Introduction

It’s time to discuss a company I’ve never discussed before. That company is Prudential Financial, Inc. (NYSE:PRU).

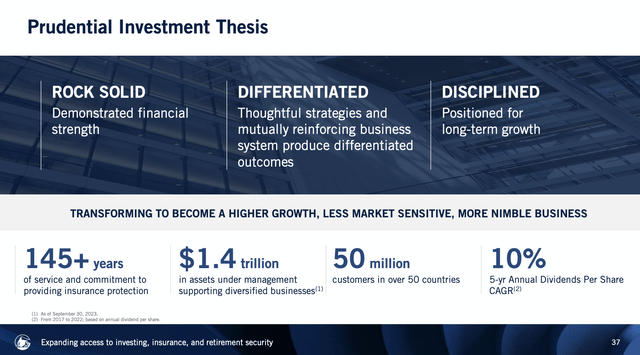

The company is a global financial services leader and a prominent active global investment manager, managing a substantial $1.4 trillion in assets as of December 31, 2022.

Prudential Financial

Its expansive operations extend across the United States, Asia, Europe, and Latin America.

The company’s core offerings include a comprehensive suite of financial products and services such as life insurance, annuities, retirement-related products, mutual funds, and investment management.

Prudential.com

To give you a short history lesson, The Prudential Insurance Company of America underwent demutualization on December 18, 2001, transitioning from a mutual life insurance company owned by policyholders to a stock life insurance company.

One of the reasons why I went with a retirement-focused screenshot from the company’s website above is because of the creation of Retirement Strategies, a new U.S. business unit announced in October 2021.

This strategic move aimed to address the retirement needs of both institutional and individual customers by combining institutional investment and pension solutions with the financial capabilities of the Individual Annuities business.

Prudential Financial

As of 2022, this is what the company’s well-diversified business portfolio looks like:

| USD in Million | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

International Businesses |

21,915 | 30.9 % | 20,074 | 33.4 % |

|

Institutional Retirement Strategies |

15,298 | 21.6 % | 19,441 | 32.4 % |

|

Individual Life |

6,897 | 9.7 % | 7,074 | 11.8 % |

|

Group Insurance |

6,217 | 8.8 % | 6,123 | 10.2 % |

|

Individual Retirement Strategies |

4,914 | 6.9 % | 5,312 | 8.8 % |

|

Reconciling Items |

5,206 | 7.3 % | -4,598 | -7.7 % |

|

Global Investment Management |

4,493 | 6.3 % | 3,622 | 6.0 % |

|

Closed Block |

5,947 | 8.4 % | 2,957 | 4.9 % |

|

Assurance IQ |

558 | 0.8 % | 510 | 0.8 % |

|

Corporate and Other |

-511 | -0.7 % | -465 | -0.8 % |

With all of this said, in this article, I am focusing on its attractiveness for investors in light of its 5% yield and attractive valuation.

So, let’s get to it!

Buying Insurance Income

I believe I am one of many when I say that my insurance costs will go up tremendously in 2024.

My health insurance premiums alone are going up by almost 20%.

I also have the highest deductibles possible.

Hence, it’s great to find ways to get paid by insurance companies.

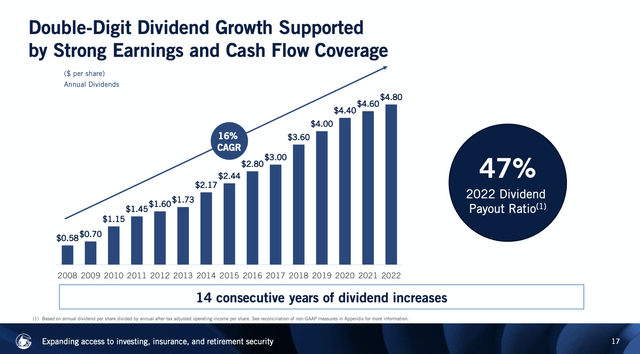

As we can see below, PRU shares yield 4.8%, which is protected by a sub-45% payout ratio. The dividend has a five-year CAGR of 6.8%.

