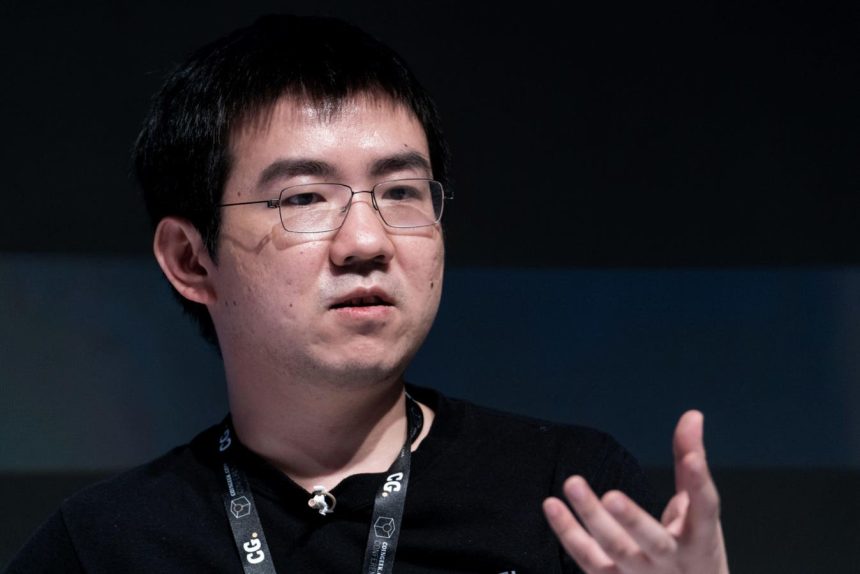

Bitdeer Technologies Group, the Singapore-based crypto mining platform controlled by mogul Jihan Wu, saw its shares surge 122% over the past month as the company announced a share buyback amid traditional financial firms’ renewed interest in digital assets.

Bitdeer said on June 16 that it would repurchase up to $1 million worth of its Nasdaq-listed stock. The move comes as the crypto market received a boost from Wall Street heavyweights once again betting on the highly-volatile industry that is reeling from a string of company fallouts and regulatory pressure. “Even if 95% of today’s coins lose all their value and disappear, the remaining 5% will grow massively,” Wu, founder and chairman of Bitdeer, told Forbes back in 2021.

A day before Bitdeer’s share buyback announcement, BlackRock, world’s largest asset manager, filed to the U.S. Securities and Exchange Commission for a bitcoin exchange-traded fund that would allow easy access for investors to get exposure to the cryptocurrency. BlackRock’s application was followed by the official launch of a new institutional-only crypto exchange, called EDX Markets, backed by the likes of Citadel Securities, Fidelity Investments and Charles Schwab.

The news brought bitcoin, the largest cryptocurrency by market cap, to its highest level in a year to more than $31,000, though that’s still much lower than its all-time peak of nearly $69,000 in November 2021. As of Friday’s market close, Bitdeer’s market cap reached almost $1.3 billion.

Bitdeer started trading on the Nasdaq stock exchange in April after a long-delayed merger with a special purpose acquisition company finally closed. The deal valued Bitdeer at $1.18 billion, down from $4 billion when the crypto miner first made the announcement during the crypto craze in November 2021.

Bitdeer is one of the biggest crypto miners by computer power. It is a spinoff from Bitmain Technologies, the Chinese bitcoin mining-chip manufacturing giant cofounded by Wu a decade ago. Bitdeer operates five mining data centers in the U.S. and Norway, with another one under construction in Bhutan. Last month, the company teamed up with the Bhutan government to launch a fund of up to $500 million for green crypto mining operations in the Himalayan kingdom.

To be sure, though bitcoin and other cryptocurrencies are rebounding, the energy-intensive crypto mining industry continues to face challenges from high electricity prices. Texas-based bitcoin miner Core Scientific filed for bankruptcy in December, less than a year after it debuted on Nasdaq through a merger with a blank-check company backed by BlackRock.

In the first quarter, Bitdeer saw its revenue drop 19.7% year-on-year to $72.6 million. Its net loss remained at around $9.5 million during the same period, the crypto mining platform said.

MORE FROM FORBES

Read the full article here