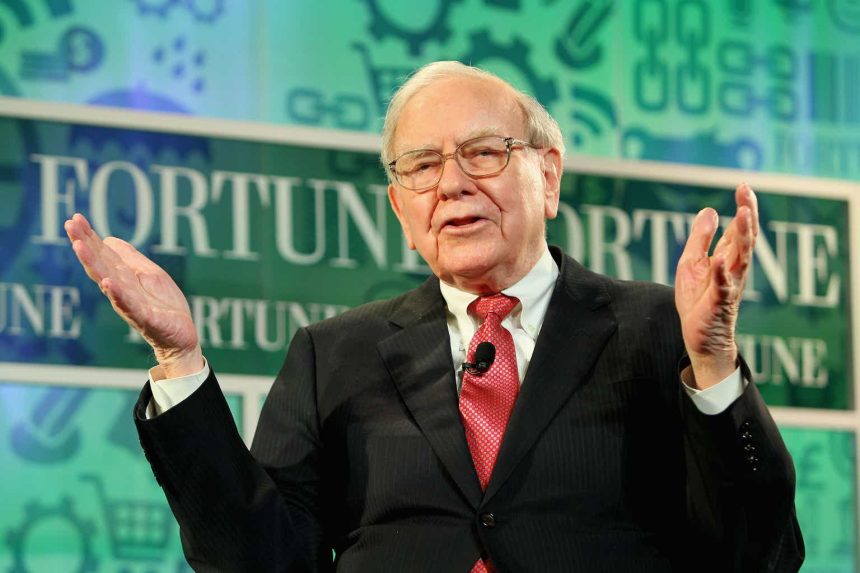

Following Warren Buffett is one of the most popular “clone” strategies among investors. With a 20% CAGR return over 60 years, Buffett’s track record is one of the best in history. But unlike many other investors who have achieved superior returns, Buffett’s approach is relatively easy to understand. This, along with the fact that Buffett is the richest investor in the world, makes him one of the most copied investors ever.

If you’re a dividend investor, you might be surprised to learn that Buffett does not have a whole lot of high dividend stocks in his portfolio. Most of his portfolio stocks pay dividends but in general the yields are fairly low. In some cases, Buffett himself earns massive yields-on-cost on stocks he bought in the past. For example, he gets 54% of his investment in Coca-Cola (KO) back each year in dividends. However, he bought at prices much lower than today’s prices. KO shares purchased today yield 2.95%.

Nevertheless, there are a few high yield names in Warren Buffett’s portfolio. Mainly financials, they can add some much needed income to your portfolio. In this article I will explore three such Warren Buffett stocks with yields over 4%.

Ally Financial

Ally Financial (ALLY) is a bank and car finance company. It also has some insurance operations. Buffett owns 29 million ALLY shares with a market value of $840 million around the time of purchase. The stock yields 4.14%, making it one of the highest yielders in Buffett’s portfolio.

ALLY has a high yield savings account that yields 4%. Having such high yields on offer helps prevent depositors fleeing to treasuries, or higher-yielding bank accounts offered by other companies. The bank charges 7.5% on mortgages and varying amounts on car loans, usually above 5%. So, despite its high interest on deposits, ALLY charges even more interest on loans, enabling it to earn lots of net interest income (“NII”).

ALLY Financial stock appears fairly cheap at today’s prices, trading at:

-

7.3 times earnings.

-

1.17 times sales.

-

0.78 times book value.

-

1.44 times operating cash flow.

It’s a pretty cheap valuation, even compared to banks, which are cheap in general. On the other hand, the company’s growth over the last year has been negative. Used car prices fell after a brief rally during the COVID-19 pandemic, although they’re starting to rise again. Potentially, this could be a bullish development for ALLY’s business, allowing it to write larger loans than it wrote last year.

Kraft Heinz

Kraft Heinz (KHC) is another high yielder in Warren Buffett’s portfolio. With a 4.4% yield, it has a lot of income potential.

Kraft Heinz is a food company that owns many recognizable brands. These include:

-

Heinz Tomato Ketchup.

-

Velveeta.

-

Kool-Aid.

-

Philadelphia Cream Cheese.

-

Jell-O.

-

Grey Poupon.

-

Oscar Mayer.

These brands are highly recognizable, which may serve as a kind of moat for KHC. Generally, companies with beloved brands enjoy pricing power, which implies that they have an edge over their competitors.

KHC is fairly inexpensive for a food brand company, trading at the following multiples according to Seeking Alpha Quant:

-

12.73 times earnings.

-

1.66 times sales.

-

0.91 times book value.

-

18 times operating cash flow.

These multiples are reasonable enough to earn KHC a “B” on value in Seeking Alpha’s Quant ratings, which is a respectable score.

Citigroup

Last but not least we have Citigroup (C), one of the few bank stocks still in Warren Buffett’s portfolio. The stock yields 4.3% at today’s prices, which is one of the better yields among the big banks. Nevertheless, the company’s payout ratio is only 34%, so it isn’t spending too much on dividends compared to profit. This is a rare trait among high yielders.

At today’s prices, C trades at:

-

7.88 times adjusted earnings.

-

7.5 times GAAP earnings.

-

1.3 times sales.

-

0.48 times book value.

-

24 times operating cash flow.

This is a very cheap valuation, even by banking standards, giving the stock an A- in Seeking Alpha’s sector-relative quant ratings. On the other hand, its five year CAGR growth in earnings (1.3%) is much worse than for Bank of America (BAC) or JPMorgan (JPM), and its 19.9% net margin is behind those companies’ margins as well. The company’s earnings declined 36% in the most recent quarter, making it the worst performer of the banks that reported a few weeks ago.

The Bottom Line

The bottom line on high yield Buffett stocks is that there aren’t very many of them, but they do exist. If you’re into banks or food brands, you’ll find some names that fit the bill. In general, Buffett stocks do not have stratospheric yields, though most of them do pay dividends. So, the Berkshire Hathaway (BRK.B) portfolio is a good source of inspiration for income-hungry investors.

Read the full article here