The Biden administration formally launched a new income-driven repayment plan this week, as student loan payments are set to resume later this summer.

Top officials are touting the plan as the most affordable student loan repayment plan ever created. Under the program, many borrowers will have low or even $0 payments.

Here’s the latest.

‘Most Affordable’ Student Loan Payment Plan Ever, Says Biden Administration

On Tuesday, the Education Department launched a broad campaign to get borrowers to enroll in the Saving on a Valuable Education, or SAVE, plan. The Biden administration’s new income-driven repayment program is the “most affordable repayment plan ever,” according to official department statements.

The SAVE plan will have a number of benefits including lower monthly payments, a subsidy that will eliminate interest capitalization and interest accrual that exceeds a borrower’s monthly payment, marital tax filing flexibilities to exclude spousal income, and accelerated student loan forgiveness for borrowers with lower initial balances.

“Borrowers will see their total payments per dollar borrowed fall by 40%,” said the Education Department in a statement released on Tuesday. “Borrowers with the lowest projected lifetime earnings will see payments per dollar borrowed fall by 83%.”

Lower-Income Borrowers Could Have $0 Student Loan Payments

One of the key features of the new SAVE plan is an expanded poverty exemption. Borrowers whose earnings fall within that exemption would have a calculated monthly payment of $0 per month. Even $0 “payments” can count toward student loan forgiveness under IDR plans.

SAVE’s poverty exemption is 225% of the federal poverty limit for the borrower’s family size — significantly higher than the 100% to 150% under prior income-driven repayment plan options. That means that under SAVE, borrowers can earn more income, but still have low or $0 payments.

According to an Education Department statement released last month, SAVE “will cut monthly payments to $0 for millions of borrowers making $32,800 or less individually,” or $67,500 for a borrower with a family size of four.

“More than 1 million additional low-income borrowers will qualify for a $0 payment,” said the department on Tuesday.

Application For New Student Loan Payment Plan Is Live

After several weeks of beta testing, the application for the new SAVE plan is available, and borrowers can start enrolling this week.

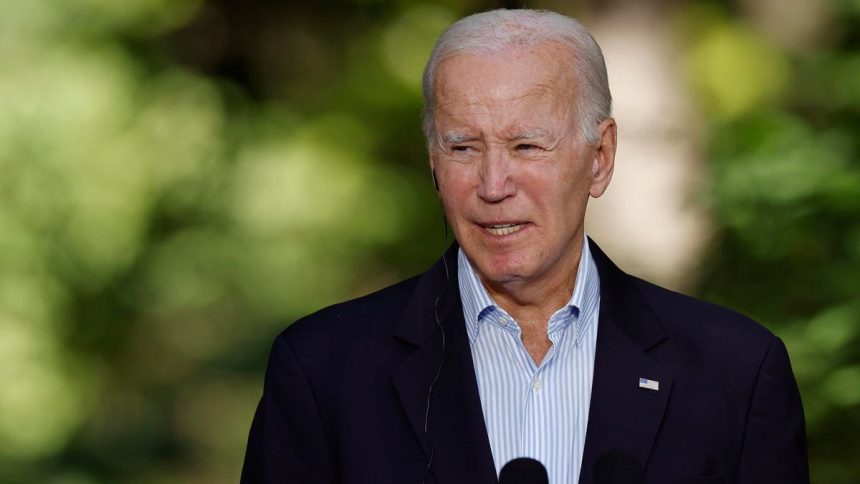

“Visit StudentAid.gov/SAVE and submit an application,” said President Biden in recorded remarks on Tuesday. “Takes about 10 minutes to fill it out. And if you’re eligible for the SAVE Plan, sign up now so you can lower your monthly payments in advance of payments resuming this fall.” Borrowers who are already on the REPAYE plan will be automatically transferred to the SAVE plan.

The Biden administration is also launching an outreach campaign, and will be coordinating with a number of nonprofit advocacy groups to encourage borrowers to enroll in SAVE in the coming weeks.

Further Student Loan Forgiveness Reading

Mass Student Loan Forgiveness Emails Sent As Challengers Appeal To Block Debt Relief

Student Loan Forgiveness Just Got Easier For These Borrowers

Student Loan Forgiveness Update: What The Latest Court Victory Means For Borrowers

Critical Student Loan Repayment And Forgiveness Deadlines Loom In August — And Beyond

Read the full article here