Business updates

The past quarter proved challenging for 1-800-FLOWERS.COM, Inc. (NASDAQ:FLWS) with a drop in total revenue by 11.1% to $417.6 million. Despite this, the gross profit margin rose to 33.6%, credited to the Consumer Floral and Gifts and BloomNet® segments. Operating expenses, with a $64.6 million non-cash impairment charge, increased by $44.7 million. Excluding this charge, expenses actually fell by 11.0%. Profitability improved, with an adjusted net loss of $17.8 million.

Examining the segment performance, Gourmet Foods and Gift Baskets saw an 11.7% revenue decrease, while the gross profit margin dropped to 24.6%. Despite revenues in the Consumer Floral and Gifts segment falling by 11.8%, gross profit margin increased to 37.9%. BloomNet, the most resilient segment, experienced a 3.8% sales dip but increased its gross profit margin to 42.5%.

Overall, the company’s financial outcomes weren’t as unfavorable as anticipated. The administration’s emphasis on enhancing operating efficiencies has indeed bolstered profit margins, particularly within the Consumer Floral and Gifts and BloomNet sectors.

Expansion/diversification through the M&A offers wider market opportunities

Apart from enhancing internal efficiency and inventory management, FLWS maintains its dedication to fostering long-term growth, as demonstrated by the recent acquisitions of Things Remembered and SmartGift. These recent additions extend FLWS’s offerings into non-perishable gift categories such as personalized goods. Today, FLWS has evolved beyond a solely floral business into a comprehensive gifting enterprise encompassing gourmet food, cookies, snacks, chocolates, steaks, seafood, popcorn, and more. A visit to the FLWS website reveals a plethora of related brand logos (below).

FLWS Brands (FLWS website)

The multi-brand strategy certainly provides broader market opportunities. The traditional floral business, which typically grows organically at or slightly above GDP growth rates, appears to be falling out of favor as a gifting option. Brands like Harry & David and Personalization Mall are long-established businesses with a loyal customer base that were formerly operating on outdated retail technology stacks. FLWS can now penetrate the larger gifting market by employing its e-commerce and supply chain technology to expand these acquired businesses. While all the acquired brands operate independently, FLWS can also utilize its marketing capabilities and promotional programs, such as the Passport membership, to enhance cross-selling. This is particularly beneficial considering FLWS’s extensive experience and valuable customer data obtained from its complex floral business, which I believe is challenging to replicate.

FLWS may face more competitive pressure than before

While owning a diverse portfolio of brands, managing FLWS’s operations has become neither simpler nor easier. Many of the brands acquired were struggling to grow prior to acquisition. Notably, the Gourmet Foods and Gift Baskets segment faces lower gross margins and increased competition. The customer base for these brands is typically older and very loyal, yet it remains uncertain whether these brands can appeal to younger generations, who often favor emerging platforms like Etsy (ETSY), Amazon (AMZN), Shutterfly, and social media channels such as Instagram, Facebook (META), and YouTube (GOOG) (GOOGL). These platforms also provide a stage for smaller competitors to challenge FLWS. While FLWS has its own channels, they pale in comparison to e-commerce giants like Amazon, presenting growth challenges for FLWS. The company’s Passport membership program offers value to customers interested in shopping across various brands. However, the momentum of this program, which accounts for only 20% of total revenue, remains uncertain. Overall, it seems that FLWS management is navigating unfamiliar terrain with some gift categories. If these non-floral acquisitions merely serve to enhance and amplify their floral business, then this strategy seems sound. However, it appears that FLWS intends to fully engage in these competitive segments, which to me, seems like a potential distraction. There is higher potential but more difficult to do.

Responsible and aligned management is a plus

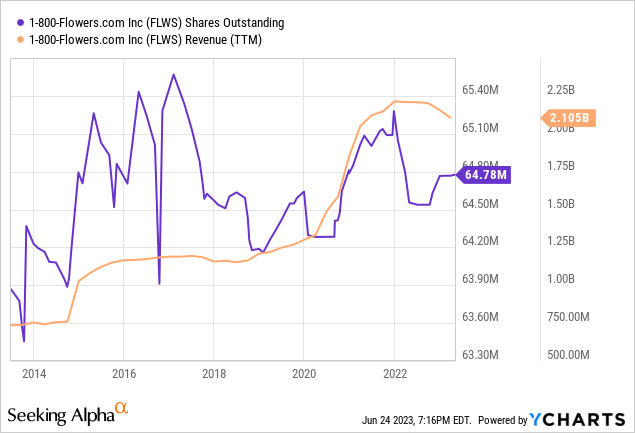

A notable strength of FLWS is its experienced management team rooted in its family business heritage. CEO Chris McCann is a second-generation leader, succeeding his father, Jim McCann. The majority of the board and management have shown long-term commitment to the company, highlighted by a remarkably low turnover rate. This loyalty often signifies a well-functioning organization. Given the significant insider ownership rate of 48%, it’s unlikely that management will misuse investment capital or resort to share dilution. As illustrated in the following chart, while FLWS has maintained a steady share count at 64M, its revenue has doubled from under 1B to over 2B+. Furthermore, its current level of debt doesn’t pose a bankruptcy risk, adding to its financial stability.

Bottom Line

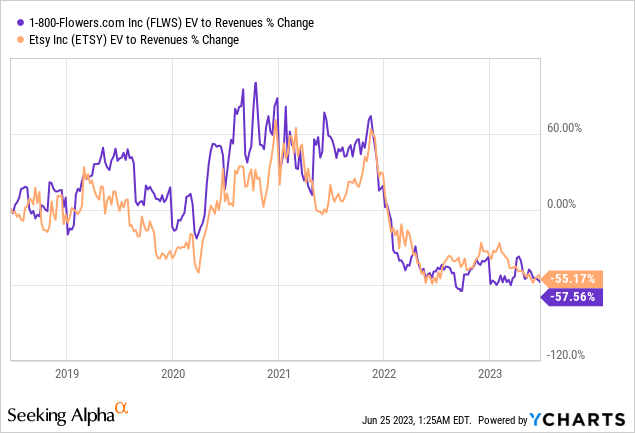

During their recent conference call, the company acknowledged the ongoing hurdles in the consumer environment. Nonetheless, efforts to manage expenses appear to be enhancing profitability. The management has revised its full-year outlook, projecting an approximate 8% YOY decline, with adjusted EBITDA estimated between $85M and $90M. They expect the free cash flow to exceed $75M. Given that FLWS has only missed its financial targets in three quarters since 2018, these forecasts seem achievable. A free cash flow of $75M also implies an EV/free cash flow multiple of less than 10x. Moreover, the current EV/sales ratio stands at a mere 0.34. All in all, the stock appears undervalued and seems to warrant a higher multiple. It’s worth noting that FLWS’s multiples often align with Etsy’s (shown below), which could serve as a useful benchmark.

Read the full article here