In my opinion, chess and investing have a great deal in common. Although I no longer play in active tournaments, I was officially a USCF expert in chess when I did play. Based on my online rating, I play closer to master level these days. One thing that I found to be incredibly valuable when it comes to improvement is to analyze the games that I play in order to find mistakes and to find what I am doing right. Reinforcement is invaluable for those looking to improve. When it comes to investing, I believe that the same mindset applies. That is why, starting with data from 2022 to early 2023, I began looking at the performance of the companies that I rated a “strong buy” to see how well I am doing against the broader market.

Some of these stocks I have purchased and still own today. Others, however, despite being incredibly bullish on them, I have never purchased them. This is because I run a very concentrated portfolio that almost never exceeds 10 holdings. Ideally, I would like that number to be even lower. But I do struggle when I see attractive prospects. So, to appropriately evaluate my own calls, I decided to rely on a hypothetical scenario whereby, from the time I rated a company a “strong buy” until the time it was downgraded, I assumed that a $1,000 investment in that firm had been made. Following that approach has so far proven to be incredibly eye-opening.

In addition to serving as a barometer of my ability to pick out high-conviction prospects, this approach also allows me to keep track of high quality firms that might be temporarily underperforming the market that could go on to generate even more robust upside. As an example, if I rate a company a ‘strong buy’ and that firm goes on to significantly underperform the market in the near term, that could make it even more attractive for those focused on the long term. Of course, I could also just be wrong about that particular holding. But absent a downgrade, you should interpret my decision to keep the company rated a “strong buy” as a sign that the bullish case still makes sense.

A solid year

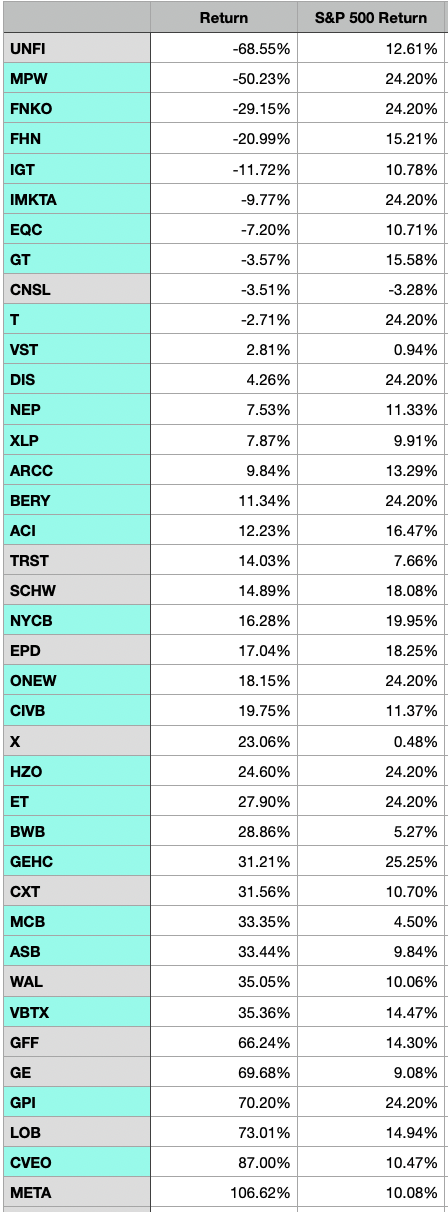

2022 and 2023 were very interesting years for the market. Inclusive of dividends, the S&P 500 dropped 18.4% in 2022. It then shot up to the tune of 24.2% in 2023. As a value investor, it should come as no surprise that, after a difficult year, I would find a larger number of attractive prospects to consider. But even keeping this in mind, when I did the final tally at the end of 2023, even I was shocked by how many “strong buy” candidates I discovered. During the year, 39 different companies ended up being rated a “strong buy.” That’s up 39.3% over the 28 companies that received the same rating in 2022.

Author

*Blue cells denote holdings that are still classified as “strong buy” prospects.

