Junk fees on financial accounts hurt people living paycheck to paycheck the most. Full stop.

Surprise bills often rack up the most onerous fees. Unplanned expenses cost the average American family living paycheck to paycheck nearly $2,000 a year, according to findings from the Cash Poor report by SoLo, a Black-owned fintech firm.

Of those surveyed, auto repair bills were the main offender, accounting for 29% of unplanned expenses over the past 12 months. All told, junk fees paid by cash-poor families total more than $25 billion.

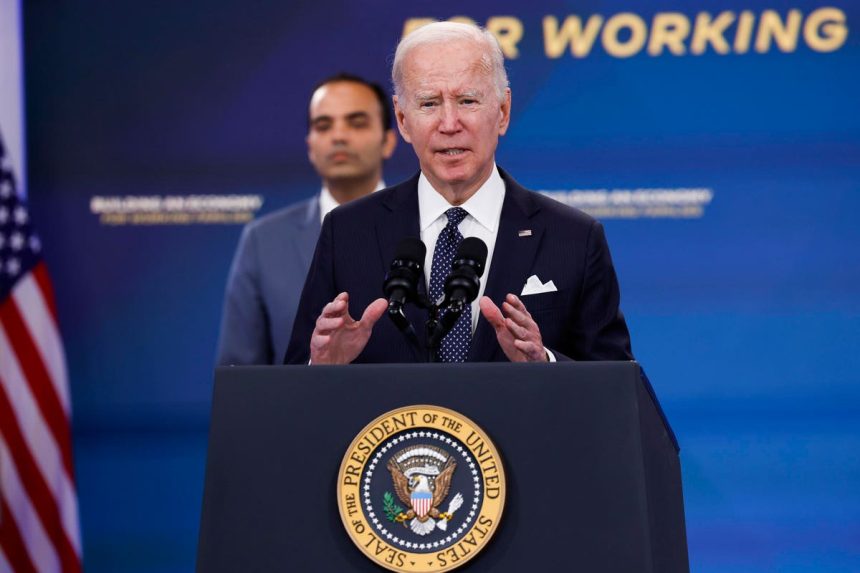

There’s a surprising range of junk fees that nickel and dime unsuspecting consumers. They could be levied by banks on overdrafts or even deposits. The Consumer Financial Protection Board (CFPB) found that high fees were being charged on financial products endorsed by colleges and sold to students. The ongoing plague of junk fees also attracted the attention of President Biden, who last year teamed up with the CFPB and began a White House campaign to curtail them.

“These so called junk fees are not just an irritant – they can weaken market competition, raise costs for consumers and businesses, and hit the most vulnerable Americans the hardest,” according to a White House statement.

People who have poor credit ratings often pay the highest finance charges. “Subprime credit cards are by far the worst for borrowers regarding additional fees, which are intended for those with lower income and poor credit ratings,” according to SoLo.

“Looking at the data,” SoLo found, “these credit cards account for an additional $11.5 billion in fees. That breaks down to an annual $770 per year for Americans living paycheck to paycheck. Fees include annual percentage rate, subscription, late fees, fast payment processing fee, annual subscription, application fee, monthly maintenance, new cards fee, and ATM fees. “Behind subprime credit cards, payday loans are the second most costly option, totaling approximately $6 billion in additional fees.”

“Fintech solutions, such as earned wage access and peer-to-peer lending, offer the best and cheapest solution, amounting to $1.3 in annual fees.”

How do you avoid junk fees? Here are some tips:

- Only use credit or that you can pay back in full. If you pay within the bank’s monthly grace period, you avoid finance charges and late fees.

- Know all the fees; the annual percentage rate is not the only charge you’ll pay. Read the fine print on your statements.

- Credit and loans are a crutch and not an extension of income. Create an emergency savings account to avoid borrowing.

- Building credit takes time and utilization. Be patient. Consider a budget and stick to it.

Read the full article here