Investment Thesis

Aehr Test Systems (NASDAQ:AEHR) is down over 50% in the last 3 months, which prompted me to check the company´s financials and see if it would be a good time to start a position. The company´s financials are solid, with no debt weighing on its cash flow, however, the short-term risks pose a danger. Nevertheless, the company´s drop in share price seems to be a blessing since it is trading now at its fair price and the company may perform well once the negative sentiment in the semiconductor sector goes away, coupled with improving economic conditions.

Financials

As of Q1 ’24, the company had around $51m in cash and equivalents, against zero outstanding debt. This is a very good position to be in, as it allows for maximum flexibility in how the company would like to utilize its free cash flow, without the burden of annual interest expense hovering over the operations. This allows the management to use the cash to further growth of the company and continue to stay on top of the game with investments in R&D. This also lets the company reward its shareholders, whether that would be through paying dividends, which I´m not the biggest fan of, or share repurchases if the share price is considered cheap. Ultimately, a company like AEHR should focus on expanding its operations and reinvesting all the cash available back into itself, which will reward loyal shareholders immensely. The company is at no risk of insolvency.

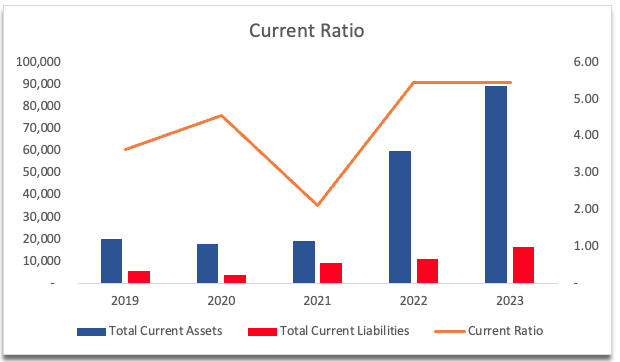

The company´s current ratio is very strong, sitting at around 5, which is not bad of course, but I feel it is not very efficient as it is too high. The high ratio is driven by an increase in inventory, which may not be a good thing if the company cannot sell through it. Another driver of the high ratio is an increase in available liquidity. You can never have enough cash, however, if it is just sitting in the account and not being utilized, the company is not growing as efficiently as it can by utilizing the cash outstanding. I consider a company utilizing its assets efficiently to have a current ratio between 1.5 to 2.0, which is what I consider to be an efficient range. So, I wouldn’t mind seeing the ratio coming down in the future. Safe to say, that the company has no liquidity issues.

Current Ratio (Author)

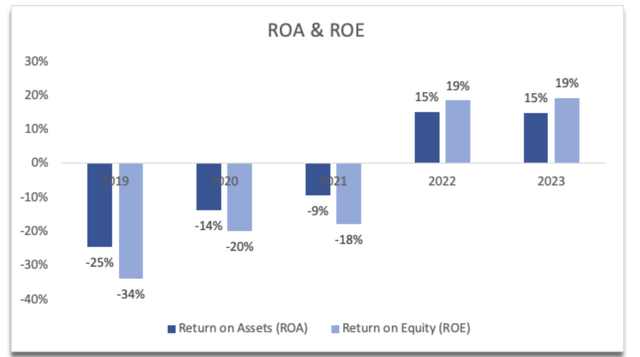

Speaking of efficiency, the company´s ROA and ROE have significantly improved in the last couple of years. This improvement was driven by the management´s ability to take control of operating expenses and other costs, which made the company GAAP profitable.

ROA and ROE (Author)

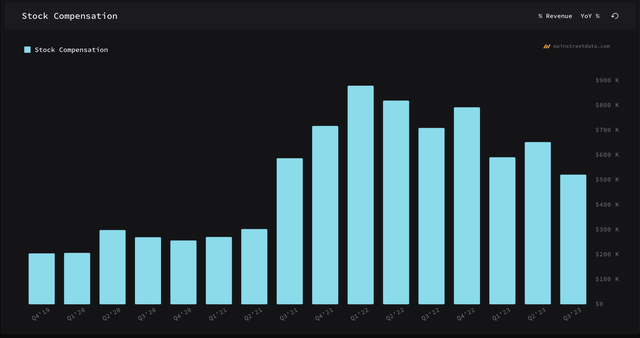

Of course, it helped that the company saw a 206% increase in top line in FY22, while OpEx and COGS increased only by 55% and 157%, respectively. So, it looks like the company can scale efficiently because expenses did not increase at the same rate as the top line. I also like the fact that the company is starting to rely less on stock-based compensation, which will further improve its cost structure.

