8×8 (NASDAQ:EGHT) provides SaaS interface solutions for contact centers and communications with customers such as Acer, Trek, and Kubota, providing voice, video, and chat functionalities. The company has been able to grow revenues consistently in its long-term history but has stopped on its growth track in recent quarters, leaving investors wondering about the company’s future. As the growth has stopped and SaaS valuations have overall come down, the stock is far from its highs – the stock price of $3.66 at the time of writing is around 91% below the stock price’s high achieved in 2021. As with many SaaS companies, the stock’s valuation has come down to a more reasonable level with higher interest rates and more moderate growth estimates.

Five-Year Stock Chart (Seeking Alpha)

Underlying Financials

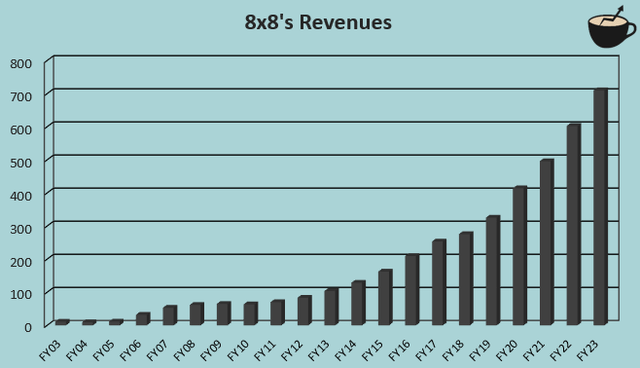

8×8’s long-term revenue history is nothing short of impressive. From FY2003 to FY2023, the company has achieved a revenue CAGR of 23.2%:

Author’s Calculation Using TIKR Data

The achieved growth is a result of a great organic performance as well as select acquisitions, most notably the acquisition of Fuze for a consideration of $250 million, announced in December of 2021.

On the profitability side, 8×8 seems very weak at first glance with a negative GAAP EBIT margin of -8.9% in FY2023. The underlying cash flows are significantly better than the company’s GAAP figures let investors believe, though – the company has a very significant amount of amortization related to intangible assets ($10.2m in H1 of FY2024), capitalized internal-use software amortizations ($10.1 million in H1/FY2024), debt discount and issuance costs ($2.2 million in H1/FY2024), and deferred sales commission costs ($20.1 million in H1/FY2024). Compared to the significant amount in amortization, 8×8 has a significantly lower amount of investments and deferred costs with $1.6 million in CapEx, $7.4 million in internal-use software costs, $6.2 million in purchases of investments, $12.1 million in deferred sales commission costs, and $2.1 million in deferred revenues in H1 of FY2024. Altogether, amortizations add up to $13.3 million more than investments in the period.

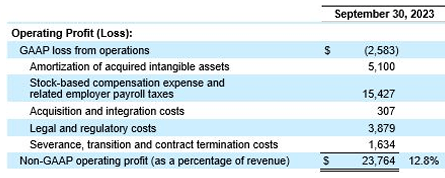

8×8 reports a non-GAAP operating income, which seems a bit more representative of the company’s earnings capabilities. The company does the following reconciliations to its GAAP EBIT for the non-GAAP figure:

EGHT Q3 Investor Presentation

Most of the reconciliations seem reasonable, but I don’t believe that stock-based compensation should be excluded from earnings; SBC has a significant cost, realized through dilution. 8×8 had an outstanding weighted average share count of 100.0 million in FY2020, compared to the current trailing number of 116.4 million. Typical for technology companies, 8×8 has had a very high amount of SBC in the past with a current trailing amount of $69.8 million. With the lower share price, the compensation will inevitably result in even higher dilution. For FY2024, 8×8 estimates a non-GAAP EBIT margin of 12% to 13%, up from 8.4% in FY2023.

Investment Case is Dependent on Future Growth

I believe that the investment case for 8×8 depends very largely on future growth. The company has historically achieved a very good amount of growth, but the growth has been very lacking in recent quarters. After the comparison figures have started to already include Fuze’s revenues, 8×8’s revenues have stayed near flat, and revenues even declined by 1.8% year-over-year in H1 of FY2024. Investors are left wondering whether 8×8’s growth story has stopped its track, or if the current performance is a temporary hiccup.

8×8’s revenues should have been affected largely by the Covid pandemic – as businesses shut down in-person operations, online contact centers should benefit largely. Yet, 8×8’s revenues only grew by 19.3% in FY2021 as the pandemic started to affect society, in line with the company’s previous years’ growth rate. The small effect does seem to correlate with competitors’ achieved figures, still – for example, NICE Ltd. achieved a growth of 4.7% in 2020 after growing by 9.0% in 2019, Five9 grew by 32.6% in 2020 after a 2019 growth of 27.3%, and RingCentral grew by 31.1% in 2020 after a 2019 growth of 34.0%. The other mentioned companies have continued to grow in recent quarters as well, though, contrary to 8×8 – 8×8 seems to have some internal struggles.

