The AFRM Investment Thesis Remains Speculative

Affirm (NASDAQ:AFRM) stock has posted underwhelming FQ3’23 results, with net revenues of $380.98M (-4.6% QoQ/+7.3% YoY) and widening losses of adj EPS of -$0.57 (+47.2% QoQ/-200% YoY). Its FY2023 revenue guidance of $1.54B (+14.9% YoY) similarly reflects a drastic deceleration compared to its historical YoY cadence of +55% in FY2022 and +70.8% in FY2021.

While part of the latter may be attributed to the tightened discretionary spending due to the rising inflationary pressures, we suppose most of it may be a result of the intensified competition arising in the Buy Now Pay Later (BNPL) segment thus far.

As a reference, AFRM processed $4.63B (-18.5% QoQ/+18.4% YoY) of Gross Merchandise Volume in the latest quarter.

In comparison, PayPal Holdings (PYPL) recorded $6B of BNPL volume in Q1’23 (-14.2% QoQ/+70% YoY), with Block (SQ) similarly expanding its BNPL volume to $5.6B (+18% YoY). Combined with other BNPL/financing options from Big Techs, such as Apple (AAPL) and Alphabet (GOOG) (GOOGL), it appears that AFRM has no moat after all.

This is on top of the supposed “loss of exclusivity” with Amazon (AMZN), though AFRM has also confirmed that the GMV attributable to the former does not exceed 20% of its total GMV by the latest quarter.

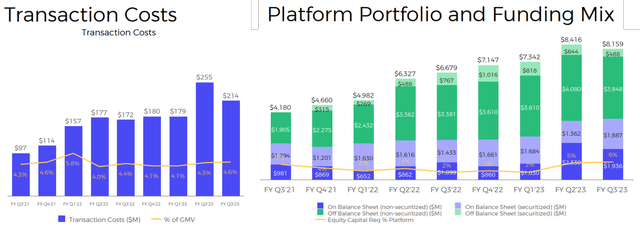

AFRM Transaction Costs & Loans On Balance Sheet

AFRM

Either way, AFRM’s prospects look uncertain as well, with the recent banking crisis likely tightening its funding sources. In FQ3’23 alone, the transaction costs have risen to 4.6% (+0.1 point QoQ/+0.2 points YoY) and funding costs to $51.18M (+16.9% QoQ/+223.5% YoY). This is on top of the growing loans held on its balance sheet at $3.11B at the same time (-15.7% QoQ/+23.4% YoY).

Its provision for credit losses has also accelerated to $237.37M (+122.5% QoQ/+30% YoY), with net charge-offs growing to $41.95M (+119.6% QoQ/+20% YoY) by the latest quarter.

Combined with the FQ4’23 guidance of increased loan delinquency rate and credit losses, it is unsurprising that we are uncertain about AFRM’s prospects, worsened by the deterioration of its balance sheet at cash/short-term investments of $972.48M (-40% QoQ/-57% YoY) in FQ3’23.

Then again, AFRM has taken notable steps to improve its profitability by expanding its interest-bearing GMV to 69% by FQ3’23 (+2 points QoQ/+12 YoY), naturally improving its interest income to $178.27M (+14.7% QoQ/+32.4% YoY) by the latest quarter.

This cadence is particularly attributed to its shift in pricing initiatives by increasing the APR for loans from the previous 0% programs to merchant-subsidized low APR loans of between 4% and 9.99%. This is on top of expanding its maximum APR from 30% to 36%.

Since interest income accounts for a growing part of AFRM’s net revenues at 46.7% in the latest quarter (+7.9 points QoQ/+8.8 YoY), it is also unsurprising that its funding capacity continues to expand to $11.4B (+8.5% QoQ/+26.6% YoY). This cadence demonstrates that the fintech’s capital market partners are increasingly confident in the company’s execution despite the peak recessionary fears.

Combined with the management’s guidance of doubled progress in the pricing initiatives in the intermediate term, we may see its profitability improve over time, well-balanced by the moderation in its operating expenses to $442M (-12.2% QoQ/+11.3% YoY) and the accretive impact of its restructuring by FQ4’23.

Therefore, we may see AFRM’s losses narrow by the next quarter, triggering moderate tailwinds to its stock performance.

So, Is AFRM Stock A Buy, Sell, Or Hold?

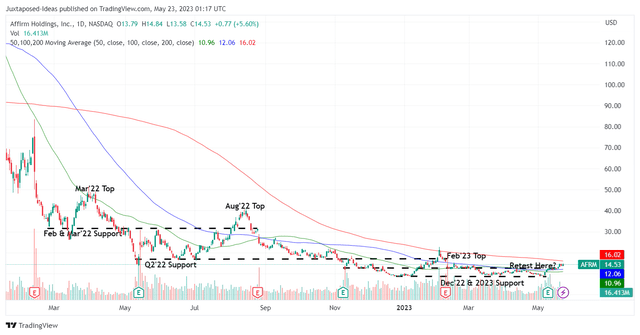

AFRM 1Y Stock Price

TradingView

For now, AFRM has already swiftly rebounded from its 2023 support levels of $9s and broke its next resistance levels of $12s. However, given the uncertain macroeconomics and the massive short interest of 21.97% at the time of writing, we believe the stock may remain volatile or worse, retrace in the near term.

Therefore, while the stock may look attractive here, investors may only add if the exercise consequently lowers their dollar cost average. Otherwise, we prefer to prudently rate AFRM as a Hold here, since the economic downturn may only lift by 2024, if not 2025, giving investors plenty of chances for adding at more attractive levels.

Furthermore, market analysts continue to project minimal profitability over the next few years, with minimal positive FCF by FY2024 and negative adj/GAAP EPS through FY2027, suggesting the stock’s underperformance over the next few quarters.

Read the full article here