Business Overview

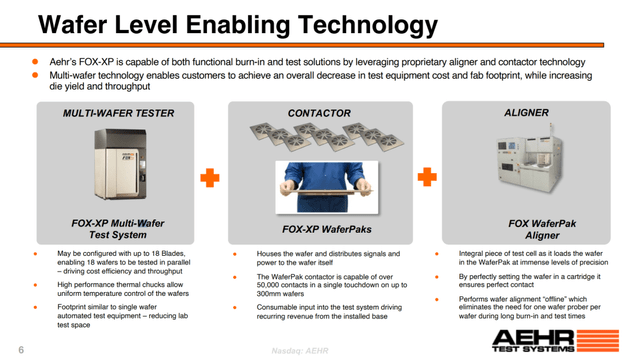

Aehr Test Systems (NASDAQ:AEHR) is a semiconductor manufacturing equipment provider that specializes in wafer-level burn-in semiconductor testing. Its primary products are the FOX-P series testers. With each FOX-P series tester, a WaferPak Contactor is required. The contactor is similar to a probe card but also carries wafers. Similar to probe cards for other semiconductor test processes, each WaferPak Contactor is specialized for a specific chip design, making it a source of recurring revenue for Aehr. Rounding out the system is an automation tool called WaferPak Aligner. These aligners enable transfer between FOUPs and Contactors. Aligners allow for full test process automation for customers. The FOX-P systems and WaferPak Aligners can be used for many different chip designs while each WaferPak Contactor is unique to each specific chip design. Similarly, for Die-level testing, the DiePak Loader (akin to WaferPak Aligner) and DiePak Carrier (akin to WaferPak Contactor) can automate the full process flow of burn-in testing with the FOX-P series machines.

Aehr.com

The FOX-P series includes the XP, CP, and NP models. The XP is the multi-wafer counterpart to the CP machine, which offers the lowest cost per test but is only a single-wafer tester. The NP machine is a low-cost entry-level system meant for companies to initiate a new product introduction and production. Back to WaferPak Contactors, the primary difference between this contactor and traditional probe cards is described in the 2023 annual report:

One of the key components of the FOX systems is the patented WaferPak Contactor. The WaferPak Contactor contains a full-wafer single-touchdown probe card which is easily removable from the system. Traditional probe cards often are only able to contact a portion of the wafer, requiring multiple touchdowns to test the entire wafer. Traditional probe cards also require the use of a dedicated wafer prober handler for each wafer in order to press the wafer up to make contact with the probe card. The need for a wafer prober per wafer is a significant cost adder to the cost of testing a wafer, and also creates the need for significant clean room space to facilitate the footprint of a wafer prober per wafer. The unique design of the WaferPak as well as the FOX-XP and FOX-NP systems remove the need for a dedicated wafer prober per wafer, allowing for better utilization of clean room space. A single FOX-XP system with a set of WaferPak Contactors can test up to 18 wafers at a time in the same footprint as a single-wafer wafer prober and test system offered by Aehr’s competitors.

Already we can see that Aehr’s product line offers cost benefits to customers, as one WaferPak Aligner replaces multiple traditional probe cards. Also, take note that these systems allow for better utilization of clean room space – we’ll return to this later. According to SemiAnalysis, the FOX-XP system costs about $2.5M, WaferPak Contactors come in at about $1.5M and WaferPak Aligners are less than $1M, bringing the total cost to purchase an automated burn-in testing process flow at $5M. Each additional customer Aehr adds will materially boost revenue, with one full system sale including the FOX-XP tester representing ~6% of 2023 revenue.

Aehr Investor Slides

In the Q1 2024 earnings call, CEO Gayn Erickson mentioned that new design volume has tripled in the past nine months, leading to record sales of WaferPak Contactors. This was caused by the booming diversity of EV models. This will be a sustained trend, as multiple makes and models are common in the auto industry, with regular model redesign cycles. Aehr also closed a sale of a FOX-NP system with the associated WaferPak Aligner and multiple Contactors to a “multi-billion dollar semiconductor supplier that serves several markets, including automotive, community, consumer, energy, industrial and medical markets.” This same customer also intends to purchase a FOX-XP system as their production capacity expands. While this customer does have EV exposure, they are also a supplier to the industrial sector. Two previously announced new customers are also outside the EV industry and in the Industrial sector instead. So, while the EV industry will be a significant growth driver for Aehr, they are decreasingly dependent on its sustained growth for their business success.

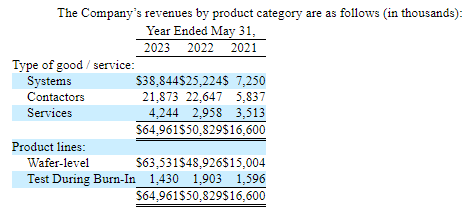

Aehr disaggregates revenue by systems, contactors, and services. Systems and contactors are the main drivers of revenue growth. While contactors are considered a part of the whole system of the testing process from a strategic perspective, management disaggregates them since they provide an annual recurring revenue stream. Over time, this will give investors insight into the durability of revenue growth. One FOX-P series system can last around 5-7 years and will be used with numerous different contactors based on the chip design being tested. Services include installation, maintenance, or training services and will grow organically over time as Aehr’s installed base grows.

