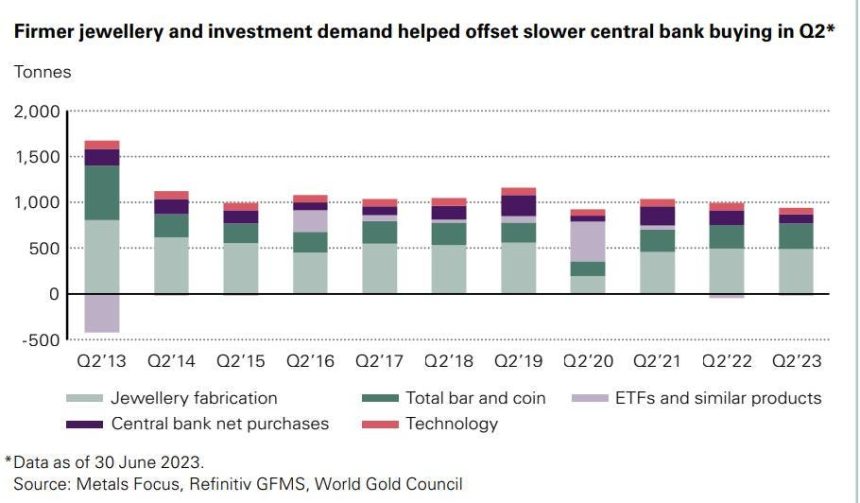

Weaker central bank purchasing caused gold demand to slip by low-single-digit percentages during quarter two, according to the World Gold Council (WGC).

Excluding over-the-counter trading, total gold demand slipped 2% year on year between April and June, to 921 tonnes. This contributed to a 6% year on year reversal in first half demand, to 2,062 tonnes.

However, the WGC said that the first-half drop “was largely explained by this year’s modest outflows from gold [exchange-traded funds, or ETFs] being compared with the strong surge of inflows in early 2022.”

Including over-the-counter trading and stock flows, second-quarter demand for the yellow metal rose 7% from the first, to 1,255 tonnes. For the six months to June demand ticked 5% higher to 2,460 tonnes.

Central Bank Buying Cools

Central banks purchased just 103 tonnes of the precious metal in quarter two. This was down from 284 tonnes in the previous three-month period, and lower than the 159 tonnes that were bought in the second quarter of last year.

The sharp decline was driven in part by actions from the Central Bank of Turkey. The bank flipped from being a prominent buyer in quarter one to a big seller in the following quarter as it sold bullion into the local market following a ban of gold imports into the country. It sold 132 tonnes of the shiny commodity in quarter two.

Yet despite the second-quarter slowdown, central bank buying reached record levels in the first half of 2023 thanks to strong purchasing between January and March. The WGC said that “buying activity remains widespread and distributed among both emerging and developed countries.”

Jewellery Demand Rises, Investment Falls

Stronger jewellery demand helped offset falling central bank purchases in the last quarter, the WGC noted. Despite the high gold price — it rose to around $2,050 per ounce in April and May, within a whisker of new all-time peaks — demand for the metal increased 3% year on year to 476 tonnes.

Demand from China rocketed 28% over the period as the country emerged from Covid-19 lockdowns. But jewellery sales were brought down by cooler appetite in India, where demand dropped 18%.

Worldwide bar and coin investment advanced 6% year on year in quarter two, to 278 tonnes. The WGC said that “bar and coin demand was driven by very sizable jumps in a handful of markets — notably Turkey and the Middle East — and was mostly due to market-specific factors.”

However, global ETFs endured outflows north of 21 tonnes in the second quarter. This in turn reduced total investment demand (excluding OTC dealing) to 256 tonnes for the three months, though this was still 20% higher year on year.

OTC meanwhile investment leapt 44% in quarter two, to 335 tonnes. The organisation noted that “although opaque, demand from this sector of the market was apparent as the gold price found firm support even in the face of ETF outflows and a reduction in COMEX net longs.”

Read the full article here