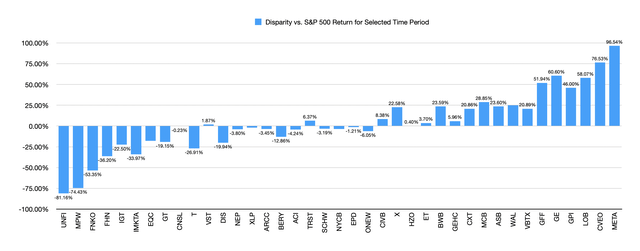

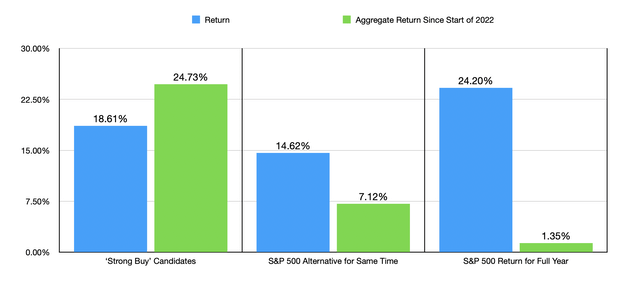

In some respects, 2023 was a really good year for me. And in other respects, there were some things that didn’t turn out quite right. For starters, only 19 of the 39 companies, or 48.7%, that I rated a “strong buy” outperformed the S&P 500 (SP500). Keep in mind that I am not talking about the S&P 500 for the year in its entirety. I am counting from the latter of the start of 2023 and when a particular security was rated a “strong buy” until the earlier of the time that stock was downgraded or the end of 2023. Regardless, this in and of itself is thoroughly disappointing. Even though my hit rate was far lower than 2022 when 20 of the 28 companies, or 71.4%, outperformed the S&P 500, following my approach would have yielded upside of 18.61% compared to the 14.62% seen by allocating that capital at the same time into the S&P 500.

It’s important to keep in mind that investing should be a long-term initiative, not a short-term one. The emphasis should be on finding quality companies that outperform year after year. That is why we also should take into consideration performance for 2022. Using the same approach for the 28 stocks that I picked out last year, some of which continued to be held in two and through 2023, upside would have been 5.16% compared to the 6.54% decline had those same investments been made in the S&P 500.

Spread over two years, buying the “strong buy” candidates that I pointed out would have yielded upside of 24.73% compared to the 7.12% seen by allocating that same capital to the S&P 500. Alternatively, putting all of that capital into the S&P 500 at the start of 2022 and holding it through the end of last year would have yielded upside of only 1.35%. I would also like to point out that if you were to remove the five worst performers from the group and the five best performers from the group for 2023, my approach would have been up 17.24% for last year compared to 14.29% using the S&P 500 as an alternative.

Author

So far, this strategy seems to be paying off rather nicely. I fully anticipate that there will eventually be a down year for me. But so far, so good. When it comes to the picture moving forward, I would make the case that while some of the companies that appreciated significantly could still offer robust upside, investors might be best off looking at some of the companies that have been hit the hardest. Four of the five companies that I had rated a “strong buy” that were at the bottom of the list in terms of performance are our companies that remain a “strong buy” as of this writing. The two worst of these are companies that I actually own shares of, Medical Properties Trust, Inc. (MPW) and Funko, Inc. (FNKO), with shares down 50.2% and 29.2%, respectively. I’ve written about both of these companies not too long ago here and here. And while I acknowledge that their potential might not be as great as it was when I initially became bullish on them, I do still think they have tremendous upside from where they are trading today.

Author

The other two are companies that I do not own shares of. However, I currently see no reason to change my bullish stance. First Horizon Corporation (FHN) was a financial institution that I pointed out as attractive because of the large spread between where shares were trading and the price at which The Toronto-Dominion Bank (TD) was slated to pay for the enterprise as part of their merger agreement. That deal ultimately fell through and shares of the company plunged. After that plunge, I ended up writing about the company again in an article that was published in early May of last year. I reiterated my “strong buy” rating and the results so far have been encouraging. While the stock is still down materially from where it was previously, shares are up 32.3% from my May article compared to the 15.3% upside seen by the S&P 500. And lastly, there is International Game Technology PLC (IGT), a gambling-oriented technology firm that generates nearly 56% of its revenue from the U.S. but is headquartered out of the UK. After seeing shares initially spike after management announced a strategic review process regarding two of the company’s three operating segments, the stock has pulled back rather significantly and is down 11.7%. However, the data regarding the enterprise is still promising. In the third quarter of 2023, for instance, revenue was $5 million higher than it was the same time one year earlier. Meanwhile, operating cash flow rose 25.4% year over year while EBITDA was up 7.7%.

Takeaway

I have been following and analyzing markets since 2008. And I have been actively investing in the market for nearly that long. From my experience, value investing works when it is done right. It’s easy to make a mistake, but that’s why some degree of diversification is encouraged. So far over the past two years, I have proven this method to be successful. Of course, there are no guarantees about what the future holds. Anybody who makes you a promise about the future is likely trying to deceive you or does not know how things work themselves. But by focusing on high quality companies, returns that exceed the broader market are possible. Right now, some of the companies that have been hit the hardest that I have been bullish on are ones that I still think additional upside is warranted for. So I think investors would be wise to pay special attention to those.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here