Investment Thesis

Advantage Solutions Inc. (NASDAQ:ADV) is an American Sales and Marketing solutions provider headquartered in Irvine, California. In this thesis, I will analyze its third-quarter results along with its future growth prospects. I will also be analyzing its valuation at the current price level and the upside potential in its stock price. It has been experiencing stressed profit margins due to increased costs and lower-than-expected increases in revenues, leading to losses for the company. Hence, I assign a hold rating for ADV.

Company Overview

ADV is a provider of outsourced sales and marketing solutions to consumer goods companies in the United States. Its business can be segregated into two segments: Sales and Marketing. The sales services segment offers a wide range of services, from sales growth to cost optimization. The company offers flexible business strategies in the form of headquarters relationship management, analytics, insights, brand-centric merchandising services and intelligence, and administration. The marketing services segment provides digital marketing, consumer marketing, brand experiential services, brand marketing, and advertising.

Q3 FY2023 Result

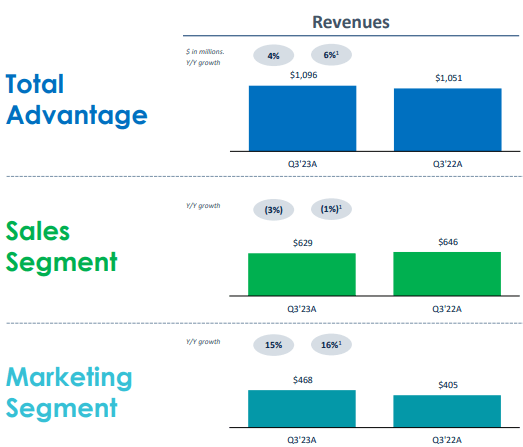

ADV reported weak third-quarter results, with muted revenue growth and worsening income margins. The marketing services business proved to be the outperformer, with a significant 15% increase in revenues. The increased demand for digital marketing, in-store sampling, and demonstration services growth primarily drove the revenues. The sales services segment disappointed with a 2.7% decline in revenues. The management clarified that the decline was a result of the divestiture of the third party reselling business, but I think the slowing demand for its sales services from the US market majorly impacted the revenue growth.

Investor Relations ADV

It reported total revenues of $1.09 billion, up 4.3% compared to $1.05 billion in the same quarter last year. As I mentioned earlier, the decline in sales services primarily restricted revenue growth. The sales services segment revenue stood at $629 million, down 2.7% compared to $646 million in the corresponding quarter last year. As per my analysis, the decline in the US client base due to a slowdown in the market resulted in this decline. I expect the sales segment revenues to remain stressed throughout FY23, given the expected recession, which could impact the clients’ spending on aggressive sales campaigns. On the other hand, the marketing services segment experienced a 15% increase in revenues to $468 million, up from $405 million in the same quarter last year. The higher demand for digital marketing, especially after COVID-19, primarily drove the revenues. I believe its marketing services business has significant potential and could continue to outperform even in the upcoming quarters. The company witnessed a sharp fall in operating income due to higher wages and compensation expenses. I expect the expenses to keep increasing, given the increased headcount commitment by the management, as a part of which they have hired more than 1200 employees in Q3 FY23 alone. The net loss for the quarter was reported at $22.5 million, translating to a loss per share of $0.07, compared to net earnings per share of $0.07 in Q3 FY22. Multiple factors contributed to this decline, including the increased administration expenses and higher interest expenses.

Investor Presentation ADV

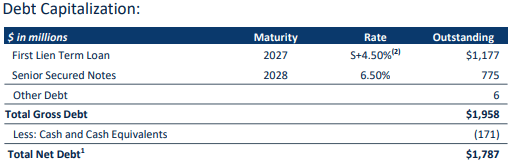

Now, let us have a look at its balance sheet. It reported cash and cash equivalents of $171.3 million against long-term debt of $1.9 billion. Here is where the main problem lies. The company ended the quarter with a net leverage ratio of 4.2x, which is way higher than standard levels of 2x-2.5x for non-heavy capex companies like ADV. High debt is putting significant stress on its balance sheet, affecting its ability to raise funds in the future to boost growth. Not only that, but the higher interest expenses are denting its profit margins. To put this in perspective, it reported interest expenses of $42.3 million, a massive jump of 80% compared to $23.5 million in the same quarter last year. I would recommend investors consider its debt obligation before investing in the company.

Overall, the company failed to impress me on multiple parameters, including muted revenue growth and declining profit margins. The marketing services segment has the potential to be the revenue driver in the coming quarters, but the company will have to focus on the sales services segment to drive the revenues strongly. The management estimates FY23 adjusted EBITDA to be in the range of $400 million to $420 million. The guidance doesn’t instill much confidence and reflects the deteriorating adjusted EBITDA compared to FY22’s and FY21’s adjusted EBITDA of $436 million and $521.2 million, respectively. The company is expected to see stressed profit margins in the near future with the expected increase in expenses and a slowdown in the market.

Valuation

ADV is currently trading at a share price of $3.91, a YTD increase of 78.3%. It has a market cap of $1.31 billion. It is trading at a twelve-month trailing non-GAAP P/E multiple of $16.2x, compared to the sector median of 13.3x. This clearly reflects that the company is trading at a premium. The stock price has seen a sharp increase after its third-quarter results, and current price levels don’t provide a favorable risk-reward profile. I do not see a significant upside in the share price from current price levels, and I would not recommend initiating a fresh buying position.

Conclusion

The weak performance of the sales services segment and increasing costs resulted in losses for the company. The FY23 guidance doesn’t paint a different picture either and reflects the declining income for the company. High debt and increased interest expenses are serious problems that need to be tackled. It is trading at a premium, leaving no room for a reasonable stock price growth. Considering all these factors, I assign a Hold rating for ADV.

Read the full article here