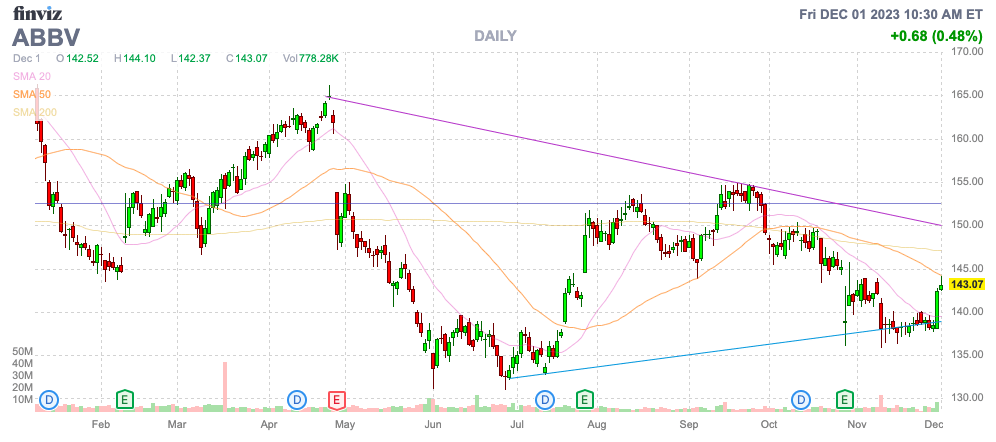

The biopharma space continues to face a lot of pain with the LOE on major drugs. AbbVie Inc. (NYSE:ABBV) is the latest company to acquire a promising biotech in the form of ImmunoGen, Inc. (IMGN) to improve the drug pipeline. My investment thesis is Bullish on the stock, which is trading near the yearly lows despite the strong cash flows.

Finviz

ImmunoGen Deal

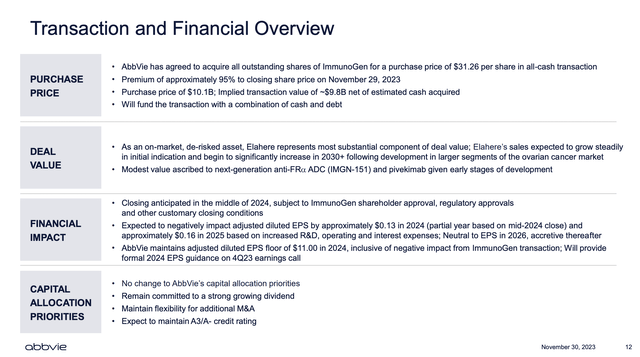

AbbVie reached a deal to acquire ImmunoGen for $31.26 per share in an all-cash transaction valued at $10.1 billion. ImmunoGen got a 95% premium to the prior closing price, sending the stock soaring 83% on the day.

AbbVie ImmunoGen Merger Presentation

The small biotech has the ovarian cancer drug Elahere approved, with a consensus revenue target of $375 million this year and jumping to nearly $1 billion by 2026. The deal is dilutive by $0.13 in 2024 depending on the actual closing date of the transaction.

The novel cancer drug in the class called antibody-drug conjugates (ADCs) isn’t a mega-drug currently. AbbVie is buying ImmunoGen for the drug pipeline and for the potential to use the AbbVie marketing machine to grow the drug’s sales profile and expand the approved medical conditions over time via new ongoing trials.

The market forecasts a $3+ billion global market for ovarian cancer with a forecast to double in 5 years and reach $12 billion in 10 years, or 2033. The big key for investors to understand the possibility with Elahere is the market expansion and growth opportunities, not as much for any blockbuster sales in the near term.

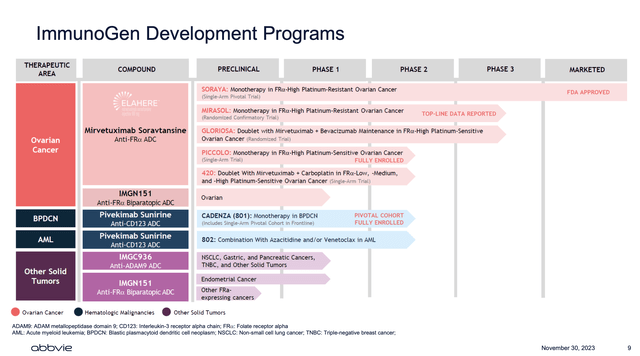

ImmunoGen has a solid development program, with drugs targeting solid tumors and hematologic malignancies. The hematologic malignancies drug has several Phase 2 studies ongoing.

AbbVie ImmunoGen Merger Presentation

AbbVie Needs Growth

The large biopharma just reported Q3’23 earnings of $2.95 per share and guided up to an $11.21 EPS for 2023. AbbVie continues to run into issues with revenue declines from LOE of Humira offset by new drug launches.

Back in Q3, Humira revenues were down 36% to $3.55 billion. Overall, AbbVie only reported a 6% dip in revenues to $13.93 billion. A lot of the Humira revenue gains were offset by 50% gains in Skyrizi and Rinvoq, with combined quarterly revenues of $3.24 billion.

The company guided to a 2024 EPS of up to $11.00 for a slight dip from the 2023 level. The ImmunoGen deal will lower the upside EPS target to only $10.87 while revenues will rise based on half a year of sales.

One of the new issues with cash merger deals in the lower interest income or additional debt cost. In the past few years, corporations immediately made positive income on cash deals due to idle cases not generating a return.

AbbVie ended last quarter with a cash balance of over $13 billion and nearly $56 billion in debt. The net debt position is about $42 billion. The interest income jumped to $157 million, while interest expenses were stable at $555 million for a net cost of $398 million.

In essence, AbbVie will pay at least $400 million in additional net interest expenses. The amount includes the loss of interest income from using the existing large cash balance to pay for ImmunoGen.

With 1.8 billion shares outstanding, the guidance for a $0.13 dilutive EPS impact in 2024 is mainly due to the impact to interest expenses. ImmunoGen is forecast to be slightly profitable next year, earning ~$100 million based on a $0.37 EPS target.

AbbVie generates $20+ billion in annual cash flows and spends about half of those cash flows on the dividend, currently yielding around 4.4%. The company will generate enough cash flow to pay for the deal by the time it actually closes.

The additional revenues will help the view of the biopharma, considering the market preference for growth equities. AbbVie will need the ImmunoGen business to reach revenues far beyond the $1 billion range to move the needle on a business already topping $50 billion.

Takeaway

The key investor takeaway is that AbbVie Inc. has a drug deal in ovarian cancer, pushing the company back into growth mode in 2024. The stock isn’t overly cheap, trading at nearly 13x EPS targets while this deal is dilutive in the short term. Ultimately, though, if AbbVie can return to growth and put the Humira LOE in the rearview mirror, the stock will reward shareholders with a strong profit and a large dividend yield.

Read the full article here