Back in July, I wrote that Advance Auto Parts (NYSE:AAP) was struggling with margins and competitive pricing in a high inflation environment, and that a turnaround would not be easy. Since then the stock is down about -25%. I followed that up in September saying while the stock looked more intriguing, that its new CEO had his work cut out for him. Thus far, my margin thesis has played out, although I perhaps should have been more bearish with my rating. Let’s catch up on the name following its most recent earnings report earlier this month.

Company Profile

As a quick reminder, AAP sells automotive replacement parts to both professional and do-it-yourself (DIY) customers. Sales to professionals were nearly 60% of its 2022 sales. The company offers brand name, OEM, and its own brands.

In addition to operating stores, branches, and e-commerce platforms under its namesake brand, it also owns Carquest and Worldpac. The latter two principally serve professional customers, while Advance Auto Parts serves both.

Q3 Results

Earlier this month, AAP reported a 2.9% increase in sales to $2.72 billion. Analysts were looking for revenue of $2.67 billion.

Same-store sales rose 1.2%. The company said it saw positive comps in each region, with mid-single-digit growth in the West, Florida, and Northeast regions. Average Pro ticket was down slightly, while transactions were up mid-single digits. DIY average ticket, meanwhile, was up mid-single digits with transactions down low single digits.

Gross margins plunged -830 basis points to 36.3% and were down -640 basis points sequentially. The company took a $119 million charge on excess inventory reserves that impacted the number. Even excluding this $119 million charge, gross margins would have fallen to around 40.7%.

SG&A expenses as a percentage of sales, meanwhile, fell 30 basis points.

EPS fell from $1.92 to -82 cents, missing the analyst consensus by $2.26.

Cash flow from operations was $195 million, while free cash flow was $148 million.

The company had $1.79 billion in long-term debt and $2.2 billion in operating leases, along with $317.5 million in cash and equivalents. Its adjusted debt to EBITDAR ratio was 3.3x.

Looking ahead, AAP updated its full-year outlook. It now expects revenue of between $11.25-11.30 billion on same-store sales of -0.5% to 0.0% down from a prior outlook of $11.25-11.35 billion in revenue on -0.5% to +0.5% comparable-store sales.

EPS is now projected to come in at $1.40-1.80, down from a prior forecast of $4.50-5.10. Free cash flow is now expected to be between $50-100 million, down from a previous outlook of $150-250 million.

The company also announced that it will look to sell both its Worldpac and Canadian businesses, as well as embark on a $150 million annualized cost-saving program in 2024. However, it will use $50 million of the savings to increase pay for its frontline workers.

On its Q3 earnings call, CEO Shane O’Kelly said:

During my review of Advance, we identified the need to simplify our overall strategy while also improving execution, both of which will create value. Consistent with that, we are moving forward with a sense of urgency to help stabilize the company and return to profitable growth. Today, we are announcing decisive actions that we have initiated to achieve these objectives. Those actions are: number one, the initiation of a sale process for Worldpac; number two, the initiation of a separate sales process for our Canadian business; number three, significant cost reductions; number four, reinvestment in the field; and number five, the appointment of a new CFO as well as other organizational updates. These decisive actions are further reinforced with a renewed and vigorous commitment of selling auto parts. That is our core business. This includes eliminating numerous initiatives that were distracting us from a clear focus on the most fundamental aspects of our business. We believe our success will come from disciplined execution across the blended box model, where we service both professional installers and DIY customers from our Advance and Carquest locations.”

More than anything AAP has a gross margin issue, and that played out in this quarter and with its implied Q4 guidance. The company made some accounting moves that impacted it this quarter and next, but it looks like 40-42% could be the new normal, which is down from the mid 40% margins it has seen in year past. While a 3-4% margin difference doesn’t sound like a lot, that’s around a $350-450 million hit to the bottom line on a company that was doing about $1 billion or slightly more in EBITDA, so it’s pretty meaningful.

While Shane O’Kelly laid out his initial plan since taking over, it doesn’t really have a big component to getting gross margins back to where they were. The sale of its Worldpac and Canadian business could help lower its debt and reduce leverage, which is nice, but I don’t view APP as having overly onerous debt issues. The cost savings will help a bit, but net-net, it’s only looking at $100 million in savings. As such, I think 2024 will become the new base level for AAP’s business.

Valuation

AAP trades at a 14.1x EV/EBITDA multiple based on the 2023 EBITDA consensus of $513.3 million. Based off of the 2024 EBITDA consensus of $703.4 million, it trades at around 10.3x.

On an EV/EBITDAR basis based on 2024 estimates, it trades at 5.6x.

It trades at 12.2x forward EPS, with analysts projecting 2023 EPS of $1.54 and 10x based on 2024 estimates of $3.64.

It’s projected to grow revenue by 1.1% in 2023, increasing to 1.6% growth in 2024.

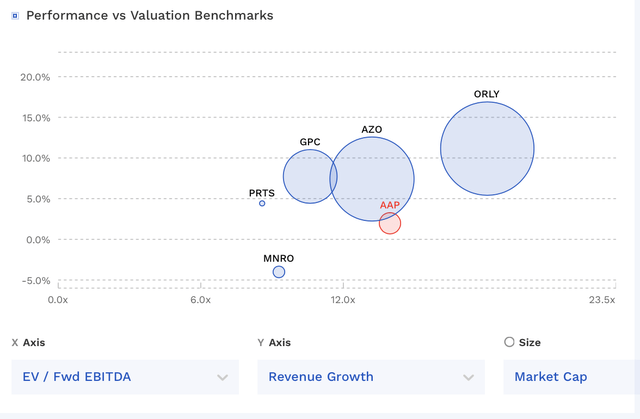

AAP Valuation Vs Peers (FinBox)

It now trades towards the middle of where its peers trade. I’d place a value of about $60 on the stock, which is about 6x 2024 EBITDAR. Given its lack of growth and slightly overleveraged balance sheet, that seems appropriate to me.

Conclusion

At the end of the day, I don’t think AAP gets fixed, instead, I think it just settles into a new normal where its margins are moderately lower, at least for a while. The company has priced its offerings higher than competitors, but to stay competitive it has had to drop its prices to be more in line with the competition. This has negatively impacted its margins.

Meanwhile, solutions to get higher margins would take some investments, as it would have to invest in new systems and technology that could help with things like sourcing and dynamic pricing. Given its balance sheet, it may not want to go that route right away. If it were to sell its Worldpac and Canadian businesses at good prices and invest in this type of technology, I could become more bullish on the names.

However, for now, there is not enough upside to my $60 target to jump on board. As such, I continue to rate the stock a “Hold.”

Read the full article here