In 2008, the company cut its dividend by 50%. Since then, it has consistently grown its dividend, protected by a strong business and an A-rated balance sheet.

Prudential Financial

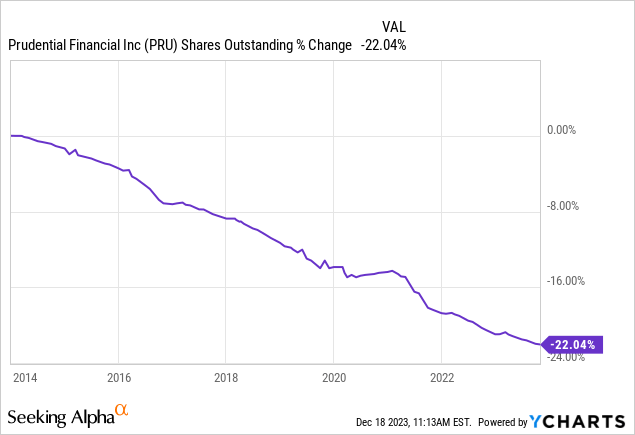

Prudential also buys back stock. In recent years, excluding the pandemic, the company has balanced both buybacks and dividends, distributing most of its free cash flow to shareholders.

Over the past ten years, the company has bought back roughly a fifth of its shares.

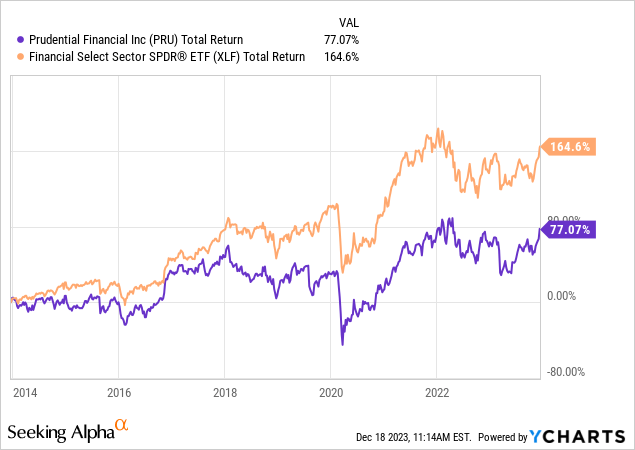

Unfortunately, the company has failed to outperform the Financial Select Sector SPDR Fund ETF (XLF) during this period, returning just 77%.

In light of underperformance and on top of having an attractive yield and buybacks, the company is innovating to boost the value it is bringing to the market for both customers and shareholders.

During this year’s Goldman Sachs U.S. Financial Services Conference in December, the company elaborated on pillars for future growth.

- Prudential has actively addressed market sensitivity by divesting back books, reinsuring back books, and transitioning towards lower market-sensitive products. Notable initiatives include changing product types, shifting towards higher-growth products such as FlexGuard, and increasing distribution channels.

- The company’s pursuit of higher growth involves strategic acquisitions and internal investments. Recent acquisitions include Deerpath Capital in private credit, while the company also works on partnerships with major platforms like Mercado Libre and LPL, which highlight efforts to broaden distribution channels, fostering growth in Latin America and the U.S. markets.

Prudential Financial

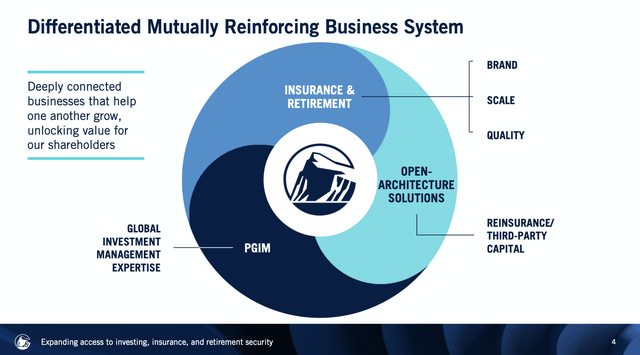

- The company also introduced Prismic, which is a reinsurance platform. Prismic enables Prudential to bring in third-party capital for reinsurance, supporting a self-reinforcing business system. By reinsuring structured settlements and utilizing third-party capital, Prudential aims to turbocharge the growth of annuities and individual insurance retirement, subsequently benefitting PGIM.

