Cutting out bad habits is far more effective than cutting out organs.”― Herbert M. Shelton.

Today, we put UFP Technologies, Inc. (NASDAQ:UFPT) in the spotlight for the first time. The stock of this niche manufacturer in the healthcare space is down some 30% from its recent highs this summer. The company delivered Q3 results at the start of November. One small insider purchase soon followed. An initial look at UFP Technologies is provided below.

Seeking Alpha

Company Overview:

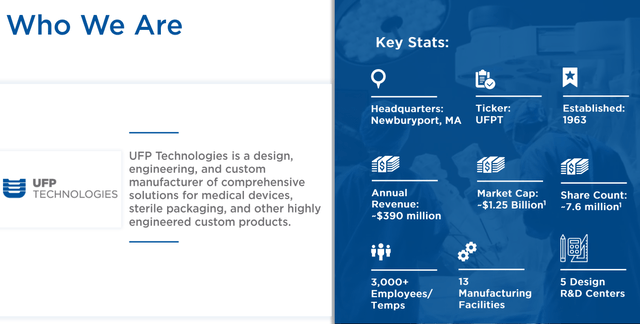

UFP Technologies, Inc. is headquartered in Newburyport, MA. The company is a designer and custom manufacturer of comprehensive solutions for medical devices, sterile packaging and other highly engineered custom products. The stock currently trades just over $140.00 a share and sports an approximate market capitalization of $1.1 billion.

August Company Presentation

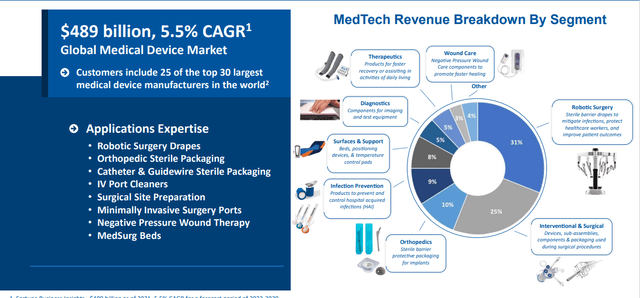

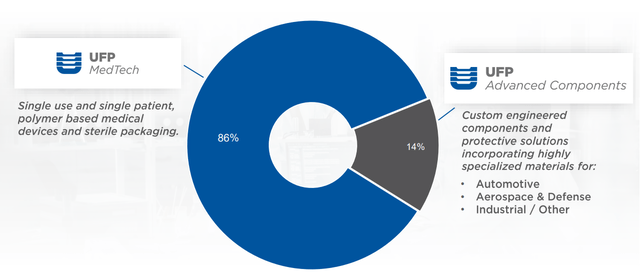

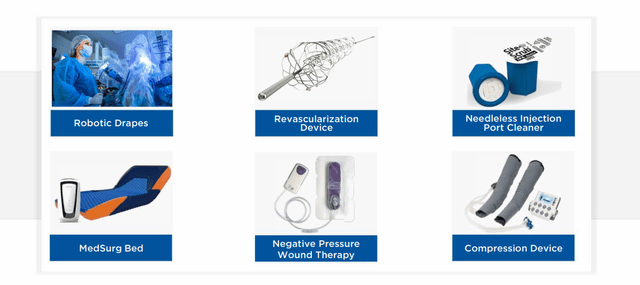

The company has transformed itself into an entirely focused medtech concerns in recent years, making several small acquisitions in 2022 (DAS, Contech, and Advant Medical) and divesting itself of molded fiber business and related real estate in Iowa in the summer of 2022. Some of the company’s core offerings include catheter and guidewire packaging and robotic surgical drapes.

August Company Presentation

UFP Technologies also provides highly engineered components and packaging solutions to other industries such as aerospace and defense including military gear and protective helmets.

August Company Presentation

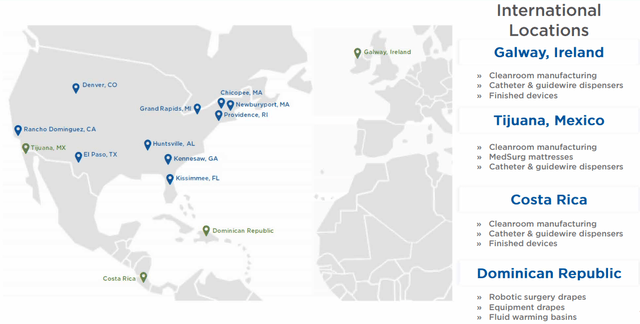

The company operates and manufactures products out of both the U.S. and low-cost countries like Mexico, Costa Rica and the Dominican Republic.

August Company Presentation

Third Quarter Results:

August Company Presentation

The company posted its third quarter numbers on November 1st. UFP Technologies delivered non-GAAP earnings of $1.54 a share on $100.8 million of revenue. Adjusted net income came in at $11.9 million, up from $10.4 million in the same period a year ago. Organic revenue growth was down significantly from the second quarter results, although adjusted net income was identical.

Equating for the sale of the Molded Fiber unit last summer, organic sales growth for the quarter was 5.6%, driven by a 6.8% increase in medical revenue. Management did note growth was somewhat muted by some customers delaying releases due to excess inventory in their systems built up during the Covid pandemic and now migrating back down to pre-pandemic levels.

Analyst Commentary & Balance Sheet:

Despite an over $1 billion market cap, UFP Technologies has little following on Wall Street. Lake Street reiterated its Buy rating and $188 price target (down from $222 previously) on the shares following Q3 results. It is the only analyst firm I can find offering up commentary on the company so far in 2023.

Just over three percent of the outstanding float in the shares are currently held short. An insider purchased this over $27,000 worth of shares on November 9th. Collectively, insiders sold just over $5.5 million worth of shares this May followed by sales of just over $3 million in August. The company ended the third quarter with just over $6 million in cash and marketable securities on its balance sheet against just under $40 million of long-term debt.

Verdict:

UFP Technologies had a profit of $5.45 a share on just under $354 million of revenue in FY2022. The one analyst firm that has posted projections sees earnings falling slightly in FY2023 to $5.31 a share even as sales rise to $595 million. Profits are estimated to rise to $6.28 a share in FY2024 on revenue growth of nine percent.

August Company Presentation

The company is open to additional strategic “bolt on” acquisitions on its journey to boost growth and margins. However, even after a 30% decline in the stock since its recent highs in mid-July, UFP Technologies, Inc. valuation is still not compelling. The shares go for over 25 times earnings, a premium to the S&P 500 (SP500) multiple even as earnings look to be flat or slightly down this year. Therefore, I have no investment recommendation around UFP Technologies at this time.

Scars are simply modern battle wounds. Sometimes the enemy happens to be inside us.”― Andrew Grey.

Read the full article here