The Test During Burn-In product line can be ignored by investors. According to Aehr, “The Advanced Burn-in and Test System, or ABTS, was introduced in fiscal 2008. Several updates to the ABTS system have been made since its introduction, including the ABTS-P system released in 2012… The ABTS system is nearing the end of its lifecycle and limited shipments are expected in the future.”

Aehr 2023 Annual Report

Aehr is positioned well in numerous high-growth markets: Power compound semiconductors (Silicon Carbide and Gallium Nitride, also known as SiC and GaN), which underpin the commercialization of BEVs (Battery Powered Electric Vehicles), EV charging infrastructure, solar panels, and sensors including LiDAR, RADAR, and Apple Facial Recognition technology. Another growth vector will be silicon photonics. SemiAnalysis calls silicon photonics Intel’s Trojan Horse that could help Intel recapture its manufacturing dominance that has slipped in recent years. As these industries continue to blossom over the long run, Aehr will be a natural benefactor due in large part to its competitive advantage in this space.

Aehr’s Competitive Advantage

According to Dylan Patel of SemiAnalysis, one of the leading Semiconductor research firms:

In a multi-die module, one bad die would cause many good dies to fail… Yield here are especially low relative to other semiconductors, and contribute to about 30% of final device cost… Aehr’s approach is complexly novel though. Instead of creating tools for testing on the device and module level, they do test at the wafer level. This allows for fewer failed devices to be packaged and for the full test cycle to be shortened… Costs are reduced as bad devices can be binned away before packaging… The cost savings when moving to wafer-level burn-in are tremendous.

This is both the industry problem statement and Aehr’s solution. EVs have distinct safety requirements for end users that are heavily regulated. Ongoing changes in the regulatory landscape can benefit Aehr over time as their products significantly increase the safety of end products tested on Aehr systems. Wafer-level burn-in testing is a clear benefit for the burgeoning EV industry, which is Aehr’s current leading source of revenue. EVs have power inverters that use high-bandgap SiC chips. High bandgap refers to the material’s ability to withstand high voltages and temperatures. The other commonly used high-bandgap power compound semiconductor is GaN, or Gallium Nitride. Aehr’s test systems can be used for both SiC and GaN chips, so even if the EV industry shifts away from SiC, Aehr stands to benefit from growth in EV manufacturing volume. Coupling this with a heterogenous chip architecture (optimal for space-constrained use cases like EVs) in which one bad die can impact the entire chip, Aehr’s systems are a clear choice for manufacturers. Aehr’s systems, with long burn-in test times, allow fabs to identify KGD’s or Known Good Dies. Identifying and only placing KGDs onto EVs is critical for cost-efficiency and end-user safety.

Aehr’s solutions offer superior economics for fabs, rounding out the competitive advantage of its offerings. Aehr will enjoy a first-mover advantage over time as they scale their manufacturing and continue enjoying economies of scale. Car manufacturing is a famously difficult process to scale, so any cost efficiencies will lead to a strong competitive advantage for manufacturing equipment suppliers.

This competitive advantage corresponds quite nicely with wider industry trends as well. First, the regionalization of chip manufacturing is leading to smaller fabs according to SemiAnalysis. TSMC has numerous fab buildouts planned, but none have the size and technical capability of the Tainan gigafab. Even though TSMC is not currently a leading fab for power compound semiconductors, established fabs are building out their power compound manufacturing capabilities. Regardless, as fab floor sizes decrease, Aehr will be a benefactor. According to the 2023 annual report: “Our technology and architectural design allow our products to take up only 5% of the test floor space compared to competitor’s products”. This is key to the durability of Aehr’s competitive advantage.

Second, the wider shift toward heterogeneous chip architectures (inclusive of EV chips) benefits Aehr quite nicely. As previously stated, having certainty that a chip is a KGD is critical for heterogenous chips as one bad die can severely impact the entire chip. Fabs benefit immensely from the certainty that Aehr’s long and heat-intensive testing systems allow.

Aehr is not resting on its laurels but is continuously improving its product offerings. The recent announcement of the FOX Bipolar Voltage Channel Module (BVCM) and Very High Voltage Channel Module (VHVCM) options extend Aehr’s penetration and leadership in SiC and GaN testing. Additional optionality also allows for more price discrimination and profit opportunities.

Erickson discussed a variety of potential GaN customers, some of which are a part of companies that also include Aehr’s SiC customers. He expects multiple purchase orders to be signed throughout fiscal 2024.

All these corresponding factors lead to quite a rosy long-term outlook for Aehr, but that outlook can be dampened by one thorn in their side: customer concentration.

The Leading Risk: Customer Concentration

According to Aehr’s 2023 10k:

Sales to the Company’s five largest customers accounted for approximately 97%, 98%, and 84% of its net sales in fiscal 2023, 2022 and 2021, respectively. During fiscal 2023, two customers accounted for approximately 79% and 10% of the Company’s net sales… The Company expects that sales of its products to a limited number of customers will continue to account for a high percentage of net sales for the foreseeable future.