Prudential Financial

A group of global investors has agreed to make equity investments in Prismic, alongside Prudential and Warburg Pincus, giving Prismic a combined initial equity investment of $1 billion. Prudential and Warburg Pincus will initially own 20% and 15% of the equity in Prismic, respectively. Prismic’s board will include two independent directors and one director nominated by each of Prudential, Warburg Pincus, and the group of investors. – Prudential

Furthermore, group retirement and pension risk transfer continue to be fruitful avenues for Prudential. Despite a slight decrease in projected growth for the current year, Prudential anticipates a substantial market of $40 billion to $45 billion. Tailwinds include well-funded pension plans, market volatility, and high PBGC fees, creating opportunities for continued growth.

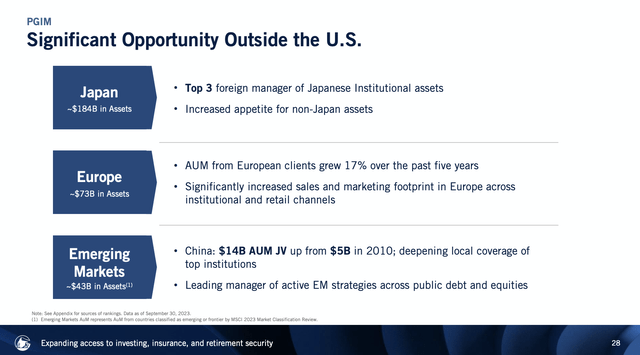

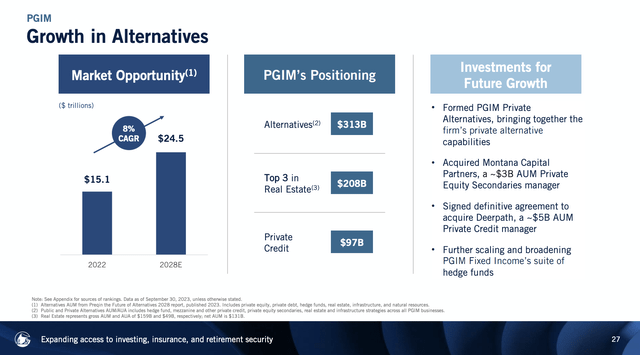

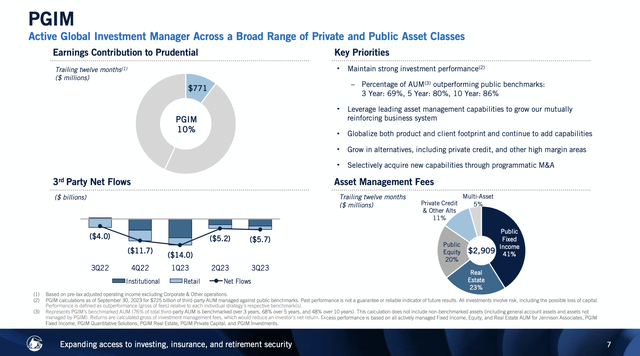

On top of that, PGIM’s multi-year performance remains robust, with a focus on both retail and institutional segments. While retail has experienced exceptional performance, institutional growth faces challenges due to fixed income exposure. Prudential’s emphasis on alternative investments, such as private credit and secondaries in private equity, indicates a strategic move to diversify and enhance performance.

Prudential Financial

And, in case you are wondering, Prudential is also using AI and Gen AI.

The company’s focus on AI and Gen AI aims to strike a balance between improving operational efficiency and providing a seamless customer experience.

So far, the emphasis is on strategic investments that yield tangible benefits, such as reducing underwriting time and improving call center processes.