Stock-based compensation (Main Street Data)

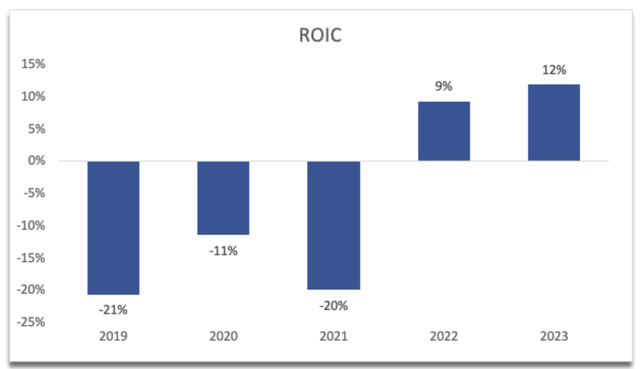

The company´s return on invested capital has also seen a decent improvement over the same period due to the same factors. It seems that the management did a commendable job of investing in projects that pay a good return. I would like to see how this metric develops over the next couple of years to conclude whether the company has any competitive advantage or a decent moat, however, I can say that the company is in a much better place than it was just a couple of years ago.

ROIC (Author)

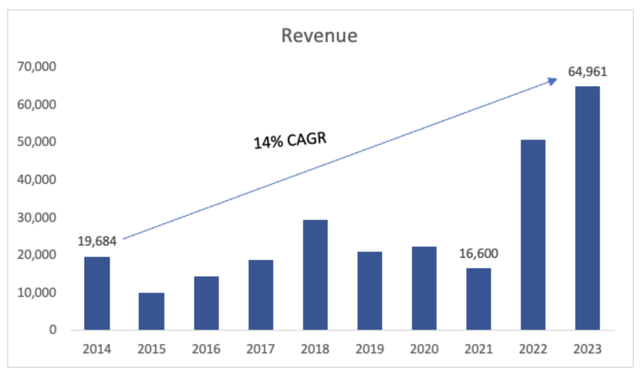

In terms of revenues, over the last decade, the company managed around 14% CAGR, which is not very impressive nor very bad, however, if we look at the recent explosion in revenues, which can be attributed to the booming demand of the company´s wafer-level products related to silicon carbide applications, particularly in EVs.

Revenue growth (Author)

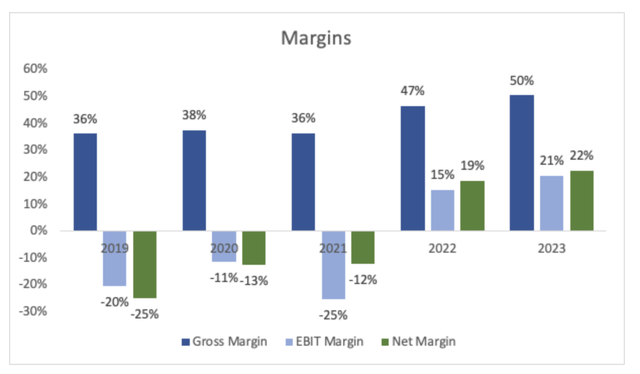

In terms of margins, we can see the same improvement driven by the company´s scalability. We are looking at a company that is completely different from just a couple of years ago. I wouldn’t be too surprised if the company will see some worse margins for FY24, due to the weakness in the semiconductor sector, driven by oversupply, lingering economic uncertainties, and a tough interest rate environment that will persist higher for longer.

Margins (Author)

Overall, the company is looking very good these last few years. Vast improvements in operations seem to be the new normal, however, since the company is on the smaller side, with not many customers, I would expect quite the fluctuations in top-line figures if we were to see worsening conditions in the sector. Nevertheless, the company is in a great position financially, with 0 debt and lots of liquidity to survive the turndown with minimal damage. I´ve covered many semiconductor stocks in the past and most of them had immaculate balance sheets, AEHR is no different.

Comments on the Outlook

One of my more recent new holdings reported what I believe to be good earnings, but the market didn’t like the fact that the guidance was weak, which sent the shares down 20% at one point. That company is ON Semi (ON). This company is the biggest contributor to AEHR´s sales figures. The company did not disclose what percentage ON contributed to the top line, however, if we look back at the FY22 10-K report, that figure stood at around 82%. It is safe to say that the figure hasn’t changed much since the company´s share price plummeted in sympathy. This will certainly translate into worse sales growth than it saw previously, however, this was to be expected as I mentioned earlier. The negative sentiment in the semiconductor industry has been around for over a year, which was driven by oversupply, high-interest rates, and an uncertain economic environment that forced many customers of different semiconductor companies to delay their purchases. This was not news to me since I´ve covered this slowdown many times, and many companies during their earnings calls told investors that tough times are not behind yet, but a glimmer of light is on the horizon. I am expecting a tough first half of the year, and then a massive improvement going forward. Many investors focus too much on short-term downturns and do not take into account the potential in the long run, which I believe the company has a lot of.

