Prospective homebuyers in certain markets may finally catch a break in 2026, according to Realtor.com’s latest forecast.

Jake Krimmel, senior economist at Realtor.com, told Fox News Digital that homes in Raleigh, Denver, Phoenix, Northern California and the Pacific Northwest will see prices decline in 2026.

THE TOP 3 REASONS HOUSING HAS BECOME SO UNAFFORDABLE IN THE US MARKET

“We forecast outright price declines in much of Florida,” Krimmel added, noting that Miami is the exception and is projected to see an increase.

The forecast also suggests that affordability will improve in several markets even if home prices edge higher. Falling mortgage rates are expected to reduce monthly payments enough to offset modest price gains.

THE PRICE OF BUILDING A HOME KEEPS CLIMBING AND UNCERTAINTY ISN’T HELPING

“Lower interest rates mean lower monthly payments. Even metro areas where we expect to see modest price appreciation will be more affordable in 2026 than in 2025,” Krimmel said.

If rates fall to the 6.3% range as projected, a 1% to 2% increase in home prices would still leave buyers paying less each month than they would in 2025.

That dynamic is expected to play out in markets such as Austin, Dallas, Nashville, Charlotte and Miami.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

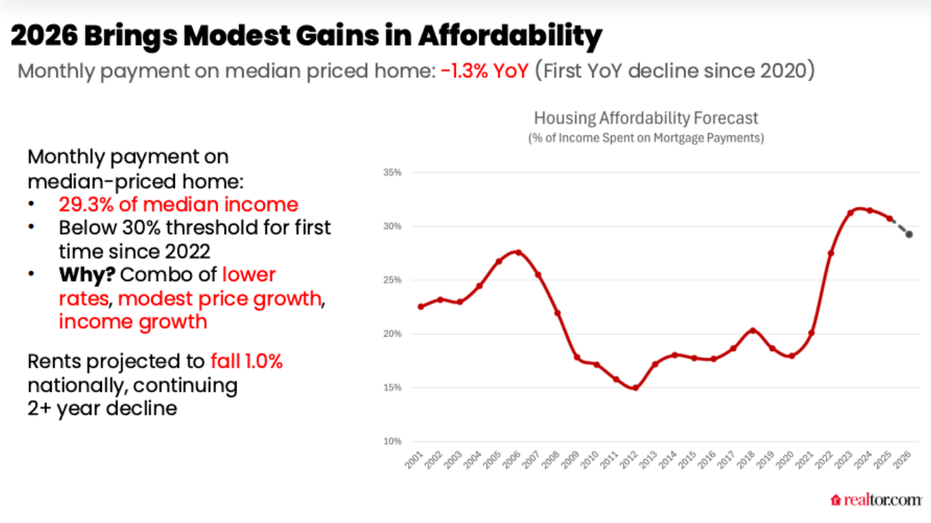

The Realtor.com forecast also predicts that easing mortgage rates and slower home-price growth are expected to nudge affordability in a slightly better direction in 2026.

Krimmel says the monthly payment on a median-priced home will edge down by 1.3% next year, marking the first annual decline since 2020.

“We are hardly out of the woods on affordability, but are at least moving in the right direction,” he said.

Read the full article here