Recent Events & Valuation

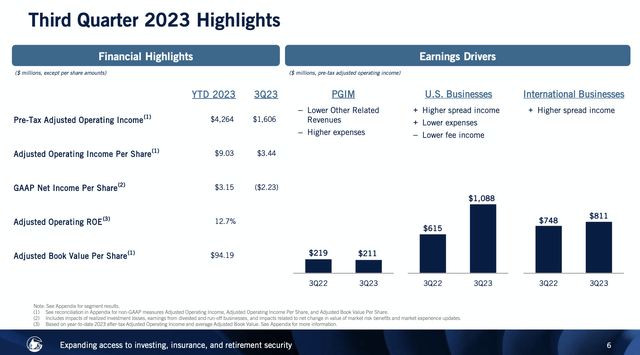

In its third quarter, the pretax adjusted operating income was $1.6 billion or $3.44 per share on an after-tax basis, marking a 45% increase from the previous year.

Unfortunately, there was a GAAP net loss of $2.1 billion, mainly attributed to mark-to-market losses on interest rate derivatives due to higher rates.

Prudential Financial

PGIM saw lower revenues in various areas, such as agency, seed, and co-investment earnings. The business faced third-party net outflows of $5.7 billion, primarily driven by lower fixed income inflows and a significant client outflow.

Prudential Financial

The good news is that the U.S. Business saw diversified earnings from fees, net investment spread, and underwriting income.

Retirement Strategies reported strong sales of $6.7 billion, with the institutional retirement business leading with sales of $4.7 billion, including notable pension risk transfer transactions.

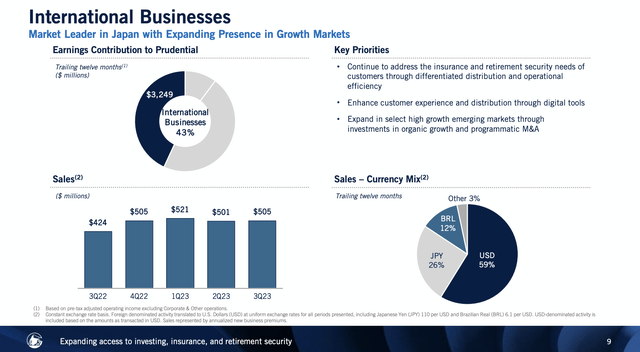

Meanwhile, International Businesses, including Japanese life insurance companies and operations in high-growth emerging markets, saw a 19% increase in sales compared to the previous year. Key contributors were record sales in Brazil and growth in the bank channel for Gibraltar.

Prudential Financial

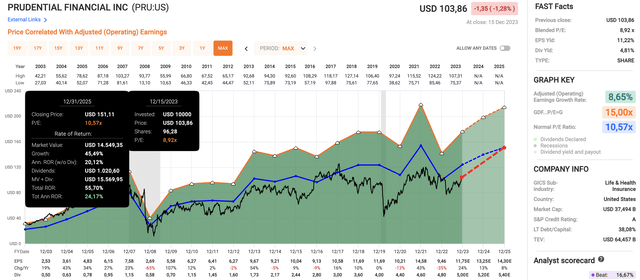

With that in mind, despite challenges, PRU remains attractively valued.

Using the data in the chart below:

- The company is currently trading at a blended P/E ratio of 8.9x.

- The normalized long-term valuation multiple is 10.6x.

- This year, EPS is expected to grow by 24%, followed by 13% growth in 2024 and 8% growth in 2025.

- A return to its normalized valuation by incorporation of its expected growth rates could result in a 24% annualized return through 2025.

FAST Graphs

While there is no way I would guarantee a return that big, I do believe that the implied fair value of $151 is fair.

This would imply between 40% and 50% longer-term upside momentum.

The current consensus price target is $103, which is roughly where the stock is trading right now.

My view is that the stock has a lot of long-term potential. I like its yield and the measures the company is taking to boost long-term growth.

However, its longer-term underperformance and the cyclical risks of insurance companies keep me from making the case that Prudential is a “must-own” stock.

It’s a great income play in the financial sector, but I would not go overweight PRU in an income-focused portfolio.

Read the full article here