529 plans have become the most popular college savings option for American families for good reason. The plans offer tax-deferred growth with tax-free withdrawals for qualifying education expenses, low-cost and diversified investment options, preferential financial aid treatment, and potential state tax benefits such as credits, deductions, and matching grants. These benefits didn’t happen all at once. 529 plans have been enhanced many times over the years via bipartisan legislative initiatives, which show no signs of slowing.

A recent report from AKF Consulting Group (AKF) highlighted the expansion of qualified expenses beyond traditional higher education, the introduction of prepaid cards for easier access to funds, and the growing presence of Exchange Traded Funds (ETFs) in investment lineups reducing average costs for participants. But what do these recent changes really mean for participants?

Not Just College Savings: Education Savings

529 plans were originally just tax-deferred savings plans for higher education. Multiple rounds of federal legislative enhancements from both Democrats and Republicans have heavily augmented the plans. For example:

- The 2017 Tax Cuts & Jobs Act allowed 529 plan savings to be used towards K-12 tuition up to $10,000. It also added the option to transfer 529 funds directly to ABLE accounts, which are tax-advantaged savings accounts for individuals with disabilities and their families.

- The 2019 SECURE Act allowed 529 funds to be used for apprenticeship programs. It also allowed families to use 529 funds to pay off some student loan debt; up to a $10,000 lifetime maximum per individual.

- The 2021 Consolidate Appropriations Act simplified the FAFSA and changed withdrawals from grandparent owned 529 plans to counting as student income – which would have a negative impact on financial aid eligibility – to be treated at the preferential rate of parental or student withdrawals.

- The 2022 SECURE Act 2.0 allowed, among other enhancement, the ability to roll unused 529 funds into a Roth account for the beneficiary, subject to qualification and certain limitations.

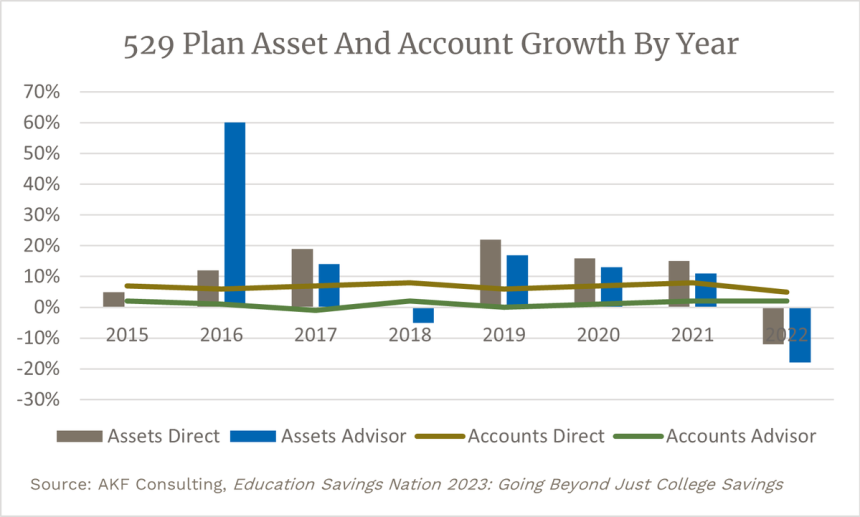

For these reasons – and many more enhancements over the preceding two decades – 529 plans have grown dramatically as more Americans have learned about and recognized their benefits. Even as assets in the plans decreased due to market declines in 2018 and 2022, account opening increased in direct- and advisor-sold plans.

Prepaid Cards: Making 529 Fund Access Easier

For decades you would need to request a distribution to access funds inside your 529 plan. To streamline payment, 529 plans have begun to introduce the option of “prepaid” cards (not to be confused with prepaid 529 plans, which are not related). Mississippi and Utah added the option earlier in 2023, and more plans are expected to follow suit.

“Now, whether you’re purchasing books, study materials, education-related technology, or your college’s meal plan, (Mississippi 529 plan) funds can be used with a simple swipe of the card,” said State Treasurer David McRae earlier this year. The card is accepted anywhere a Mastercard

MA

“Frankly, the initiative is long overdue in the 529 space, particularly when ABLE Plans made it work years ago.” said Managing Director of AKF Andrea Feirstein. “Personally, I believe more states will launch cards to remain competitive with the plans that are pushing the frontier forward today.”

Utah also introduced the “my529 Access Card,” which is accepted wherever Discover is taken. The card also has merchant restrictions, but in a good way! If someone – say, an overzealous college teenager – tried to use the card for alcohol, gambling, or adult entertainment it would be declined. Expect to see more state 529 plans to offer similar payment methods in the future.

Increased Use Of ETFs Reduces Expenses For 529 Participants

According to the report from AKF, ETFs have become more popular in investment lineups, particularly in Advisor Plans, where they are included in over 50% of offerings, now. ETFs are increasingly favored for their lower fees compared to most actively-managed open-end funds, and provide easy access to diversified asset classes.

More Improvements Coming

AKF Consulting highlighted extensive outstanding legislative initiatives that would further enhance 529 plan benefits:

- American Workforce Empowerment Act (H.R. 329) – Expands qualified institutions to include training certificate and registered apprenticeship programs

- Student Empowerment Act (S. 57) – Expands qualified expenses to allow homeschooling, education therapy for those with disabilities, and exams related to college admission

- Children Have Opportunities in Classrooms Everywhere Act (S. 105 / H.R. 463) – Expands qualified expenses to cover more expenditures, home school expenses, and would allow states to allocate grant funds for certain low-income families

- Freedom to Invest in Tomorrow’s Workforce Act (S.722 / H.R. 1477) – Expands qualified institutions to include postsecondary credential programs

- Aviation Workforce Development Act (H.R. 1818) – Expands qualified institutions to include aviation maintenance and commercial pilot courses

While most proposed bills will not into law, much of their content is appropriated in larger bills later in the year. At least some of the aforementioned enhancements are likely to be implemented at some point, as 529 plans have only ever gotten better with time, making them increasingly desirable for American families with pre-college aged children.

“Technical training, expanded apprenticeships and professional certifications will help young people begin and advance careers. Making these qualified expenses is consistent with the increasing use of 529 over the past few years,” said Feirstein. “So important, particularly as we see the cost of higher education increasing year-over-year with less certain professional outcomes.”

Read the full article here