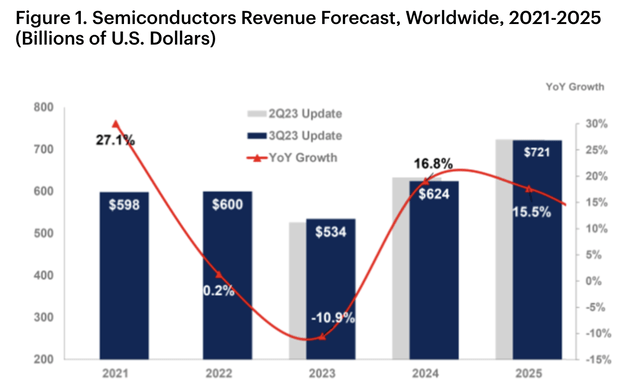

Gartner recently released their forecasts for the next couple of years and they look much better than what we saw in FY23. Gartner forecasts around 16.8% growth in FY24, which matches with many companies in the sector that foresee a much better year than FY23.

Semiconductor recovery (Gartner)

As a lot of AEHR´s revenues will depend on the success of onsemi, the EV market will be the decider if the company continues to see high profits. With many governments subsidizing the production of EVs, the growth is going to continue to be strong, which will benefit onsemi and AEHR.

In short, I believe that the company will recover from this downturn, and we will see much better results in the following years, and the long-term investors will be rewarded for their patience. Analysts’ estimates show amazing growth for the next 3 years or so, however, I take these with a grain of salt since it is impossible to predict what the company is going to do, since not even the management is certain of the future past 1 year.

Risks

Revenue is very concentrated in a few customers. As I mentioned onsemi contributes to around 80% of sales. In the past, Intel (INTC) was mentioned as one other major customer, while 5 customers accounted for 98% of net sales. That is a big risk if the competition manages to take away some of their customers, but I don’t think it is likely, however, it is worth mentioning. The company needs to focus on getting exposure and diversify its customers a lot more. Slowly they are changing this, the management announced the company added a sixth customer in the SiC business segment, “a multinational industrial conglomerate and manufacturer of semiconductors including power semiconductors, is forecasting to grow their silicon carbide business significantly to meet the market demand, which we forecast will in turn drive incremental capacity of our FOX systems as well as our proprietary WaferPak full wafer Contactors.”

The general uncertainty of the economic environment will bring a lot of volatility, for many companies including AEHR. High interest rates are hurting the demand for the company´s products, which may hurt sales further if the demand for its customers’ products slumps further, which is very likely, however, this would be short-lived as many analysts and companies do see the demand picking up sometime in ´24, whether that be in the first half or second half.

The company, which may look like it is profitable right now, may change once again if the company decides to ramp up its operations to stay ahead of the game and not lose its competitive edge. This means the company may heavily invest in R&D, which has been ramping up y/y. SBC may come back up again and for such a small company share dilution is not unheard of. On the one hand, it is a risk, on the other, it is a good thing as it may mean the company is not falling behind the competition, like Teradyne (TER), and Advantest (OTCPK:ATEYY).

Valuation

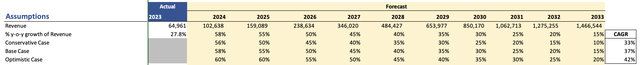

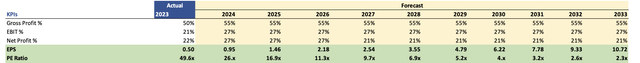

For revenue growth, the company saw massive growth in recent years, and even with a slowdown in ´23, the company managed around 28% growth. The analysts estimate 58% revenue growth in FY24 which echoes what the management said in the earnings call where the management reaffirmed previous guidance of “at least $100m, representing growth of over 50% y/y”. It is impossible to guess beyond that, however, as a rule, I like to linearly grow down future estimates over the decade, which keeps assumptions on the conservative end. Below are my assumptions for the base, conservative, and optimistic cases, and their respective CAGRs.

Revenue Assumptions (Author)

In terms of margins and EPS, I kept it simple also. I also modeled that the company would pay its fair share in taxes eventually, so that will reduce net margins in about 3 years. Below are those assumptions.

Margins and EPS Assumptions (Author)

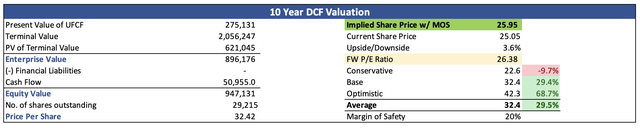

On top of these assumptions, I went with the company´s WACC of around 13% as the discount for my DCF model, which adds a huge margin of safety. I also went with my usual 2.5% terminal growth rate. Furthermore, I added another 20% margin of safety to be even more cautious. With that said, AEHR´s intrinsic value is $25.95, which means that the company is trading at its fair value currently and wouldn’t be a bad investment going forward.

Intrinsic Value (Author)

Closing Comments

So, it looks like the company offers a decent entry point right now for the long-term investor. If we look at the forward PE above, the company is trading at 11 times its ´26 earnings, which seems rather cheap. The risks mentioned are quite big in the short-run and they may bring down the company´s share price further. Nevertheless, I will be opening a small position to test the waters and if the price drops by another 15%-20%, I will be adding and making a larger holding for the long term.

I believe the company will perform well over the long run, and the continuation of adding new customers will diversify the largest risk it has, which is the concentration of revenues in a few customers.

Read the full article here