 42% of ARR for the first quarter of FY’24, compared with 39% of ARR in the first quarter of FY’23”

We can see the company’s ARR mix has shifted towards the highest tier, which significantly contributed to its overall revenue growth. I believe the recent fluctuations in lower seat could be attributed to the macro headwinds that mainly impacted small size customers. The management has also indicated that the decrease in total revenue was primarily driven by a reduction in lower seat counts. Therefore, we can expect these fluctuations to improve as we get through the cyclical trough.

Healthy Growth Momentum

1Q24 Presentation

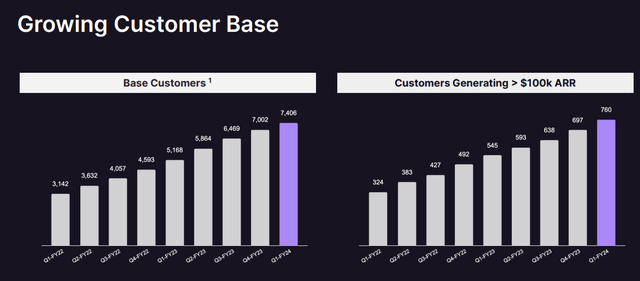

Despite the management’s effort on margins expansion, GTLB has consistently attracted customers and accelerated ARR growth in the high-tier level (>$100k). Although the chart shows a slight slowdown as the base customers only grew 5.8% QoQ in 1Q FY2024, this could be attributed to the growth in ARR from high-tier customers. We can see that >$100k ARR grew 9% QoQ in 1Q FY2024, which was almost in-line with 9.2% QoQ in 4Q FY2023. This implies that as the base customers growth is decelerating, the company is acquiring more high-tier customers, as confirmed by the management.

Valuation

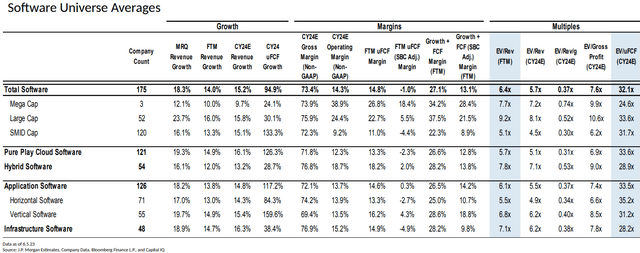

Source: J.P. Morgan Estimates, Company Data, Bloomberg Finance L.P., and Capital IQ

GTLB is currently trading at 8.3x EV/Sales FY2024, which is higher than the average of 5.7x for the software industry. This multiple factored in the management’s revenue outlook for FY2024. However, we should keep in mind that GTLB guided 28% YoY revenue growth in FY2024, beating any category in the table. This emphasizes that GTLB is still a high-growth company and justifies a valuation higher than the industry average.

However, there is a caveat. If GTLB’s growth momentum fails to meet market expectations, the stock will experience a significant sell-off, as we saw in 4Q FY2023. Therefore, we should closely watch whether GTLB can continue to deliver better-than-expected results in terms of both top and bottom-line performance. Given the company’s positive outlook for 2Q FY2024 and FY2024, I believe this can support the stock’s upside momentum, as for now.

Conclusion

In sum, GTLB has achieved impressive earnings results in the 1Q FY2024, beating expectations and raising their forward outlook for both revenue and earnings. Although the stock’s valuation is higher than the sector average, the projected revenue growth of 28% in FY2024 indicates that GTLB is still a high-growth company, deserving a higher valuation. However, there is a downside risk if GTLB fails to meet market expectations and maintain their growth momentum, as we’ve seen in the past. Nevertheless, GTLB’s positive outlook for the upcoming quarter supports the potential for continued growth. Their ability to accelerate ARR from high-tier customers, along with their focus on profitability, is encouraging for investors. Also, the introduction of new AI features can further enhance their growth potential. Therefore, as long as GTLB continues on its current trajectory and exceeds market expectations, it’s likely to sustain its growth and regain investor confidence. Therefore, I upgraded the stock to buy.

Read the full article here