Insights into the Investment Moves of “The Oracle of Omaha”

Warren Buffett (Trades, Portfolio), the legendary investor known as “The Oracle of Omaha,” has made his latest investment moves public through the 13F report for the third quarter of 2023. As the Chairman of the colossal Berkshire Hathaway

BRK.B

New Additions to the Portfolio

Buffett’s Berkshire Hathaway has welcomed three new companies into its fold this quarter:

- Liberty Live Group (LLYVA, Financial) takes the lead with 5,051,918 shares, representing 0.05% of the portfolio and a total value of $161.26 million.

- Sirius XM Holdings Inc (SIRI, Financial) follows with 9,683,224 shares, accounting for 0.01% of the portfolio and a total value of $43.77 million.

- Atlanta Braves Holdings Inc (BATRK, Financial) rounds out the new additions with 223,645 shares, valued at $7.99 million.

Significant Position Increases

The Berkshire portfolio has also seen a substantial increase in certain holdings:

- Liberty Live Group (LLYVK, Financial) experienced a remarkable 3,268.19% increase in share count, with an additional 10,802,069 shares bringing the total to 11,132,590 shares. This adjustment has a 0.11% impact on the current portfolio, with a total value of $357.36 million.

Complete Exits from Holdings

Buffett has decided to part ways with several companies in the third quarter:

- Activision Blizzard Inc (ATVI, Financial) saw the sale of all 14,658,121 shares, impacting the portfolio by -0.35%.

- General Motors

GM

Key Position Reductions

Not all relationships can last forever, as seen in the reduced positions within the portfolio:

- Chevron

CVX

CVX

- HP

HPQ

Portfolio Overview

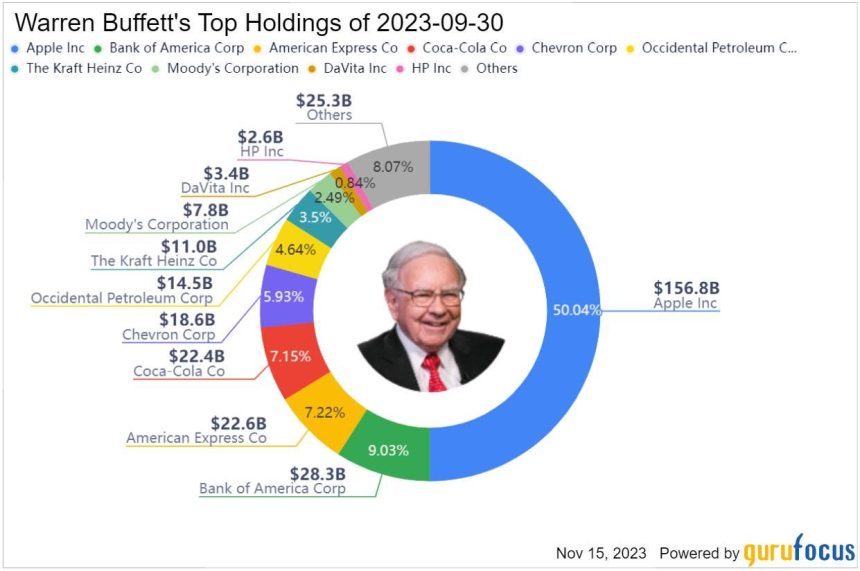

As of the third quarter of 2023, Warren Buffett (Trades, Portfolio)’s portfolio is composed of 45 stocks, with significant positions in several key industries. The top holdings include 50.04% in Apple

AAPL

BAC

AXP

KO

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Read the full article here