NEW YORK (May 15) – We were absolutely delighted to hear Mother’s Day news late yesterday that Engaged Capital, of Newport Beach, CA, planned a proxy fight for board seats on the burger chain.

We first picked Shake Shack (NYSE:SHAK) as a prospective “home run” seven years ago, when shares were at $34. Back then, as we explained in the article, we were enthusiastic about SHAK’s tent-pole and stake strategy, whereby SHAK entered a prime market location in a big way; then, moved to build new stores in lesser-traveled locations. Building out in that fashion, we explained, should drive margin growth as supply chains, management, and staffing created economies.

While the share price has doubled and, at one point, tripled, we were disappointed by a number of issues with SHAK in later articles. In November, 2017, for example, we noted inattention to operating costs, excess staffing levels (understandable at the time because it was a new “cashless” location at the time); a lack of upselling (“Do you want fries with that?”); and costly, sturdy, paper bags for a single order when a smaller, waxed paper bag would suffice. But they have now receded to just $65 on Friday, prior to the Mother’s Day news.

Get it Together, Shake Shack

Our last analysis of SHAK, in August of 2020, summarized our view of the burger chain fairly:

We’ve been fans of SHAK, but we think management has not been a good steward of the brand and we have said so several times. But nearly every entrepreneurial company (Shake Shack started, literally, from a pushcart 20 years ago) reaches a point where entrepreneurial energy meets market reality and must accede to the latter.”

Sadly, SHAK management has continued to be poor stewards, unabashed, and for a number of reasons:

1. Overhead is Outrageously High

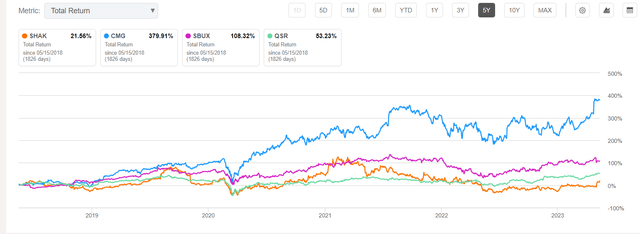

We compared SHAK total return to Chipotle Mexican Grill (CMG), another upper-scale fast food/fast casual dining and with Starbucks (SBUX), and Restaurant Brands International (QSR) over five years, with this result:

5 Year Total Return of QSR Stocks (Seeking Alpha)

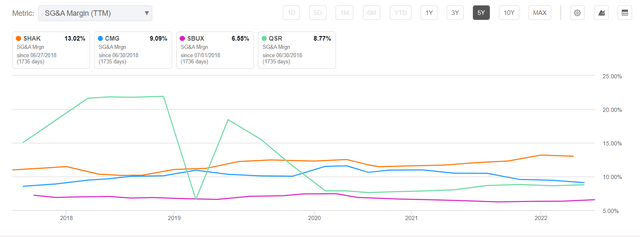

Notably, we also compared SG&A (Trailing 12 Months) to the same companies. This was that result:

Five Year SG&A (T12Months) (Seeking Alpha)

It can certainly be assumed that much of the SG&A is attributable to higher minimum wage salaries in downstate NYS where most SHAK stores are concentrated (other states minimum wages are lower, more the 50% lower in many cases.). But the “General” and “Administrative” elements of SG&A are better controllable than SHAK executives have done heretofore. SHAK’s executive headquarters are in a tony, trendy, part of Manhattan called “TriBeCa”, or Triangle Beneath Canal (Street); a one-time industrial area spruced up to cater to creative arts types like Robert De Niro etc. The burger chain appears to have spared no expense to fit in to the “tony, trendy” neighborhood, as illustrated by these interior shots of the HQ. (These offices look more like some of the bungalows assigned to Hollywood producers with a 5-picture deal than the nerve center of a burger chain.)

As we’ve said, a handful of senior executives may need to be in Tony TriBeCa, but the test kitchen, the “back office” operations, the software/app developers can all be in far less expensive quarters in the outer boroughs or in Jersey City or Hoboken.

2. The SHAK experience has never been “standard”.

We often tell clients “Standards are the codification of collective experience borne of past errors and tragedies. Ignore them at your peril.” SHAK has ignored them for over a decade. Four years ago, we related perhaps our worst view of SHAK. In an article entitled, “There’s a Crack in the Shack”, we noted that standards had never actually been developed. Sure, there were recipes, but as we and the NY Times pointed out (in 2012!!!), you had roughly a 1 in 3 chance of getting a really awesome burger or getting one that is “just so-so.” A “hit-or-miss” dining experience at a quick serve restaurant (or “fast casual”, if you insist) chain is intolerable. Smashing the burger on the grill with a spatula cannot create a uniform taste experience.

3. Where’s breakfast?

It’s absurd that most SHAK restaurants, save for airports and a few other high traffic areas, sit idle until 10:30AM. Breakfast needs to be incorporated in the SHAK offerings. But it should not be added until the standards for the lunch and dinner menus have been incorporated and proliferated at all its restaurants on a six sigma level. The SHAK dining/taste experience should be at least as standardized as McDonald’s.

Summary

Merriam-Webster describes “stewardship” as,

“the conducting, supervising, or managing of something; especially : the careful and responsible management of something entrusted to one’s care

In our view, the SHAK executive team and board has failed to steward the company to the full value of its potential. We have been grievously disappointed by the stock we first recommended seven years ago.

We very much look forward to the proxy fight with Engaged Capital. Even if it does not gain the board seats (and that seems like a difficult endeavor), we hope that the Engaged “shot across the bow” will bring the board and management, whom we view as grievously inattentive, to focus on shareholder interests in the fashion described by Engaged Capital’s philosophy.

UPDATE:

Early this morning (May 16), it was announced that Engaged Capital had agreed to “stand down” its proxy fight in exchange for certain agreements to name a board member and another “mutually agreed” upon. Moreover, as reported by SA,

Shake Shack has also agreed to retain a consulting firm to support its ongoing operational initiatives to improve restaurant execution, cost structure and profitability, and Danny Meyer and certain of his affiliates have agreed to step down their director designation rights over time.

_____________________________________________

Note: Our commentaries most often tend to be event-driven. They are mostly written from a public policy, economic, or political/geopolitical perspective. Some are written from a management consulting perspective for companies that we believe to be under-performing and include strategies that we would recommend were the companies our clients. Others discuss new management strategies we believe will fail. This approach lends special value to contrarian investors to uncover potential opportunities in companies that are otherwise in a downturn. (Opinions here with respect to whether to buy, sell, or hold such companies, however, assume the company will not change its current practices).

Read the full article here