A large factor in the decreased growth seems to also be due to 8×8’s focus on cost management to improve the company’s cash flows. In the first half of FY2024, 8×8 has been able to cut almost $38 million in operating expenses while improving gross margins from previous years. With 8×8’s leveraged balance sheet, I believe that improving cash flows is critical for the company’s survival.

In 8×8’s Q2/FY2024 earnings call, the weaker growth is attributed to the down-sell and attrition of Fuze customers, customers’ weak perception of 8×8’s offering, as well as weak macroeconomic conditions. The first two seem concerning – although it is emphasized in the earnings call that 8×8’s offering is competitive in actuality, the attribution is very worrying; the management’s words about 8×8’s offering shouldn’t necessarily be taken for granted, as often customers’ actions speak louder than a company’s management’s words. A weak perceived offering and the attrition of Fuze customers can seem like persisting issues in the competitive industry; I wouldn’t expect very high growth from 8×8 in the future either unless 8×8 can turn its perceived offering value around. With currently decreasing R&D, it could prove to be challenging.

Very Modest Growth is Priced In

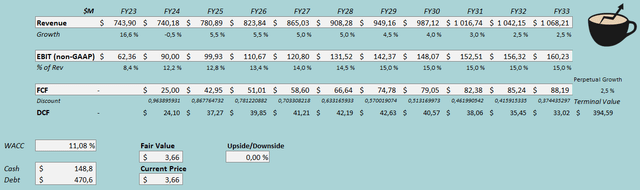

I usually value companies through a straightforward discounted cash flow model, but as the investment case for 8×8 seems incredibly volatile with large questions around future growth and margins, I believe that a reverse DCF model is more appropriate. In the model, I factor in a financial scenario where the current stock price represents a fair value for the stock.

In the reverse DCF model, it seems that very moderate growth is expected of 8×8 – in the model, I estimate a revenue growth of 5.5% in FY2025, which slows down into a perpetual growth rate of 2.5%, representing a CAGR of 3.7% from FY2023 to FY2033. For the margins, the market seems to estimate some leverage through growth and cost management – my reverse DCF model has an eventual non-GAAP EBIT margin estimate of 15.0%. In the cash flow conversion, I take into account a large amount of amortization, but on the other hand, I also include stock-based compensation into cash flows as they cause dilution and cost investors.

With the mentioned estimates along with a cost of capital of 11.08%, the DCF model estimates 8×8’s fair value at $3.66, the stock’s price at the time of writing. The estimates represent a modest financial future for 8×8, which seems fair in my opinion when considering the strong long-term, and weak medium- to short-term growth rates.

Reverse DCF Model (Author’s Calculation)

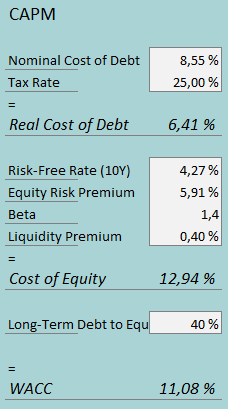

The used weighted average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In the most recent reported quarter, 8×8 had $10.1 million in interest expenses. With the company’s current amount of interest-bearing debt, 8×8’s annualized interest rate comes up to a high figure of 8.55%; it seems that lenders see 8×8 as a high-risk company. Yet, 8×8 leverages quite a high amount of debt despite the high interest rate, and I estimate a long-term debt-to-equity ratio of 40%.

For the risk-free rate on the cost of equity side, I use the United States’ 10-year bond yield of 4.27%. The equity risk premium of 5.91% is Professor Aswath Damodaran’s latest estimate for the United States, made in July. Yahoo Finance estimates 8×8’s beta at a figure of 1.40. Finally, I add a small liquidity premium of 0.4%, crafting a cost of equity of 12.94% and a WACC of 11.08%.

Takeaway

The investment case for 8×8 depends on the company’s future growth. Currently, the company has very weak revenue growth, although the company is still improving its bottom line through tighter cost management. The underlying reasons for poor growth seem the most concerning, as the slower topline growth is attributed partly to a weak perceived value of the offering. If 8×8 can improve its topline growth, I believe that the stock could be a very good investment as SaaS companies should be able to achieve significant operating leverage with growth. If not, though, the stock could prove to be a poor investment choice. Although a potential transaction involving RingCentral could create shareholder value, I don’t see the transaction as too large of a catalyst at the current point. At the current price, moderate growth seems to be priced into the stock, which seems reasonable in my opinion. For the time being, I have a hold rating.

Read the full article here