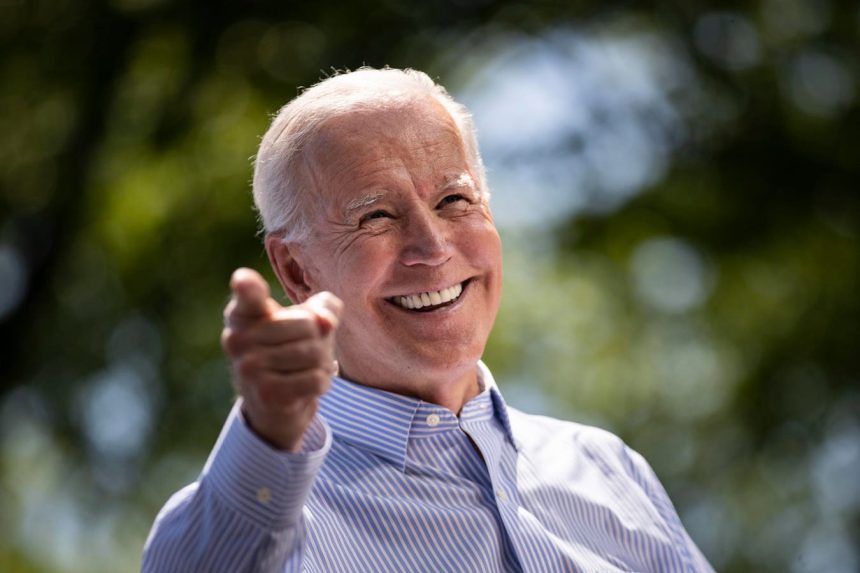

It’s one year away from the next Presidential election and the Biden administration has taken an extraordinary step. From the outside it seems like too much of a coincidence and rather worrying.

The broke Monday that the administration would invoke the Defense Production Act, which got created during the Korean War, according to a recent report from the UK-based Guardian newspaper.

The same laws were invoked during the U.S. government mandated lockdowns starting in 2023. Then that was due to the need for more ventilators and other medical equipment which were in great demand and short supply at the same time. It was like war time, but the enemy was a virus and the government shutdown caused a problem that required extreme measures.

The idea this time though is quite different. This time there is no war. There is no lockdown or other crisis.

Nevertheless the administration wants to inject the government into the production cycle. It’s a small step, but likely in the wrong direction.

What is clear is the administration has a problem with the surging cost of living and the slowing economy. Together those two items are making life hard for many Americans. And that’s something Biden will know isn’t going to please U.S. voters who tend to vote with their pocketbook rather than based on ideology.

Inflation for October read 3.2%, down from 7.1% last November, according to data collated by TradingEconomics. That is progress but ti is still significantly above the Federal Reserve’s 2% target rate. And in addition, just because the inflation rate has fallen doesn’t mean prices have. They are significantly higher than they were two years ago.

Meanwhile the unemployment rate has surged to 3.9% in October from 3.4% in January, again according to TradingEconomics which collates the data. Meanwhile job creation has dropped below population grow to less than 200,000 a month in October. If job creation stays that low then the unemployment rate will likely continue to rise.

So what is going on? Biden knows that much of the American population is hurting financially and that will make it harder for him to win election next November.

Already former president Donald Trump is ahead of Biden by as much as six percentage points, according to recent polls collated by the FiveThirtyEight website. The gap is larger if Kamala Harris was Trump’s foe, leaving the latter with an 11 point lead, the website shows.

Either gap will be hard to close but doing something to lower inflation may be enough to keep the voters happier.

However, the question we might want to ask is simple: Is it right that the government should invoke a law usually reserved for war time when such an event isn’t going on? Shouldn’t the use of such a law be reserved for truly extraordinary crises such as war or a a pandemic?

In this case the optics seem poor.

The worse part of the story is that too much government interference in the economy is a step towards Soviet Era central planning. And as anyone who studied what happened to the USSR under Stalin will know the results will almost certainly be bad if more of the same come s along.

Read the full article here