This risk is compounded by a recent slowdown in CapEx of ON Semi, Aehr’s leading customer. Another Seeking Alpha analyst details this quite nicely in a Sell-rated article titled Aehr Test Systems: Key Customer Slowing Silicon Carbide Capacity Expansion.

While this risk is real and serious, I believe the wider industry trends and Aehr’s distinct competitive advantage will shield them from the serious downside impacts of customer concentration. Aehr is actively growing its customer base and also noted that customers are increasingly trusting of Aehr’s products. In the recent earnings call, Erickson noted that their last two booked customers did not test Aehr equipment before purchasing it. This is in stark contrast to early customer engagements, which required extensive testing before purchase. One of the risks noted in Aehr’s annual report was that some customers require long test processes of Aehr’s products before making a final decision to move forward with a purchase order. This is driven in large part by Aehr’s lack of size and scale. Fabs do not want to commit to purchasing the equipment of a company that is at risk of going out of business.

Another risk I’d like to point out is company vision, or lack thereof. Throughout the entire earnings call and recent annual report, there is minimal discussion of long-term business strategy. Aehr is a one-trick pony with its FOX-P series systems, with no discussion of potential new product categories. While intense focus is good for microcaps, there is also little discussion of the total addressable market, long-term growth goals, or business strategy to capture market share in growing markets. Management gave guidance only for the upcoming quarter and year, which while ambitious, does not provide an adequate picture of the long-term goals of the business.

Despite this risk, I do believe Aehr will be able to grow significantly over time. Aehr’s annual report details its employee stock incentive program, showing significant stock ownership by employees. The September 13, 2023 Proxy Statement shows quite significant equity ownership of management and a reward structure that aligns management compensation with business success. In short, both employees and management are incentivized to continue delivering shareholder value over time. I’ll be on the lookout for long-term strategy discussions moving forward, so while I am noting this risk I do not believe it’s material enough to forego investing in Aehr at current levels.

Investability

An investment in Aehr is a pure growth play. Aehr is a microcap that is a leader across a variety of nascent industries. As such, risk and uncertainty are significantly higher than larger more established companies like Applied Materials (AMAT), ASML (ASML), and KLA Corp (KLAC). Of course, with risk comes higher return expectations. If Aehr successfully executes, investor returns will be significant for years to come. Aehr is positioned very well to do just that, but execution is key. All investors should be acutely focused on the ongoing growth of end markets, safety regulations in EV chip testing requirements and autonomous driving, and Aehr’s market share in the ever-growing semiconductor manufacturing equipment market.

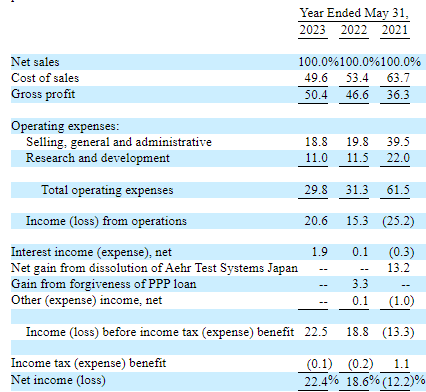

From a financial perspective, Aehr is delivering healthy growth relative to its current market cap. At the time of writing, Aehr is worth $723.7M with TTM sales of $74.9M. A price/sales of less than 10 for a company with a competitive advantage across numerous high-growth industries is a reasonable price to pay. Further, despite its small size Aehr enjoys an extremely healthy profit profile. Gross margins for fiscal 2023 were 50.4%, up YoY from 46.6%, with 1.2% of that increase due to manufacturing efficiencies from higher sales volume. Fiscal 2021 gross margin was 36.3% and the YoY change to 46.6% was also driven primarily by economies of scale. As Aehr continues penetrating its core markets and taking market share, this trend of economies of scale enhancing the margin profile will continue. Alongside the healthy gross margin, Aehr earns $0.22 of profit for every $1 in sales. Their 22.4% net margin is up from 18.6% in fiscal 2022, which was a stunning 30.8 percentage point increase from fiscal 2021’s -12.2% net margin. Aehr also demonstrated impressive discipline by actually shrinking SG&A spend YoY in both 2023 and 2022, contributing to the continued growth in net margin.

Aehr’s Margin Profile (Aehr 2023 Annual Report)

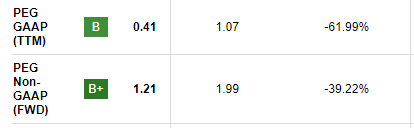

While Seeking Alpha Quant gives Aehr a D+ Valuation rating, reflecting a relative overvaluation compared to peers, Aehr has a strong PEG ratio from both a GAAP and non-GAAP perspective. Growth investors should certainly not count Aehr out given the 3-year price performance, and take the recent 6-month 40% drawdown as an opportunity to build a position in this company.

Seeking Alpha

At this time, given both a strong competitive advantage and attractive valuation, I rate Aehr a Strong Buy.

Read the full article here