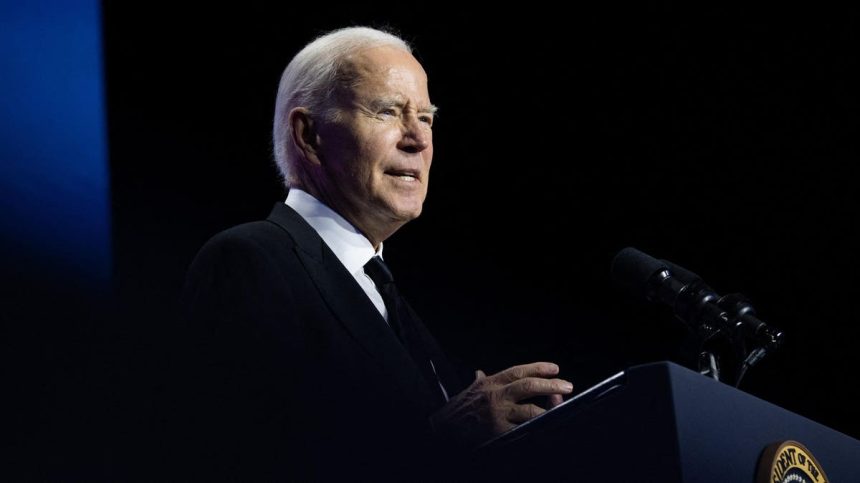

The Biden administration is implementing a number of student loan forgiveness initiatives on several fronts. These programs are separate from the mass student debt relief plan that the Supreme Court struck down over the summer.

But even as the Education Department moves forward with these loan forgiveness programs, political and legal threats loom on the horizon. Here’s the latest.

Biden Administration Has Approved Billions In ‘Targeted’ Student Loan Forgiveness

Under President Biden, the Education Department has “already approved more than $117 billion in targeted relief,” according to data released in a statement earlier this month. More than 3.4 million borrowers have received student loan forgiveness under these initiatives. This includes:

This student debt relief, while sweeping, falls short of the $400 billion in loan forgiveness that was expected to be approved under Biden’s mass student debt cancellation plan that the Supreme Court blocked in June. However, millions of borrowers continue to benefit from these separate initiatives, and relief is ongoing. And the Biden administration is moving forward to establish a replacement student loan forgiveness plan, although it may be months before the details of that new program become clear.

Meanwhile, the Biden administration has launched the SAVE plan, a new income-driven repayment plan that officials are saying is the most affordable repayment option ever for student loan borrowers. SAVE will result in $0 payments for a million borrowers, and may accelerate student loan forgiveness for undergraduate borrowers with relatively low initial balances starting next summer.

Political And Legal Hurdles To Continued Student Loan Forgiveness

But the Biden administration’s efforts to implement these student loan forgiveness initiatives continue to face political and legal headwinds.

A legal challenge brought by conservative-learning groups to block the IDR Account Adjustment was rejected by a federal judge in Michigan in August. However, the challengers indicated that they would appeal to the Sixth Circuit Court of Appeals. Briefing for that appeal is due next month.

At the same time, the federal government appears to be heading toward a shutdown, as a relatively small group of far-right Republicans demand deep spending cuts in exchange for keeping the government open. If Congress is unable to pass a federal spending bill because of the impasse and the government shuts down, student loan borrowers may be impacted. Non-essential work at the Education Department could be halted, jeopardizing and delaying progress in implementing Biden’s targeted student loan forgiveness programs.

Meanwhile, congressional Republicans launched an effort earlier this month to repeal the SAVE plan. The effort is likely to ultimately fail due to Biden’s anticipated veto, but suggests that the administration’s student debt relief initiatives will continue to face challenges.

Further Student Loan Forgiveness Reading

Timeline For Biden’s New Student Loan Forgiveness Plan Gets Clearer

Critical Day For Student Loan Borrowers Is Here — 4 Key Details

Biden Administration Announces $72 Million In Student Loan Forgiveness

There’s Still Time To Qualify For Student Loan Forgiveness Under Adjustment

Read the full article here